PRESS RELEASE

Commercial Bank of Dubai to Partner with NOW Money To Provide Financial Inclusion Across The UAE

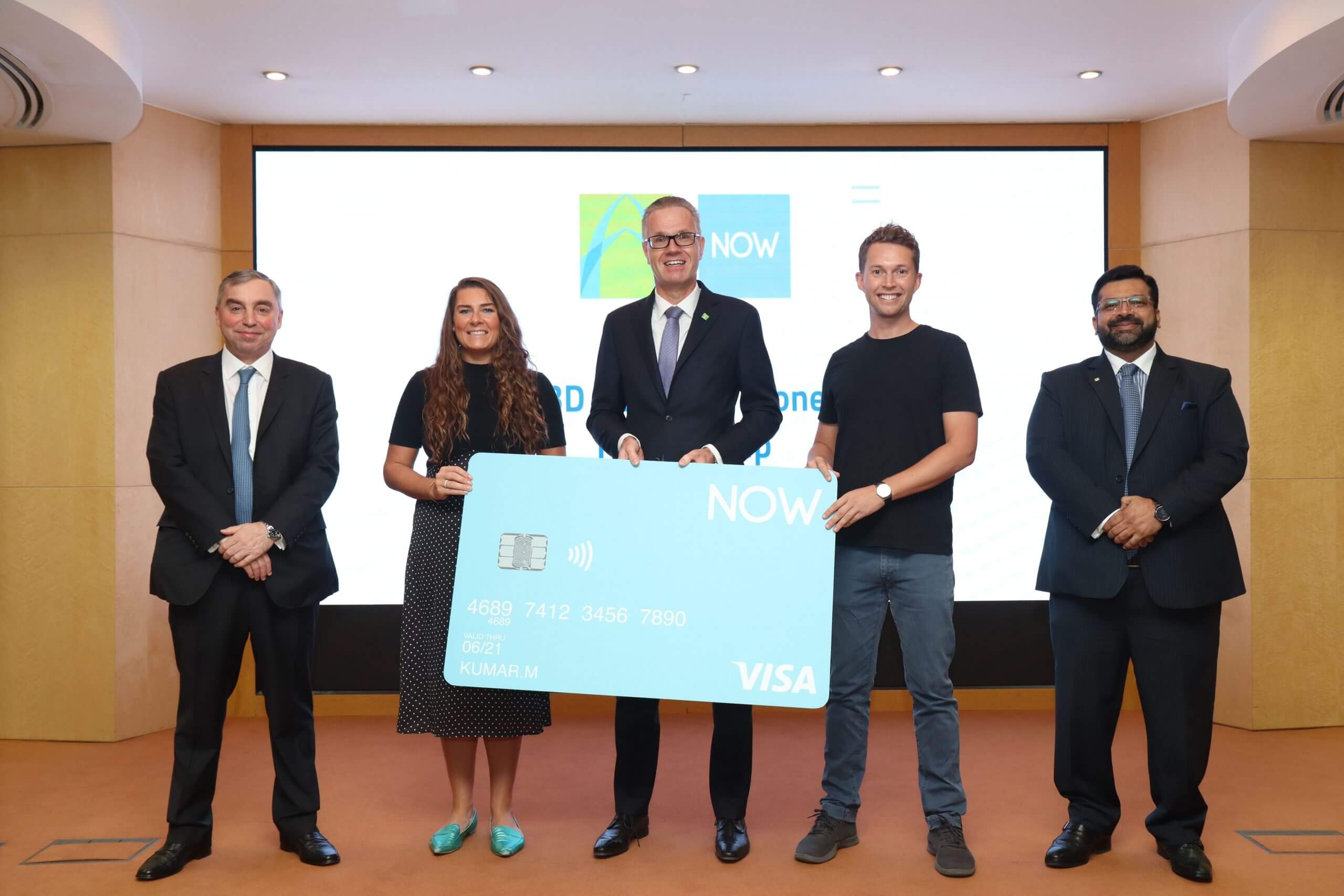

Dubai – October 18, 2020 — Commercial Bank of Dubai (CBD), one of the leading financial institutions in the UAE, has signed a partnership agreement with NOW Money, the digital account service, to provide accounts and cards targeted specifically at low-income customers.

NOW Money will open accounts for existing CBD low-income customers (previously known as Rateb customers) with immediate effect, allowing these customers to benefit from a frictionless digital experience and avail a range of innovative low-cost financial services. These accounts will also be offered to customers currently not banking with CBD. NOW Money and CBD believe that this solution will empower customers and provide a personal and convenient financial experience that has been lacking in the market to date.

This is pioneering for the region, according to NOW Money’s cofounder Ian Dillon, and demonstrates the commitment of CBD, NOW Money and the UAE to provide quality financial services to people from any economic background in a Cohesive Society, one of the UAE’s 2021 Vision goals.

“We’re thrilled to be partnering with CBD,” said Ian Dillon. “Our joint aim is to give lower-income people access to the digital financial system for the first time. We are offering them control and convenience for their finances in a much more advanced and cost-effective way than anything else in the market.”

“Partnering with CBD gives customers the peace of mind of a reputed and trusted bank, with the user-friendly and secure technology of a fintech,” Katharine Budd, NOW Money’s other cofounder added.

Dr. Bernd van Linder, Chief Executive Officer, Commercial Bank of Dubai, said: “ We are delighted to partner with NOW Money to extend our banking service for low-income, largely unbanked customers in the UAE. Given the high smart phone penetration in the region, we believe Now Money – a digital, app based solution will be extremely popular with customers offering them convenience and ease of use in addition to a range of benefits.”

Amit Malhotra, General Manager – Personal Banking Group, Commercial Bank of Dubai,said: “At CBD, we are constantly working on enhancing our products and services to cater to all of our customers’ financial needs. Our partnership with NOW Money will enable us to provide a holistic banking experience to our low-income customers through our award-winning mobile banking platform. The account doesn’t have any minimum balance requirement and offers instant remittance services, helping the expat community in the UAE transfer money securely, quickly and conveniently to their loved ones back home.”

ENDS

For further information, pictures, or to request an interview or guest article submission with NOW Money’s cofounders Katharine Budd or Ian Dillon, please contact:

PR Enquiries:

Twitter: @kat_budd @ian_dillon5

***Note to editors***

About Commercial Bank of Dubai

- Commercial Bank of Dubai (CBD) was established in 1969 by an Emiri Decree issued by His Highness, the late Sheikh Rashid bin Saeed Al Maktoum.

- Over the decades, CBD has transformed into a progressive and modern banking institution. CBD is supported by a sturdy financial base led by a strong and stable management, as proven by our clients who have stood with us over the years.

- Today, CBD is in a position to offer a wide range of retail and commercial banking products and services, in both conventional and Shariah-compliant formats, with a network of 15 branches and over 120 ATMs throughout the UAE.

- CBD has won several awards in the digital and innovation realm notably and recently for “Best Mobile Banking App” and “Best in Lending” at the Global Finance’s 2020 World’s Best Digital Bank Awards.

For more information about CBD, please visit www.cbd.ae or follow @cbduae on Twitter and Instagram.

About NOW Money

- NOW Money is the working name of NOW Payment Services Provider L.L.C, licence number 767072 since 2016.

- NOW Money uses proprietary mobile technology to provide accounts and low-cost financial services to lower-income people in the Gulf Cooperation Council (‘GCC’) countries.

- NOW Money works with companies as a payroll service. Every company receives the easy-to-use NOW Money payroll portal, and every employee receives a NOW Money account, card and the NOW Money app, which gives them the ability to remit money overseas safely and quickly at low cost.

- NOW Money has won awards internationally for financial inclusion and is backed by the UAE, UK and US’ best-known fintech venture capital funds.

For more information about NOW Money, please visit www.nowmoney.me/about/ and follow @NOWMoneyME on Twitter and LinkedIn.