Your Employees

Can Take Control

of their

Finances.

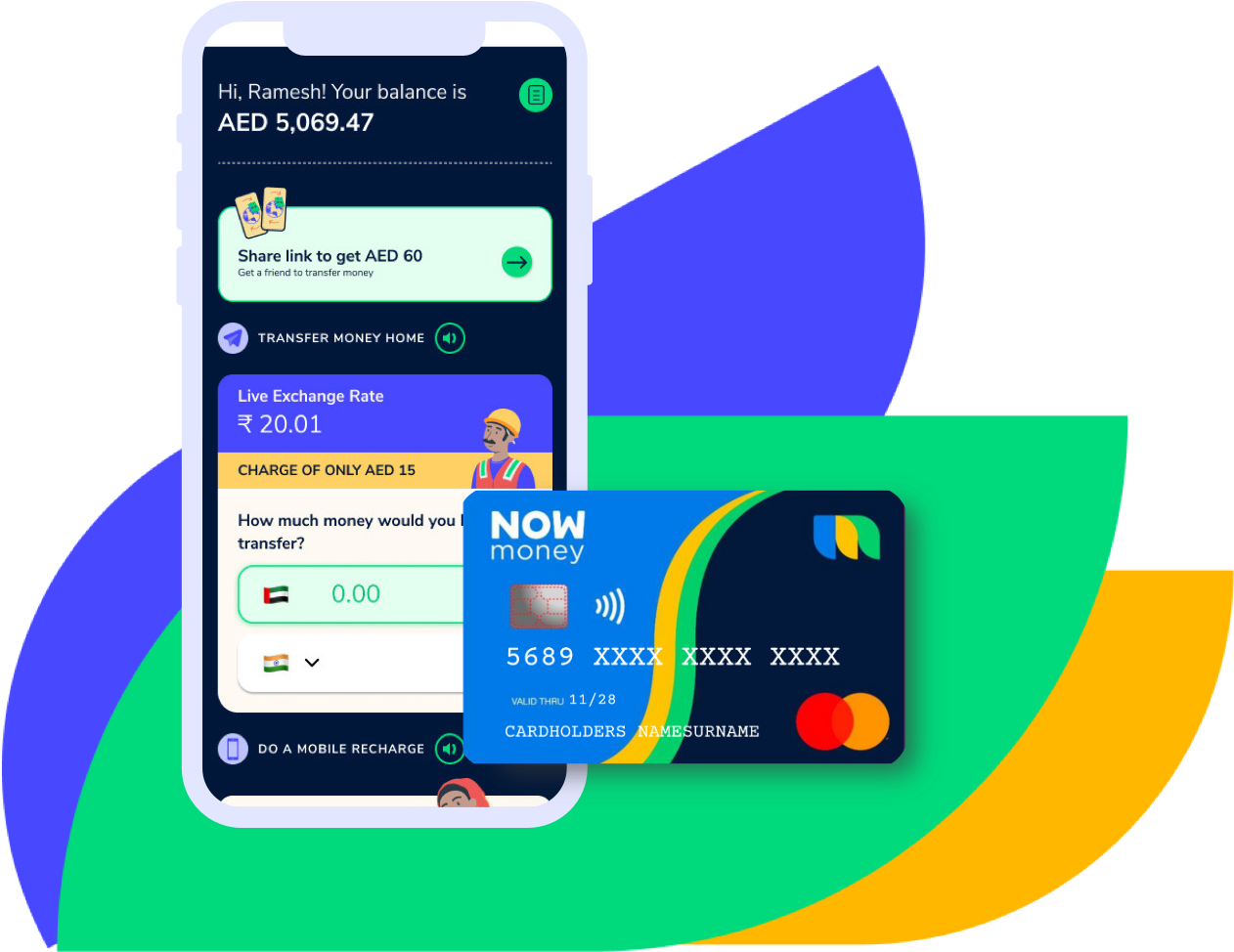

Our Mobile Banking Solution is a safe and secure digital

bank account with Mastercard debit card.

Partnered with Commercial Bank of International.

The Bank Account

Your Employees Deserve.

Your employees work hard for the people they love and the money they send home to family each month can be a lifeline.

With NOW Money they’ll spend less time, energy and fees on managing their finances.

They can say goodbye to long queues at the exchange house and keep more of their hard earned cash.

Managing Money is Simple

Get Paid

Salary or other money can be paid directly into the bank account and get notified when a payment arrives.

Send Money

Send money quickly and easily to friends and family back home through Bank Transfer or Cash Pick-Up.

Spend Money

Contactless Mastercard debit card to buy things online and in shops.

Top-Up Phone

Easy to stay connected with local and international top ups for mobile recharge.

Instant Balance

Checking account funds and track spending whenever and wherever, through the App.

Value Packed Features

Enjoy features such as free remittances and lost card replacement, included in your package.

Are you a business looking to provide your employees with bank accounts?

Hear from our happy clients

Discover how our solution has helped them provide mobile banking to their employees.

Frequently asked questions from employees

How do I get a Now Money Mobile Bank account?

We work with employers who transfer the salaries of their employees into a NOW Money Mobile Bank account. To get an account, your employer must use the NOW Money Payroll solution.

How do I access my account and activate my new card?

The NOW Money team will be on hand to help you download the mobile app, register as a Mobile Bank user and activate your Mastercard card.

You’ll need to have your Emirates ID (EID) and be ready to record a selfie video for identification purposes.

Our team will walk you through each step.

Can I withdraw cash at an ATM?

Yes. Your withdrawal limits can range from 1 free withdrawal per month to unlimited, depending on your subscription. However, we invite you to use the Mastercard card and the Mobile Bank app as they offer both security and convenience.

Is there a cost to recharge my mobile?

There is no cost to you other than the credit bundle or data plan you buy.

What if I misplace my Mastercard card?

Don’t panic. You can temporarily freeze your card in the app while you search for it. You can then unfreeze the card when you find it, or request a new one if your card is lost or stolen. A new card will be sent to you within 48 hours.

What if my card is lost or stolen?

Immediately report your card as lost or stolen in the app or by calling us on 600 566900. A new card will be sent to you within 2-4 working days.

How do I change my personal details in the app?

You can change your password or mobile number using the NOW Money App, but you will need your Emirates ID for verification. Additionally, you can change your PIN and instantly freeze/unfreeze your card if you misplace it.

To update your Emirates ID, access the settings located at the bottom of the App home page. Go to the Accounts section, where you will find the option to update your Emirates ID.

What if I need help?

Call 600 566900 to talk to customer support. Our customer service is available 7 days a week from 9am to 9pm.

What languages does NOW Money support?

Our Mobile Bank app and our Customer Care Team offer support in up to ten languages: English, Hindi, Tamil, Malayalam, Urdu, Tagalog, Nepali, Bangla, Swahili and Arabic.