In this post I will look at a company’s working capital and how to calculate its components in order to build toward a financial model.

You may be wondering, however, what is working capital?

Working capital is the funds a company has for its day-to-day activities. It can also be described as the company’s current position, where if we take all of its current assets, convert them to cash and pay off all of its liabilities– then whatever is left – positive or negative – describes the company’s current liquidity position. The firm should have enough cash left to support itself. If the figure is negative, it means that the business cannot sustain itself. On the other hand, if you end up with a large positive figure, it may indicate that the company doesn’t maintain its working capital sufficiently enough and is too cash heavy.

The formula for calculating working capital is very simple:

Working Capital = Current Assets – Current Liabilities.

However, this is only simple to calculate if you have a balance sheet in place and know where to get these figures from. If you are, like us, just starting out and in the process of preparing one, how can you derive your working capital figure?

In this case you may need to;

1) identify the components of the working capital based on a monthly budget, and…

2) calculate these components based on the duration of the working capital cycle which reflects the delay in time that cash takes to arrive in/out of your bank account as we all understand that cash doesn’t always flow simultaneously in and out once the transactions take place.

From the formula above, you might have guessed that the working capital consists of the following accounts (=components):

- Accounts receivable – this is what is owed to the company for its services

- Accounts payable – this is what the company owes for the purchases it makes

- Accrued expenses – same as above, apart from these expenses will not yet be invoiced

- Prepaid expenses – these are prepayments made for purchases in advance

Working capital also includes inventory, as well as other current liabilities and other current assets. For the purpose of this blog, I will not include these, as I want to a) keep this simple, and b) some of these are not relevant for a fintech start-up such as NOW Money.

In order to estimate the working capital duration cycle, I will use the simplified operating cycle method, which takes into consideration the time it takes for each business operation to convert an asset or liability into cash.

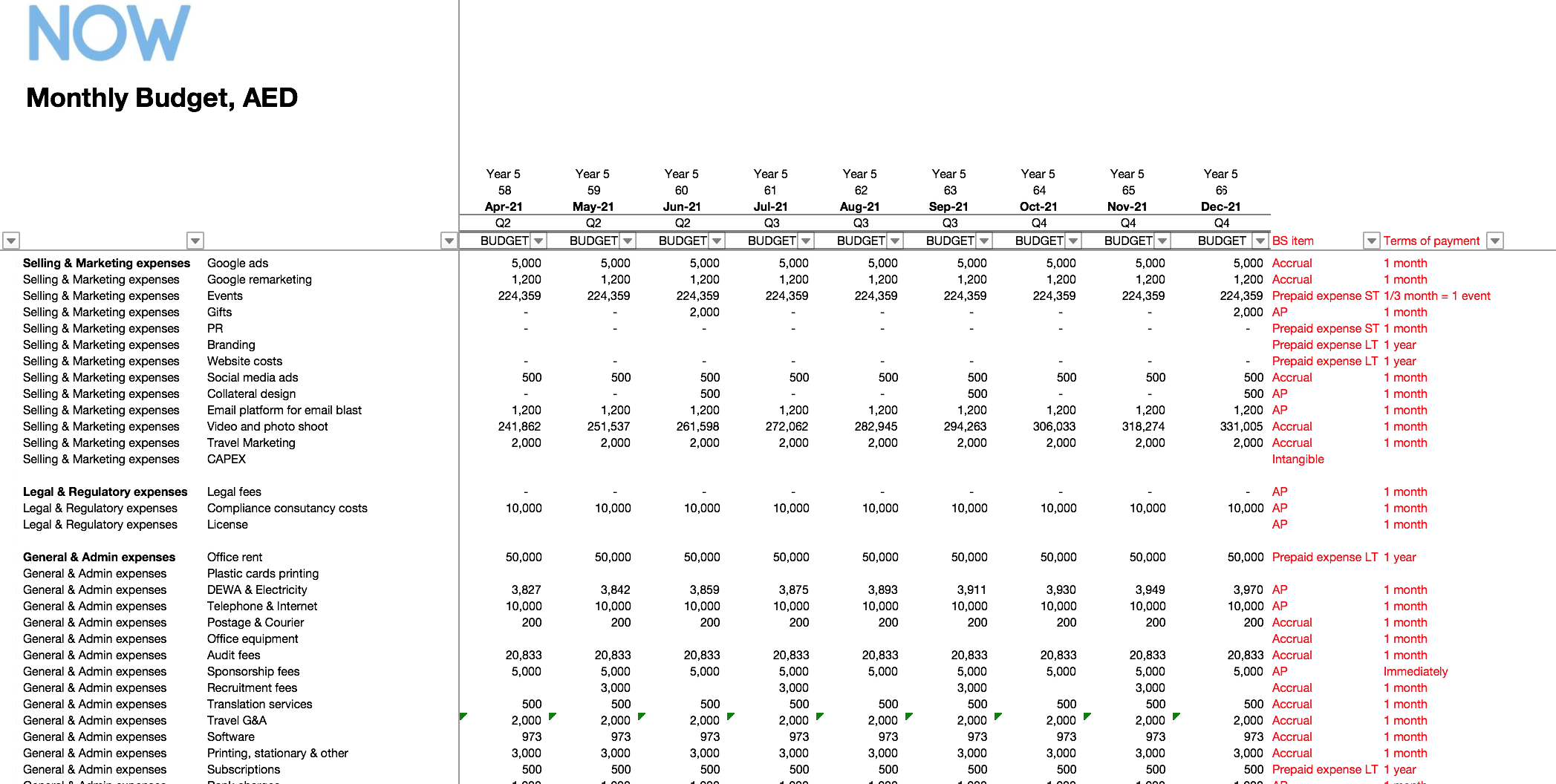

Firstly, you’ll need to look at each line of your monthly budget and assign each one a component from the list above.

Secondly, you’ll need to consider how long it will take to pay bills/receive the money. I suggest you use 1 month to start with for most of your AP/AR.

At the end of this exercise you should have a table that looks something like this:

With regard to the terms of payment, instead of using months, if you want to be more precise, you can use days.

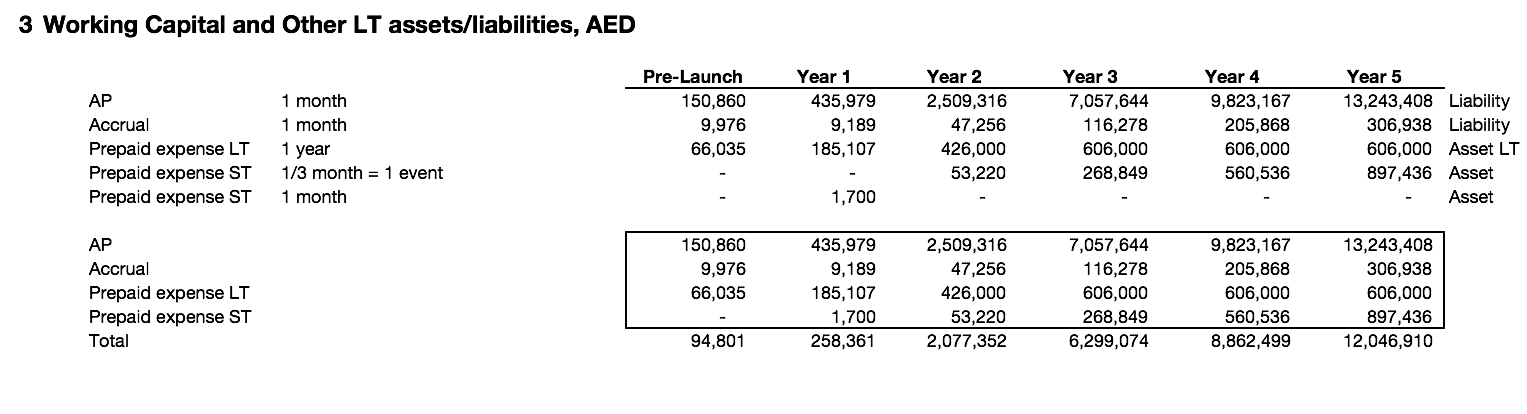

Thirdly, by using the Excel Sumif formula with 2 conditions – accounts names (AP/AR/Other/etc) and the terms (1 month/2 months/1 year/etc), accumulate the working capital components on a separate sheet and calculate the amount for each one depending on the operating cycle. For example, 1 month (annual figure divided by 12 or if it’s a monthly budget – just use December figures), a year (if it’s one-off payment at the end of the year) – leave as it is, or even zero – if the payment should be made/received immediately – which is what happens with our revenues. If you used days before – divide the annual figure by 365 and multiply it by the number of days.

As you may have noticed, here we have LT assets as well, which are not part of the working capital, however we will need these later when we start preparing financial statements.

At the end of this exercise you will have calculated the components of the working capital ready to use in your future projected balance sheet and cash flow statements, which I will cover in my next blog!