Banking the unbanked has never been a more urgent issue in the GCC region. Despite having large unbanked populations, the UAE and Saudi Arabia became the world’s second- and third-highest senders of international remittances in 2020, transferring $43 billion and $35 billion abroad respectively, according to the World Bank.

This vast sum of international money transfers is being led by workers originating from South and South East Asia, who constitute more than 88% of the UAE’s population.

However, because these workers often earn less than the threshold required by traditional banks, they do not have the luxury of digital money transfer options and are forced to depend on physical exchange houses to send money to their families overseas. Apart from the stress of making frequent trips to exchange houses, these people are often locked into a system that charges them high fees and forces them to wait in long queues every month, with follow-up visits if common problems arise.

This is just one of the many recurring challenges that unbanked or underbanked workers face living and working in the UAE and the GCC region.

In this article, we’ll look at the current situation that unbanked workers face in the GCC (focusing on the UAE in particular) and the steps we at NOW Money have taken to banking the unbanked by providing a fair level of digital banking to all companies and their employees, no matter their salary level.

Our corporate digital payroll system enables all employees to have mobile bank accounts, a range of low-cost money transfer options and debit cards.

We’ll consider:

- An overview: Why are there so many unbanked migrants in the GCC region?

- Challenges that unbanked migrants in the GCC region face

- How NOW Money is banking the unbanked

- The benefits of mobile banking for employees and employers

- Getting started with NOW Money

1. An overview: Why are there so many unbanked migrants in the GCC region?

The current situation for unbanked workers in the GCC has been well documented. Arab News shares the challenges that UAE migrants face with international money transfers by telling the story of Ramesh Giri, a 24-year-old parking attendant who has to visit an exchange branch and pay $7 every month to send $600 to his family in Nepal. He dreads this whole routine and complains about how the cost of sending money home is delaying his goal to become a restaurateur.

The reality is that many migrant workers are in Ramesh’s shoes – in addition to working hard and long hours for their salary, they are forced to pay high fees and make frequent and inconvenient trips to exchange houses.

This issue arises because most migrant workers are unable to meet the requirements to access a domestic bank account. For example, many banks in the UAE require a salary certificate from the immigrant’s employer with a minimum salary requirement typically between AED 3,000 and AED 5,000 (the minimum monthly salary requirement is AED 3,599 for Emirates BND, to take an example). Moreover, premium banks can require much higher amounts.

Some banks can also request that new arrivals submit a six-month bank statement and a reference letter from the person’s bank in his or her country of origin, a demand that might be difficult for many migrants to meet.

Even when the above conditions are met, many banks will impose minimum balance requirements that might be very hard for workers to comply with.

As noted above, for residents it ranges between AED 3,000 and AED 5,000, while for non-residents (usually foreign executives or landowners) it might reach up to $100,000, according to the Europe Emirates Group, a company registration firm in Dubai.

In addition to being rejected on the basis of their salary, the high transaction fees banks charge mean they provide little value to the average foreign worker anyway. For example, in addition to AED 25 penalty fee for having account balance lower than the minimum required balance, UAE banks are also notorious for charging high ATM withdrawal fees. Consequently, even as far back as 2018, traditional banks only served the top 30% of income earners with the rest left unbanked or poorly banked, according to Finextra.

More recently (2020), the Journal of Risk and Financial Management (JRFM) puts the figure of the unbanked population at 32% of the working population (or about 1.7 million individuals) and the partially unbanked at 19% of the working population. These unbanked and partially unbanked segments of the population have to become “reliant on money exchanges and informal networks to receive their wages and remit home savings.”

More broadly, PwC, a global accounting firm, puts the unbanked population for the entire GCC region at 22% as at February 2021. However, Gulf Business, a Dubai-based news website, estimates it could be as high as 70%. Whatever the number is, it’s evident that millions of people in the GCC still remain unbanked.

2. Challenges that unbanked migrants in the GCC region face

Given the above, many migrant workers remain unbanked. And this situation poses many challenges to their daily lives.

First, many migrants have to deal with inefficient conditions when sending money back home. In a survey of migrants in the hospitality and construction sectors, Gulf Research Centre discovered that 41% of respondents are dissatisfied with their options to remit money home.

This is especially understandable for unbanked migrants who need to seek out physical exchange houses, wait in long queues, pay high fees, and then wait for the exchange houses to process their requests at a time of their choosing. Surprisingly, these exchange houses can be cheaper than most traditional banks, which charge service fees and use exchange rates that are not in the best interests of the sender. Yet, despite being a better deal than traditional banks, many migrants are left wanting for safer and more convenient money transfer services.

Second, many migrants have to carry out their transactions in cash. As we all know, this means a greater exposure to the risk of theft on one hand, and overspending on the other hand.

Third, it means that unbanked migrants need to pay high fees to facilitators (formal and informal networks, as per the Journal of Risk and Financial Management) for them to access financial services that require bank accounts rather than cash (say, for paying a Netflix subscription). Similarly, it is more expensive for people without bank accounts to access loans since there is no record that confirms their creditworthiness. They then remain at the mercy of those who will charge them higher interest rates to compensate for their lack of records. Again, this often means turning to informal sources such as loan sharks, who operate an aggressive system to recoup their high-interest loans.

Fourth, lack of access to financial services tends to perpetuate inequalities in society.

Financial inclusion (that is, banking the unbanked) ensures that those on the lower rungs of the income ladder also have access to vital financial services that can help them climb up the ladder and improve their living standards.

“Financial inclusion is a key element of social inclusion, particularly useful in combating poverty and income inequality by opening blocked advancement opportunities for disadvantaged segments of the population,” according to a 2020 research paper in the Journal of Economic Structures, “The findings are in favor of further promoting access to and usage of formal financial services by marginalized segments of the population in order to maximize society’s overall welfare.”

Is crypto the way out?

Due to the challenges faced by the unbanked, many have talked about the possibility of banking the unbanked via cryptocurrency. As of early 2022, the UAE government has published regulations for companies that want to create crypto exchanges in order to facilitate remittances, and the government is now ready to issue licences.

Despite this, in the context of banking the unbanked, cryptocurrency is faced with some of the same familiar problems as traditional banks, and sometimes even more.

First, “the documentation clients need to provide to meet regulations, including proof of residence, income and secure assets, means migrant workers will likely be shut out,” according to Arab News.

Second, with Dubai residents losing $22 million to crypto scams between January and August 2021, according to Arab News, the improvement of the crypto landscape to be secure enough for migrant remittances would likely take a bit more time.

Third, the volatility of cryptocurrencies still creates scepticism for many. Knowing the money you send could change in value before your beneficiary receives it is a risk many prefer not to take.

Fourth, even if cryptocurrency solves the problem of remittances, we are still far off from its acceptance as a legal tender for daily transactions (only El Salvador has done this). Consequently, the unbanked will still have to make do with their formal and informal fiat currency-based networks.

But what if there is another way?

3. How NOW Money is banking the unbanked

At NOW Money, we saw the potential for banking the unbanked in the fact that the UAE has among the highest smartphone penetration rates in the world at an incredible 91%, according to 2022 data from eMarketer, a global marketing firm.

We began by asking: what if we could turn these vast numbers of smartphones into mobile bank accounts for migrant workers? The result is that we are now banking the unbanked by providing digital bank accounts that are easily accessible on a smartphone.

As a digital payroll system, we help employers open accessible digital bank accounts for all their employees, allowing them to easily receive their salary (and other payments) in a protected and convenient mobile bank account. Offering such access to mobile banking will be transformative for the average worker in the UAE, and the benefits are vast.

The benefits of mobile banking for employees and employers

Some of the benefits of opening mobile bank accounts for your employees include:

- Increased ease of transferring money abroad: Instead of traveling long distances to exchange houses and spending a lot of time waiting in a queue, employees can now send money to their loved ones abroad on their mobile phones.

- Cheaper money transfers: Instead of enduring the high fees charged by exchange houses and banks, your employees can now send money abroad and domestically in a more cost-effective way.

- Better and more cost-effective access to financial services: Instead of paying third parties exorbitant fees to access basic financial services (aside from transferring money abroad), your employees can now access these services by themselves with their mobile bank accounts.

- More security: Also, with a mobile bank account, your employees won’t have to carry cash around and expose themselves to the risk of robbery.

- Better financial management: As we all know, it’s harder to track your spending when you use cash. With a mobile bank account, employees can easily keep track of their income and expenses, which is crucial to successful financial management.

- Better employee wellbeing: By removing the stress of travelling to exchange houses, waiting in queues, paying high fees to access financial services, mobile bank accounts improve the overall well-being of your employees.

However, your employees are not the only ones who benefit. Even as an employer, your business can gain massive advantages when your employees have their own mobile bank accounts:

- Improved productivity: The better the well-being of employees, the more productive they are. When the stress and exorbitant fees involved in transferring money abroad and enjoying financial services are removed, employees can focus on their work without distractions. A workforce with more security (not carrying cash around), better financial management, and a cost-effective and less stressful access to essential financial services is more inclined to higher productivity. The more productive your employees, the better for your business. A Gallup and the London School of Economics study has shown a positive correlation between employee wellbeing, employee productivity, and firm performance.

- Increase in sales performance: When one of our retail clients decided to pay sales incentives daily instead of quarterly, they experienced a 50% increase in sales. A mobile bank account allows you to pay sales incentives and bonuses as frequently as you want. All it requires is just some clicks of some buttons. Cash and payroll cards don’t afford this same flexibility.

- Compliance with WPS (For UAE employers): WPS guidelines prevent you from making WPS payments in cash or by cheque. Every WPS payment has to be an electronic transfer through your WPS agent. By providing your employees with mobile bank accounts, you’ll be well poised to adhere to the WPS guideline and avoid infractions.

By using NOW Money to provide your employees with mobile bank accounts, your company will be improving their lives and enhancing your business’s performance at once. How can you as an employer get started with NOW Money?

Getting started with NOW Money

When you register with us, we provide your employees with our award winning NOW Money mobile bank account.

Once we have provided these mobile bank accounts to them, you will be able to include them as part of your employee data: add the bank accounts of your employees on the salary information file (SIF) you upload to our platform.

With their digital bank accounts on our platform, you will be able to schedule WPS and non-WPS payments easily.

The NOW Money Employees Tab

Our digital bank accounts don’t have minimum salary or minimum account balance requirements. So, all your workers can benefit from them. We also solve the problem of remittances by allowing migrant workers to transfer money to their home countries from our mobile bank app in just a few minutes.

To facilitate daily transactions, we also provide a contactless debit card. Migrant workers can also access the various financial services (local and international mobile recharges, salary advance, etc) that they were hitherto forced to use from formal and informal networks at high fees.

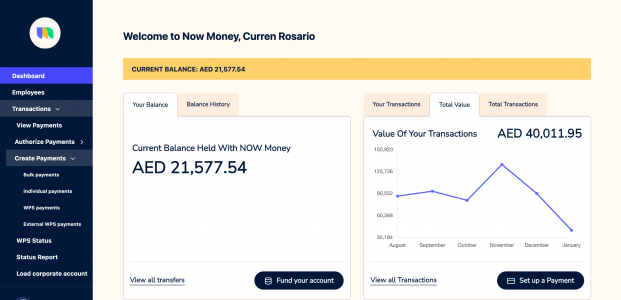

As an employer, you can manage every part of your payroll system directly from the NOW Money dashboard: add SIFs, create payment orders, check your WPS status, check your account balance, and more.

The Now Money Dashboard

With NOW Money, you are using a smart and flexible payroll system. However, even more than this, you will be helping solve the problem of unbanked migrants in the UAE as your otherwise unbanked and partially unbanked employees can now access various life-changing financial services at lower-than-average rates.

Takeaways

- The difficulty of opening bank accounts in the GCC means that many of its working population, who are mostly migrants, are unbanked.

- These unbanked migrants have to pay high fees and go through lots of stress to send money abroad.

- Also, they have to pay high fees to access financial services (otherwise available to the banked) through various formal and informal networks and suffer from the prevalence of inequality.

- NOW Money has solved this problem by providing digital bank accounts that don’t have the same limiting requirements as the banks.

- Once you sign up your company on NOW Money’s payroll system, we open digital bank accounts for your employees who are unbanked.

Are you ready for a better way to pay your employees?

Find out how NOW Money can add value to your business with flexible payroll and inclusive employee banking solutions.

Arrange a quick call with our team to see how NOW Money can work for you.