Financial inclusion is crucial to reducing inequality and increasing economic growth. Consequently, GCC governments have been encouraging the private sector to take larger steps to improve access to financial systems.

Across the world, government schemes for financial inclusion are increasingly promoting the benefits that basic access to financial services provides for economic growth, and the fintech sector is leading the charge in response with various innovations such as mobile banking, e-wallets, digital payments, peer-to-peer transfers, and international remittances.

Over the past decades, increasing amounts of economic studies have shown what many governments now readily proclaim: that financial inclusion is an effective determinant in the reduction of income inequality and poverty.

Similarly, a study looking specifically at the MENA region published in the International Review of Economics and Finance concluded that “financial inclusion positively impacts GDP per capita growth in the [MENA] countries. Financial inclusion measured by the households’ financial access index has a positive and statistically significant impact on economic growth in the MENA region.”

Since economic growth and equity are two key macroeconomic objectives of every government, it is no wonder that governments across the globe are implementing strategies to improve financial inclusion.

The Government of India, for example, has launched about 11 different financial inclusion schemes in a bid to “provide social security to the less fortunate sections of the society.”

Moreover, “universal access to finance has been adopted as a goal by India, Pakistan, South Africa, Mexico, Brazil, Colombia, Malaysia and a number of European countries,” according to a study by the World Bank.

The MENA region has not been left behind, however. “Five MENA countries now have a financial inclusion strategy, and with three of these adopted since 2006 this seems to be a growing trend for the region,” according to the World Bank study above.

More specifically, GCC countries are also taking positive steps. While recognising opportunities for improvement, the IMF comments that “GCC countries have made progress on financial inclusion.”

In this article, we will consider different GCC government schemes for financial inclusion, the various innovations that have accompanied them, and how these schemes can help to reduce income inequality and empower growth in the GCC. We’ll consider:

- How governments typically define financial inclusion

- Government schemes for financial inclusion in the GCC

- Impact of government schemes for financial inclusion in the business landscape

- The road to reduced economic inequality

Do you want to promote financial inclusion in your workplace? With NOW Money, you can pay salaries to all of your employees through a mobile bank account, allowing them to escape the hurdles of opening via a traditional bank. Register for NOW Money or learn more about our mobile banking solutions built for foreign workers.

1. How governments typically define financial inclusion

According to the World Bank, “financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – [and are] delivered in a responsible and sustainable way.”

Indeed, research published in Environmental Science and Pollution Research identified access to credit and savings services as key components of financial inclusion. Yet, the study goes a step further to state a wider definition of financial inclusion as “increased availability of financial services and products to the majority of the population in the country.”

Bank Bazaar, a personal loan provider, also highlights broad inclusivity aspects of financial inclusion, defining it as “offering banking and financial solutions and services to every individual in the society without any form of discrimination.” That is, “it primarily aims to include everybody in the society by giving them basic financial services without looking at a person’s income or savings.”

This element of non-discrimination emphasised by Bank Bazaar is key in defining what financial inclusion really is all about.

Financial inclusion is not merely a quantitative increase in the availability of financial products and banking services; it also includes a desire to “bank the unbanked” and to “include everybody in the society” (including the underprivileged, the senior citizens, and those in the rural areas) irrespective of their income level.

For the World Bank, there are two key steps in the journey to this kind of broad financial inclusion. First is the availability of transaction accounts (accounts from which people can transact without carrying cash). “A transaction account serves as a gateway to other financial services, which is why ensuring that people worldwide can have access to a transaction account continues to be an area of focus for the World Bank.”

Second is the actual usage of these transaction accounts. People should not only have transaction accounts, they should also use such accounts so they can have access to financial and banking services “such as credit and insurance, to start and expand businesses, invest in education or health, manage risk, and weather financial shocks, which can improve the overall quality of their lives.”

So, how does this impact how governments interpret “financial inclusion.”

In essence, today financial inclusion is widely seen as the process of ensuring that everyone has non-discriminatory access to a transaction account and that account holders are able to use them as a pathway to enjoy of basic financial services (such as life insurance, loans, credit cards, and saving or investment accounts) that will support the improvement of their lives.

Financial inclusion, as defined above, has become an important goal for governments across the world because of how it contributes to the UN Sustainable Development Goals (SDGs).

According to the United Nations Development Programme (UNDP), financial inclusion is key to the achievement of eight of the 17 SDGs:

- SDG1: Eradicating poverty

- SDG 2: Ending hunger and achieving food security

- SDG 3: Good health and well-being

- SDG 5: Gender equality and women empowerment

- SDG 8: Decent work and economic growth

- SDG 9: Industry, innovation, and infrastructure

- SDG 10: Reducing inequality.

- SDG 17 Partnerships and collaborations for the achievement of the goals

Thus, by investing in financial inclusion, governments can chart a stronger path towards “peace and prosperity for people and the planet, now and into the future,” the stated aim of the SDGs.

2. Government schemes for financial inclusion in the GCC

The UAE

In the MENA Financial Inclusion Report released by the Fintech Consortium in 2020, the UAE was recognised as the top player in financial inclusion with the highest financial inclusion rate at 46%. When the statistics were tweaked to include only those 15 years old or older, the UAE had a financial inclusion rate of 87%.

Commenting on this report, the Economic Times (India) said: “the UAE Government has been playing an active role in supporting the growth of local fintech ecosystem with key initiatives that include the launch of sandbox in two offshore sites as well (as) rules on crypto-assets and alternative lending among other things.” Also, “Fintech Hive at Dubai International Financial Centre (DIFC) in particular has come out with various measures to promote fintech startups in its efforts to ensure financial inclusion and gender parity.”

The Fintech Hive is a hub created by the UAE government to provide fintech startups with the resources they need (including flexible enrolment requirements) to create products and services that will contribute to financial innovation – in the UAE in particular and the MENA region in general. At the time of writing, fintech startups have raised over $455 million through this hub.

According to Adeeb Ahamed, managing director of Lulu Financial Group, a financial services conglomerate in the UAE, the UAE’s Emirates ID has been a key factor enhancing financial inclusion. “An individual’s verifiable identity becomes a critical factor to get them even remotely close to formal financial channels,” he said. Therefore, by providing verifiable identity, the UAE government is making it possible to include many people in the financial inclusion loop.

The UAE government has also made effective efforts to transform the country into a cashless society by encouraging digital payments for goods and services.

One of the most potent schemes in this regard is the Wage Protection System (WPS), which was launched in 2009, a policy that was recognised by MasterCard in its study of countries moving towards cashless societies.

More recently, the UAE Central Bank has partnered with a consortium led by Accenture to execute the National Payment Systems strategy. The goal here is to “allow ‘real-time’ payments and fund transfers 24 hours a day.”

This country-wide migration will include overhauling current platforms, building new data centres in the cloud, digitising check-based payments, and developing new payment applications. Here, fintechs have a gigantic role that is already being played out through the launches of new digital money transfer, digital payroll system and other payment services.

In 2021, the Middle East Business Intelligence declared that “the UAE government is making greater strides than ever before towards being a cashless economy and is introducing initiatives to promote digital banking and strengthen the security and efficiency of payments to secure and easy-to-use cashless platforms to offer a seamless digital journey.”

Samer Haj-Yehia, chairman of Bank Leumi, acknowledged renewed regulatory support for fintechs in the UAE and other GCC countries at the recent Future Investment Initiative 6. “The fintech industry is on the rise, the economy is healthy unlike other economies around the world… the prospects for the future are very good.l,” he said. “If you look at the regulations which are fundamental for the banking sector in particular, the regulators are giving the tailwind to support the change.”

That is, the UAE government, among others, is nurturing a regulatory space that makes it easier for fintechs to develop and for traditional banking institutions to embrace change, all in an effort to improve financial inclusion and support economic growth.

Saudi Arabia

Other countries in the GCC have also been working towards better financial inclusion. Saudi Arabia is a good case study.

At FII6, H.E. Mohammed Al Jadaan, Minister of Finance of Saudi Arabia, encouraged cooperation and collaboration, especially in these unprecedented times where the world would need stability and predictability.

Saudi Arabia has provided “secure testing and experimenting with new digital financial technologies within a single sandbox environment and FinTech lab,” according to Wallet Factory, a software vendor for financial services providers. This scheme has led to a rise in the availability of “P2P (peer-to-peer) transfers, eWallets, and international payments.”

Consequently, many Saudi Arabia fintech startups have been able to raise massive amounts of funds, as documented by Global Trade Magazine. For example, Tamara, a buy-now-pay-later fintech solution, raised $110 million in Series A funding in 2021, and another $100 million in Series B funding in 2022.

Financial inclusion is also part of Vision 2030, the government reform initiative designed to improve the financial sector of Saudi Arabia, which it aims to do by focusing on the financial participation and empowerment of youth, women, and SMEs (including access to more funds at lower interest rates).

Regarding SMEs, Vision 2030 will build on the Financial Sector Development Program launched in 2017. Among other initiatives, this scheme was designed to help focus more funding on SMEs as the engine of growth.

Looking forward, Saudi Arabia hopes to reach an e-payment target of 70% of all payments by 2030. In 2019, the government signed a MoU with 12 private sector firms to achieve this goal. One of its main plans is to establish a national QR code for domestic payments. The Saudi Arabia Monetary Authority has also launched an open banking initiative that will ensure increased competition, which will lead to better service delivery to consumers.

On November 2, 2022, Saudi Arabia’s Central Bank (SAMA) issued a new framework that will guide its Open Banking initiative.

According to SAMA, open banking “enables the customers of financial institutions to share their financial data securely with a third party provider, which in turn provides new and innovative financial services and products for customers.” This is expected to improve collaborations between banks and fintechs as they provide better financial products for the consumers.

Looking forward, Saudi Arabia hopes to reach an e-payment target of 70% of all payments by 2030. In 2019, the government signed a MoU with 12 private sector firms to achieve this goal. One of its main plans is to establish a national QR code for domestic payments.

The Saudi Arabia Monetary Authority has also launched an open banking initiative that will ensure increased competition, which will lead to better service delivery to consumers.

Bahrain

Bahrain has also led the move to financial inclusivity.

According to Casteleigh Associates, “Bahrain has placed itself at the forefront of regulatory reform: in 2017, its central bank was the first to permit fintech businesses to test products and services with clients. At present, it remains the only GCC state to approve a law allowing small and medium-sized enterprises (SMEs) to raise financing through crowdfunding (either conventional or sharia-complaint).”

Bahrain has also issued regulations regarding “open banking, crypto-assets, and robo-advisory and payment services,” according to Gulf Business.

In essence, several governments of the GCC have been making strides towards financial inclusion through regulatory reforms, infrastructure development, and general reforms of the financial sector.

“The finance sector in the GCC region is about to pass a significant threshold which holds the potential to revolutionise many aspects of citizens’ lives,” said Cateleigh Associates.

“Just as the arrival of the mobile phone in the late 1990s allowed GCC states to leapfrog many developed countries already wedded to the infrastructure of the landline, financial technology (fintech) could once again catapult them ahead of the pack: the combination of a conducive policy environment, desire among leaders to steal a globally competitive edge and a rich, but poorly penetrated market looks very promising.”

3. Impact of government schemes for financial inclusion in the business landscape

The greatest impact of these government schemes for financial inclusion has been the growth of a booming fintech startup sector that has been nurtured specifically to improve upon the region’s financial services through innovation.

For example, more than 160 startups have been beneficiaries of UAE’s Fintech Hive and more than 500 businesses have been registered. As we saw above, similar developments have led to the creation of various e-wallets, peer-to-peer networks, and international payment platforms in Saudi Arabia.

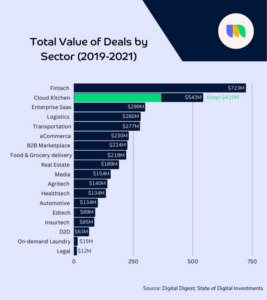

The State of Digital Investments in MENA 2019-2021, a report created by Digital Digest, a news agency, and Arabnet, a program organiser focused on tech innovation in MENA, has recorded a dramatic rise in digital investments in the MENA region from 244 deals worth $551 million in 2019 to 644 deals worth $2.89 billion in 2021.

In November 2020, Western Union purchased a 15% stake worth $1.3 billion of STC Pay, which is part of Saudi Telecommunications Company (STC), a major telco company in Saudi Arabia. The deal made STC Pay the first fintech unicorn in the country, a momentous milestone for the industry.

For PwC, “the high-profile minority stake purchase marks a symbolic watershed in the development of the regional fintech market, and brings its potential to the attention of even more international investors seeking opportunities in new territories.”

Also, in January 2022, CNBC reported Sequoia Capital India’s foray into the GCC when Lean Technologies, a startup fintech in Saudi Arabia and a product of the government’s open banking initiative, won a $33 million Series B funding.

4.The road to reduced economic inequality

The need for financial inclusion as a positive step towards reduced income inequality and improved economic growth has been recognised by many UAE fintechs, including NOW Money, which launched in 2016 with the mission to provide employers with digital payroll and employees with mobile bank accounts.

Since launching, NOW Money has worked to stay ahead of the game, providing mobile banking solutions that have made it possible for UAE workers who cannot open an account at a bank branch to have a transaction account. With this account, foreign workers can withdraw money at ATMs with a NOW Money debit card, transfer money locally and internationally, and recharge phones locally and internationally, among other financial services.

The work that has been done by NOW Money has become helping to bring many more people into the financial system.

The proportion of UAE residents 15 years or older with an account with commercial banks or money-market service providers increased from 59.73% in 2011 to 88.21% in 2019, according to a World Bank survey. Saudi Arabia also grew its account ownership rate from 46.42% to 71.70% within the same timeframe.

This growth in financial inclusion (measured by account ownership in this case) is a welcome development and it is just the beginning.

Going forward, “there are good reasons to believe the region has the collective will to give rise to these ecosystems and reap their broader economic benefits,” says PwC. However, this will require consistent efforts by all stakeholders: government, financial institutions, and entrepreneurs. In addition to individual effort, these stakeholders will have to engage in various cooperative efforts to create multiple thriving fintech ecosystems in the GCC.

The road towards better financial inclusion will also require more financial education so that people know how to use transaction accounts in a way that allows them to access more financial services, according to The Fintech Times.

For Adeeb Ahamed, this will require better data collection (so that everyone can have a verifiable identity) and financial literacy.

“Diversifying the existing traditional financial system along with digital transformation and governmental incentives,” are the three key requirements for Wallet Factory while Global Trade Magazine believes more effort towards cybersecurity is the key to increasing the confidence of investors and entrepreneurs.

NOW Money has led the way in the fight to bank to unbanked, but there is much more to do. Other stakeholders (private and public sector) must continue to work with the same mindset of continuous innovation so as to propel the GCC forward towards an economy where everyone can flourish.

Are you in need of a smart, flexible, and cost-effective digital payroll platform that also provides mobile bank accounts for employees? Sign up for NOW Money or learn more about our payroll management system and how we help bank the unbanked in the GCC.

Takeaways

-

Financial inclusion is correlated with lower inequality and higher economic growth and development.

-

Governments across the globe have been making attempts to improve financial inclusion as a prelude to economic growth, development, and equity.

-

Governments in the GCC and MENA have also been part of these efforts towards financial inclusion with many GCC countries taking giant strides towards creating a supportive fintech ecosystem.

-

As the GCC continues to make efforts towards financial inclusion, inequality will reduce and economic growth will increase.