The United Arab Emirates stands as an attractive place to live for many reasons. It’s innovative approach to business, it’s technologically forward outlook, the tolerance and respect for different cultures and religions and the demand for labour from all sectors of industry has meant the country has become a beacon to expats across the world.

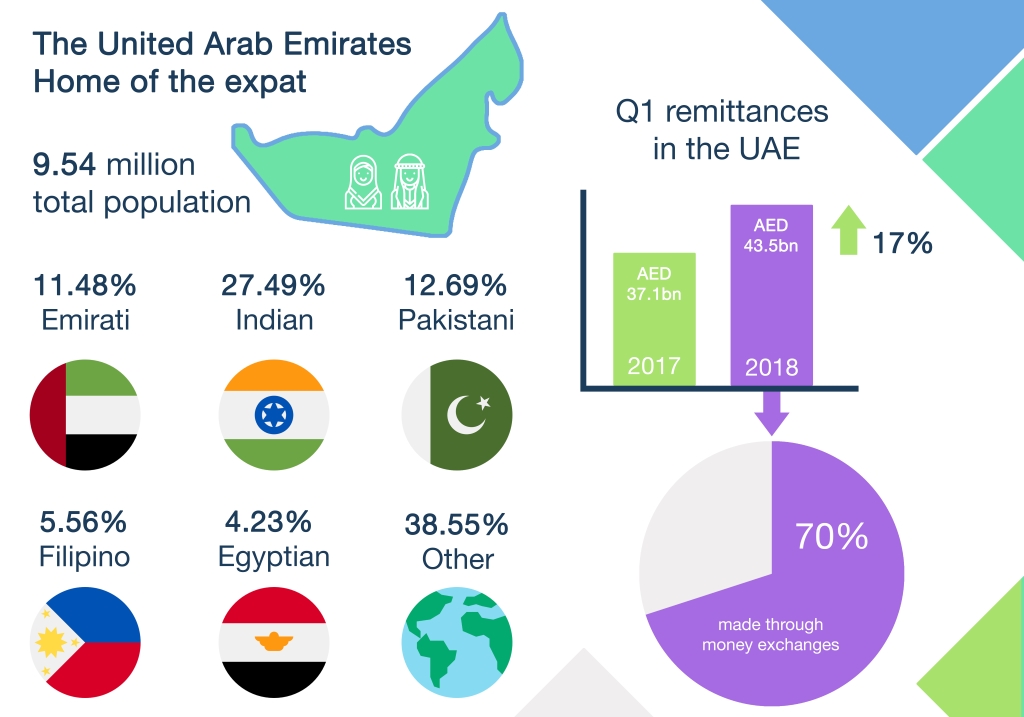

So successful has the UAE been in attracting people from elsewhere that the local population has been dwarfed by the huge number of expats flocking to this glittering oasis in the GCC. The Emirati population stands at just over 11% of 9.5million, the total population of the UAE.

Within the expat population, the largest nationality group is Indians, making up over 27%, next is Pakistan 13%, Pakistanis – 12.69, Egyptians – 4.23%, Filipinos – 5.56 % and Others – 38.55 (Bangladesh, Uzbekistan, Krygstan, etc.). Western expats account for approximately 8.5% of the total.

As the figures highlight, a significant proportion of the expat population are from South East Asian countries. Many have come here to work in low skilled, manual work in sectors such as security, construction and transport. These roles are often low income, however, the workers are earning more than they would do in their home countries and many are supporting other family members in their native lands.

Whilst the expatriate labour force is a much-needed source of strength to the UAE, providing a considerable amount of spending power between them, inevitably, due to family support needs, there is also a vast outflow of funds back to home countries.

Indian workers led the remittances with Dh16bn, followed by Pakistanis, Filipinos, Omanis, Egyptians, Americans, British and Bangladeshi expatriates.

With the considerable sums involved, remittance payments are a rich source of income for exchange houses, but this way of transferring money comes with its own problems for expats. Problems such as difficulties in accessing the physical exchanges themselves, working out the optimum time to do a transfer and avoiding fees are all faced by expats when they need to send money.

This is where FinTech companies can have a hugely positive impact on people’s daily lives. The replacing of cash transfers with digital ones will reduce costs and save time both for the senders and recipients. Creating a system that allows financial inclusion for the low paid will mean greater benefits for the entire financial system.

Giving the ‘unbanked’ access to proper financial services that suit their requirements will have a significant impact on society. It makes a difference to social mores such as equality, employment and GDP. Furthermore, it also lessens the use of cash in society which reduces costs across the board, from shopkeepers to governments. The less notes and coins in use means less money governments need to spend to produce them. Reducing the use of cash can likewise help to prevent fraud and illegal activities. Digital payments are much easier to track and scrutinise than cash ones are.

Lack of awareness amongst the low paid and low skilled workforce is often cited as a hurdle that needs to be overcome. However, the UAE has one of the worlds highest smartphone penetration rates in the world and therefore, access and use of digital devices is not a stumbling block, even among the migrant workers.

By creating favourable conditions for FinTech companies to develop and grow, the UAE will provide a financial lifeline for those who need it most. The country stands to gain enormously by giving its expat population the opportunity to participate fully in the financial sector and go digital.