Everyone who lives in the UAE knows that on January 1, 2018 value-added tax (VAT) will come into effect. There is a lot of talk, and furthermore, uncertainty, with the date just around the corner. When it comes to the impact that this will have on the world of FinTech – the uncertainty just goes over the top!

As a result of my experience with both VAT and FinTech, I thought I’d write a post about the issue, and address the main points of uncertainty.

Most people will be familiar with VAT in general, but if not, you can email us to view the presentation from my last ‘VAT in the UAE training’ here that was organized by Astrolabs on the 29th of October, 2017.

So what is a FinTech and what attributes does it have which make VAT treatment so vague?

According to Patrick Schueffel, in his paper, Taming the Beast: A Scientific Definition of Fintech in the Journal of Innovation Management; “FinTech is a new financial industry that applies technology to improve financial activities. FinTech is the new applications, processes, products, or business models in the financial services industry, composed of one or more complementary financial services and provided as an end-to-end process via the Internet.”

Based on the definition above, I have come up with some unique features of FinTech companies, and what VAT complications they may face:

1. Provision of financial services

Financial services in relation to VAT is still a grey area in current VAT legislation. However, as draft cabinet decision on the Executive Regulations of UAE VAT law says, if the financial services are performed NOT in return for an explicit fee, discount, commission, rebate or similar, then they are exempt for VAT purposes. However, if the services above are performed for a fee, discount and commission, etc., then they should be taxed at 5 per cent to the extent of the amount of that separately identifiable charge. For example, the remittance operation itself is exempt from VAT however the fee that is charged by the financial institution is not. Therefore, there will be 5 per cent VAT added to the amount of the fee, but not to the amount being remitted. The last point – agreeing to do, or arranging financial services as per current UAE legislation also counts as the provision of financial services.

When it comes to the recovery of input VAT, tax incurred on costs wholly attributable to the standard rated supply of financial services can be fully recovered; and VAT incurred on costs in relation to exempt supplies – cannot be recovered. Therefore, companies should accurately distinguish which costs are attributable to the financial services that are exempt, and which are taxable supplies. If the company has both, then the following ratio should be applied:

Taxable supplies/Taxable + Exempt supplies

For more guidance on this, please have a look at the guidance published by the federal Tax Authority here.

2. Provision of services digitally

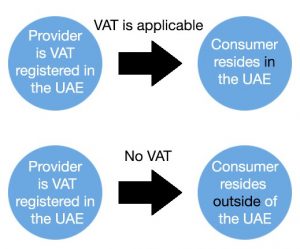

Another feature of a FinTech company, is the digital provision of its services. For this we have to be familiar with the place of supply concept, because if the services are provided to someone outside of the UAE, VAT is not applicable, and vice versa.

The place of supply for the goods, for instance, is where the goods are. When it comes to digital services, the provider has to know who is the recipient – whether it’s a company (B2B) or an individual (B2C).

In a B2B scenario, the purchaser is responsible for accounting for the invoice in accordance with a rule known as the reverse-charge mechanism. The purchaser accounts for the VAT of that invoice as an Output VAT (sounds strange but that is the way) and Input VAT at the same time, meaning there is no VAT liability, only reporting of the transaction.

With B2C, the scenarios are as follows:

3. Fintech companies registered in Dubai International Financial Centre and other free zones

There is a lot of talk around free-zones and how they are going to be treated for VAT purposes. The latest draft regulation says that if the company is registered in a designated zone which is a fenced free-zone, then it is considered as outside of the UAE VAT scope. If the free-zone is not fenced – like DIFC – then general UAE VAT rules apply.

I hope the above helps shed some light on VAT treatment for FinTech companies who, just like us are trying their best to navigate in this complex business world.

Please feel free to leave comments if you have more insight on the VAT situation described in this post, or any questions.