Welcome to the wonderful world of payroll reconciliation – where numbers and calculations meet head-on with deadlines and legal obligations. But don’t worry, it’s not all doom and gloom! In fact, with a little bit of know-how and help from new payroll technology, UAE employers can conquer this important task with ease.

Perhaps you have heard about bank reconciliation, the process where companies compare their cash book with their bank statements to identify discrepancies and bring the two to sync through an adjusted cash book.

Something similar occurs in the payroll process.

To ensure that workers are being paid the right amount at the right time, companies have to reconcile the details that they use to pay workers with supporting documents, such as employment contracts, commission bonuses, paid leave requests and others. This will help them identify discrepancies resulting from errors of omission or commission.

Errors in payroll accounting are bad for business, whether that be underpayment or overpayment of workers. Both can lead to dissatisfied employees, troubles with regulators (especially with the UAE’s WPS payroll law), and financial troubles for the company itself.

To prevent these situations, every company in the UAE must know how to handle the payroll reconciliation process in the most effectual and productive way possible.

A little secret: you don’t need to be a math wizard to know how to reconcile payroll successfully. In this article, we will provide you with the information you need to easily succeed. We’ll cover:

- What is payroll reconciliation?

- Why is payroll reconciliation in the UAE important?

- How to conduct effective payroll reconciliation

- How NOW Money simplifies the payroll reconciliation process

[Do you want to transform your payroll processing with a payroll software that also helps simplify payroll reconciliation? Request a demo to see how NOW Money can help your business.]

1. What is payroll reconciliation?

Simply put, payroll reconciliation is the process of comparing and adjusting payroll records to ensure they match up with your company’s HR and expenses records.

At one level, payroll reconciliation is all about double checking your maths. That is, before issuing payment orders, you want to ensure that you have correctly calculated the compensation of your workers.

For example, if worker A’s gross pay is AED 5,000 and his deductions add up to AED 500, you want to make sure that the net pay amounts to AED 4,500. If you have wrongly entered AED 3,500, you will want to adjust that figure.

This is a common type of human error, and occurs when staff have to handle large payroll systems.

But with the use of payroll software, you should not have any problem with these calculations as this software is automated to get the maths right.

There is a second level, however. Here, you want to cross check the documents supporting an employee’s compensation to ensure you have not made any mistake.

For example, you might want to double check an employee’s employment contract to ensure that you are paying the basic salary and allowances that you have signed with them. You want to be sure you are not paying a worker AED 2,000 in allowances when you should have been paying AED 3,000, or vice versa.

This is especially essential for part-time workers or any other type of worker being paid per hour. The payroll reconciliation process will involve going back to the time sheet to ensure that you are using the accurate number of employee hours worked.

In essence, the payroll reconciliation process is exhaustive and its aim is to ensure the utmost accuracy of your payroll, irrespective of the payroll system in use.

The frequency of the payroll reconciliation process depends on the company. It is only a year-end event for some while others do it quarterly. Given its importance, some companies prefer to run payroll reconciliation every pay period.

2. Why is payroll reconciliation important in the UAE?

So why go through the rigours of this process?

Payroll reconciliation is crucial to employees, employers, and regulators.

Importance to employees

First, employees don’t like being underpaid. Some of them will do their own calculations to ensure that the right amount is on their paychecks. If they are the first to discover discrepancies, they might think (rightly or wrongly) that the company is trying to play unfairly.

Even if the company ends up justifying themselves, a breach of trust might result and such breach may persist even if the work relationship continues.

Furthermore, some employees will not do their calculations to notice any underpayment. These ones might be put under needless pressure as they try to make do with what they are being paid. The Guardian reported in 2022 how employees of ASDA, a British supermarket chain, were having financial struggles because of underpayment resulting from payroll errors.

Second, overpayment can also put a stress on employees. Imagine having to repay money you have already spent because you thought it was rightly paid to you. The longer the overpayment persists, the more liabilities are placed on the employee.

Employers must therefore perform regular payroll reconciliation to prevent both underpayment and overpayment. In fact, correct and timely payment of compensation is one of the best ways to create a happy workplace.

Importance to employers

Underpayment hurts employers just as much as employees. Dissatisfied workers may decide to leave, leaving a gaping hole that can only be filled at a higher cost. It’s common knowledge in human resources management that it is cheaper to retain employees than replace them.

Moreover, dissatisfied workers are bad public relations (PR) for any company. This will make it harder to hire new employees or at best lead to a higher hiring cost compared to competitors.

On the other hand, overpayment means that the company is reporting lower profit. The more this goes on, the more money is lost. And, as we have seen, recalling the money can put a lot of stress on employees. So, whatever the company chooses to do, there are significant costs.

Consequently, employers, for their own sake, must take payroll reconciliation seriously.

Importance to regulators

Regulators are concerned that employees receive the right compensation at the right time.

In the UAE, the Ministry of Human Resources and Emiritisation has implemented the Wage Protection System (WPS) to achieve this aim.

The WPS regulation makes payroll reconciliation essential.

For example, deductions from an employer’s salary must not exceed 20% of the gross salary. Moreover, the company must be ready to present evidence that such deductions apply to the worker.

Also, 90% of the company’s workers must be paid at every payroll period (giving allowance for those on leave) and the Ministry must be notified of such leave.

For workers with whom the employer did not agree a particular pay day, the WPS still requires that such must be paid at least once in a month.

Complying with these regulations (and others) require that payroll staff take a second look at their payroll information – that is, conduct payroll reconciliation.

Why is compliance important? For one, there are penalties for non-compliance. Secondly, companies with greater compliance have better PR, which can help them attract the best talent in the labour market.

3. How to conduct effective payroll reconciliation

Now to the heart of the matter: how can you conduct effective and efficient payroll reconciliation?

Get familiar with WPS regulations and UAE labour laws

Before getting to the heart of the payroll reconciliation process, you need to be familiar with all relevant WPS regulations. In fact, it is preferable that employers have a checklist that payroll staff must adhere to.

In addition, the UAE labour law has regulations concerning leave (classifying some as paid, unpaid, and partially paid), deductions (for example, health insurance cannot be deducted from employees’ salaries, unlike medicaid and medicare in the US.), allowances, overtime (how to calculate the pay rate), types of workers, among others. Payroll staff must be familiar with these as well.

Understanding these laws will help you avoid trouble with the authorities.

Double check employee information

Once you have done that, you can start the payroll reconciliation process.

In the UAE, the WPS system requires that every employer has a salary information file (SIF), also known as a payroll register, that contains payroll data of the employer.

The first columns contain basic employee details like labour card number (column B), bank routing code (column C), and bank account number (column D).

Since mistakes can occur here – wrong labour card number, wrong account details, or wrong routing code – it is important to reconcile these details with originating documents such as the employment contract, among others.

Payroll staff must repeat this process for every employee.

Confirm basic pay, allowances, and deductions

On the other side of the SIF are details like start date of salary (column E), end date of salary (column F), number of days salary paid or pay period (column G), basic salary (column H), variable salary (column I), number of leave days (column J).

For salaried workers, this involves checking the employment contract to ensure that the basic salary and allowances agreed upon there are the same as that on the SIF. If increases are also agreed (say after every six months), the payroll staff must ensure that those increases are well reflected.

Furthermore, payroll staff must confirm if deductions apply to an employee or not (and if those deductions are legal to begin with). Any error of omission or commission must be corrected to ensure the correct net salary is paid.

In a country where employees pay payroll taxes, payroll staff must also ensure that they have used the accurate tax rate based on their tax brackets and have not made any mistakes in the tax filing.

Double check time sheets (time cards)

For workers receiving compensation based on the number of hours worked, payroll staff must reconcile the details on the timesheet with what has been included in the SIF.

Discrepancies can occur regarding the number of hours worked and the pay rate per hour. These discrepancies must be reconciled so that part-time workers can receive the correct compensation.

In addition, in the case of overtime, payroll staff must confirm the number of overtime hours and the rate of compensation (which must be in line with the labour law).

Reverify leave calculation

UAE labour laws also specify which types of leave are paid (annual leave or vacation time, for example), unpaid (Hajj leave, for example), and partially paid (maternity leave, for example).

Payroll staff must learn how to handle leave salary calculation and also regularly verify if they have followed the laws in their calculations.

Cross check the maths

Remember we said that the first level of payroll reconciliation is checking the maths. If you use a manual payroll processing system, you will have to do all these yourself.

Even if you use a spreadsheet (Microsoft Excel or Google Sheets), you must crosscheck your formulas to ensure you have not added deductions and subtracted allowances (for instance). Using the right data but the wrong formula is as messy as using the wrong data.

Verify general ledger entries

Finally, you need to check your general ledger to confirm the accuracy of your payroll journal entries.

Basically, every wage or salary paid should be a debit entry in the wages/salaries journal (or payroll expenses journal).

Here, you need to confirm that you have included the right amount, on the right side of the journal (debit side), and in the right ledger (expenses) and sub-ledger (wages/salaries).

4. How NOW Money simplifies the payroll reconciliation process

Using a digital payroll service like NOW Money can help simplify the payroll reconciliation process in some important ways:

Access to important documents

The payroll reconciliation process depends on your ability to recover accurate records – payroll registers (SIF), time sheets, transaction details of previous payments, etc. But paper records can be lost and even files on a computer can be lost to viruses.

NOW Money stores all payroll records and data on the cloud, which allows you to recover them anytime you want (as long as you have your login details).

Complete visibility of your workforce

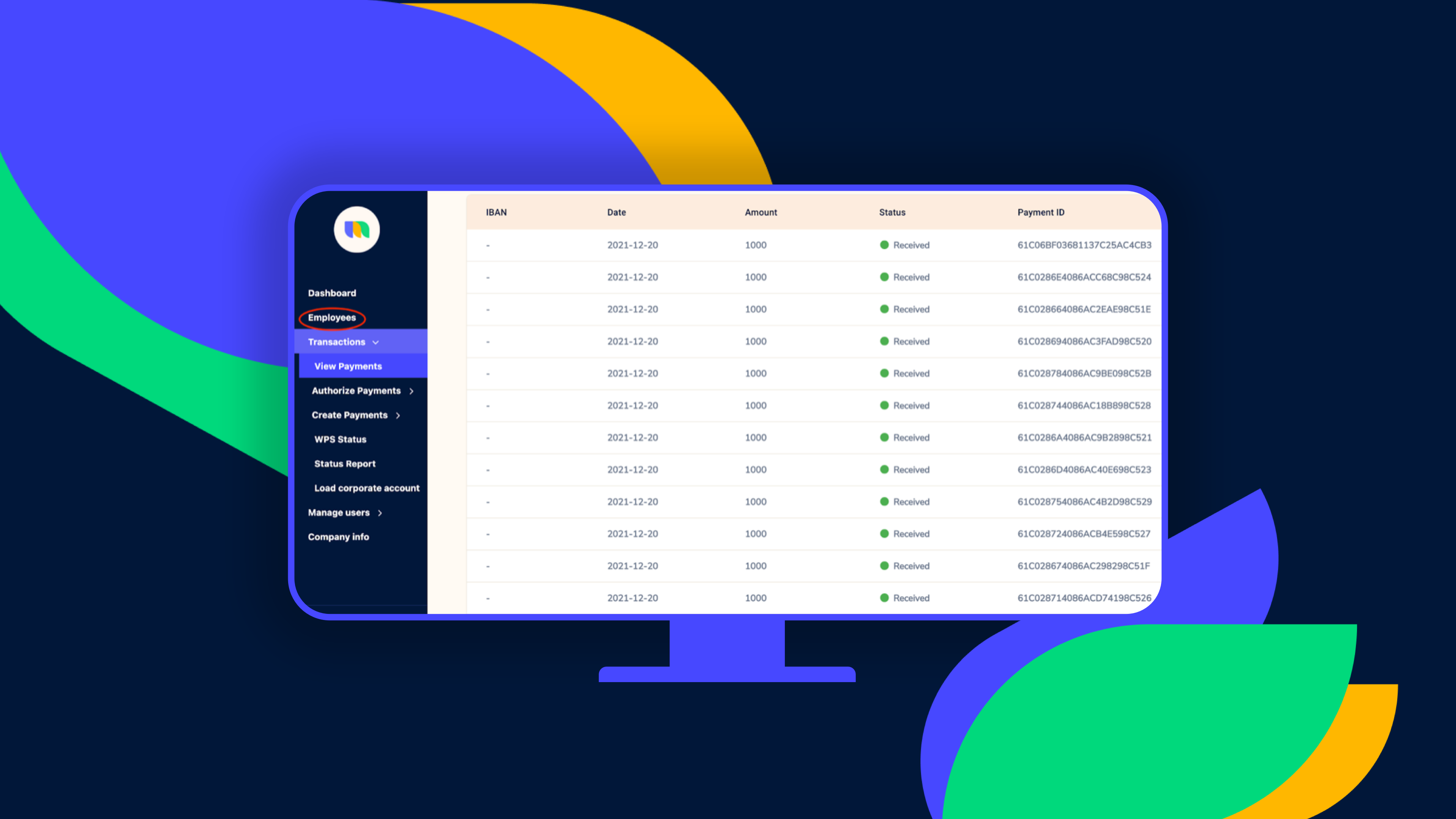

NOW Money not only shows you what you are paying employees in general, it also provides details of payroll transactions for each employee. That is, you will get a debit alert for each employee.

You can use this information in the payroll reconciliation process to confirm if the amount you have been paying the employee tallies with what you should have been paying.

Keeping tab on relevant laws

In addition to providing payroll software, NOW Money is also a WPS agent. This means the company is a source for keeping companies updated on new WPS regulations and can quickly notify users via a message on the payroll platform.

Consequently, you can be confident of not missing out on important updates that are crucial to staying compliant.

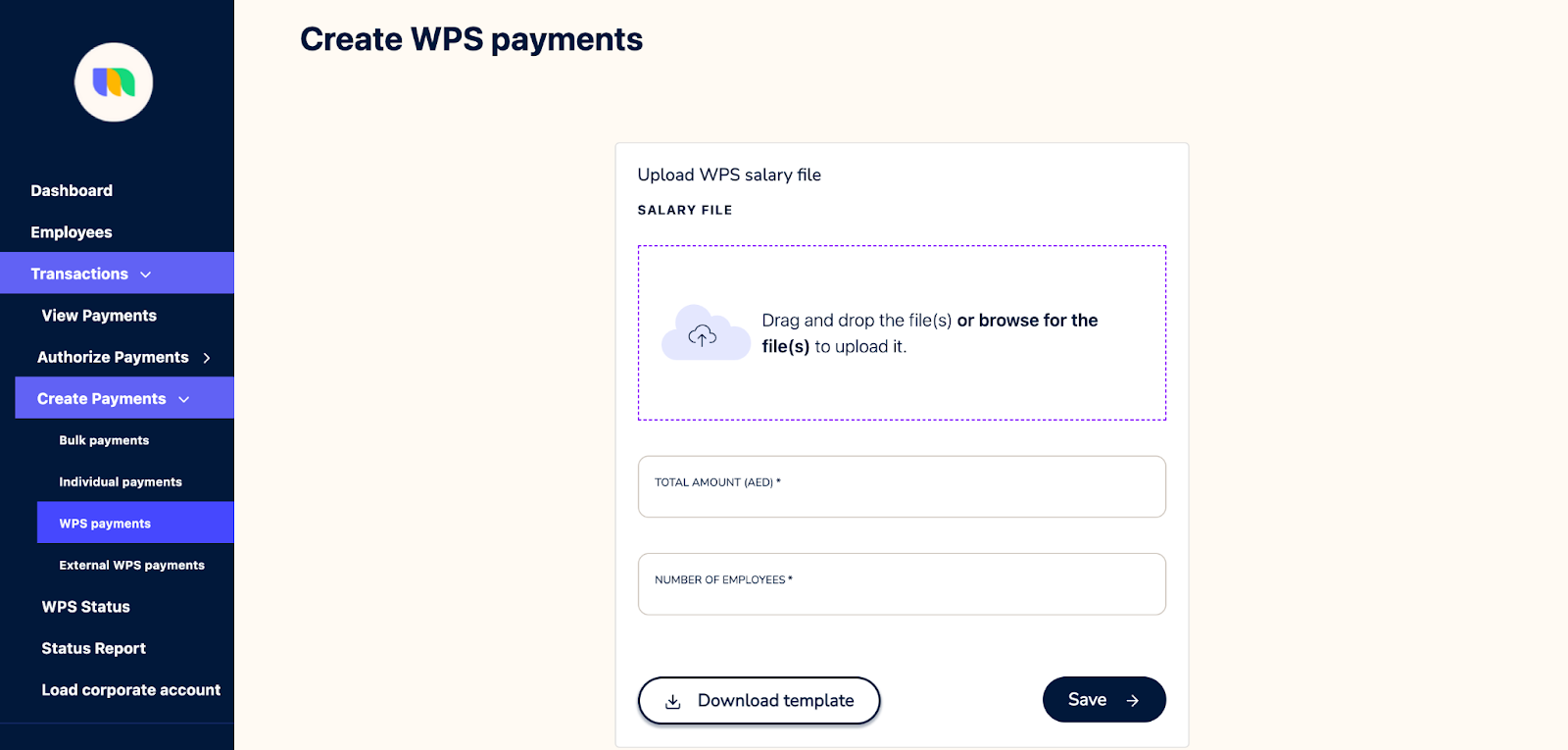

SIF templates

In the UAE, your payroll processing begins with creating detailed SIFs. And as we have seen, the payroll reconciliation process itself requires verifying the information on the SIF.

Due to its importance, NOW Money provides users with SIF templates they can easily populate, upload, and then download.

This template makes it more difficult to make mistakes and easier to identify and correct any mistake.

With quicker and safer access to important records, complete visibility of your workforce, up-to-date knowledge of relevant laws, and comprehensive SIF templates, you can make your payroll reconciliation process as seamless as possible.

In addition to easing payroll reconciliation, NOW Money makes payroll management simpler, flexible, and cost-effective. In a world where payroll software has become indispensable to successful payroll processing, NOW Money makes it easy for UAE companies, whether you are a small business or a big company, to get good value for your money.

What is more, by also serving as a WPS agent, NOW Money meets two top payroll needs through just a single portal and for a cost-efficient price.

[Do you want to simplify your payroll reconciliation process and ensure you are paying your employees the correct compensation? NOW Money is the payroll software you need. Request a demo to see how NOW Money works and how it can transform your payroll management.]

Takeaways

- The payroll reconciliation process ensures that the right amount is on employee paychecks.

- The right payment of workers is important to the workers themselves, employees, and regulators.

- Employers must be thorough and comprehensive in conducting payroll reconciliation.

- The use of a payroll software like NOW Money can simplify the payroll reconciliation process.