Global (multinational) companies opening an office in a new location have often found that working with an in-country partner or provider (ICP) for payroll processing is often a better option than independently creating their own in-house payroll management team.

But what is the meaning of ICP in payroll?

In essence, an ICP is a payroll processing company within a country that helps multinational companies to handle their payroll processing. As Payslip Platform, an HR automation technology company, puts it, an ICP is “a local payroll vendor who provides payroll services in a country that a business wants to expand into.”

Some of these companies take total control of the global company’s payroll processing while others prefer ongoing collaboration with the company’s own human resources (HR) team.

According to Enterprise Times, a business technology magazine website, the first benefit of working with an ICP (also called the aggregator model) over the wholly-owned model (global companies independently creating their own team in the country) is compliance. ICPs are more in tune with local employment and income tax laws and are therefore more likely to ensure compliance.

And with statutory compliance (and legislation issues) being one of the top problems of payroll management (especially of international payroll), according to Alp Consulting, an HR consulting company, working with an ICP should be preferred by global companies.

Enterprise Times also notes that working with an ICP ensures more accountability since ICPs “are held accountable for the quality of service they provide.” Furthermore, ICPs “help keep payroll costs under control” as well as provide a wide range of services.

In all, “the aggregator model has been found to be the most efficient and cost-effective global payroll solution.”

Nevertheless, selecting the right ICP to work with in a country is also a big decision as several factors must be considered.

In this article, we consider six things that multinational companies must consider when choosing an in-country partner.

[Are you a global company looking to set up an effective and efficient payroll system in the UAE? NOW Money’s payroll software will provide you with a fast, flexible, secure, and error-free payroll system. Request a demo to see how it works.]

1. Compliance

As said in the introduction, ease of compliance is one of the primary benefits of the aggregator model over the wholly-owned model.

Therefore, companies seeking to use the aggregator model must ensure that the ICP they have chosen to work with is well-equipped to comply with relevant local employment and taxation laws.

For example, in the UAE, the Ministry of Human Resources and Emiratisation (MOHRE) has a wage protection system (WPS) through which private companies in almost every industry in the UAE must pay their workers. Failure to comply with WPS regulations will result in fines, suspension of permits, non-issuance of new permits, and public prosecution, among others.

Given the seriousness of compliance, companies looking to work in the UAE must ensure they are working with an ICP that is very familiar with the WPS, keeps a tab on the new regulations guiding its operations, and has developed a payroll management process to adhere to its guidelines.

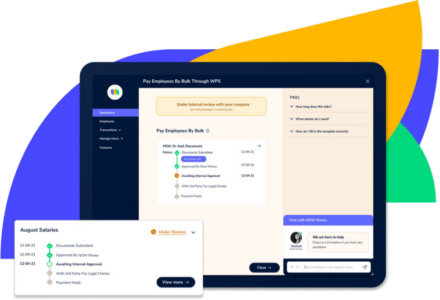

In this context, a company like NOW Money that provides payroll services in the UAE as well as serves as a WPS agent can be trusted to provide this level of compliance. This is because, as a WPS agent, NOW Money is in tune with the whole system and can easily update your payroll software to cater to any new regulations.

The main point here is that the ICP that a global company chooses to work with must be well-equipped to provide the primary benefit of ICPs – compliance. That is non-negotiable.

2. Technology

Companies with manual payroll processing have continued to struggle with the various developments in the world of payroll management.

Said differently, effective payroll processing in today’s world requires the deployment of helpful payroll technologies – especially process and workflow automation and cloud-based storage.

Consequently, when evaluating ICPs, global companies should focus on those who understand the importance of payroll software and have developed platforms that use the latest technologies to improve payroll processing. It is these types of ICPs that can help them save costs and time, digitise payroll records, secure employees’ data, grant them control over their data, and ensure flexibility and continuity.

In summary, global companies should inquire into the type of payroll technology that an ICP uses and ensure they select the one who provides the best value.

3. Range of services

While payroll management is the key service that global companies need, it doesn’t hurt to work with ICPs that go out of their way to provide even more relevant and beneficial add-on services.

A good example in the UAE is NOW Money. Having noticed that many employees in the UAE, especially migrant workers, find it hard to open bank accounts because of the difficult requirements imposed by banks, NOW Money created a mobile banking solution.

With this solution, workers can now have a mobile bank account or wallet through which they can receive their wages, salaries, and other remuneration (bonus payments, overtime, etc.). They can also access the same financial services as people with traditional bank accounts – withdrawing and making payments with a debit card, transferring money to others (home and abroad), purchasing items, paying bills, etc.

But how is this relevant to global companies?

The WPS system requires that every salary payment should be done electronically. Without bank accounts, it is hard for them to comply. But with the mobile bank accounts provided by NOW Money, they can easily comply with WPS at no extra cost. And this is just one of many benefits of mobile banking for employers.

We have also seen various payroll companies offering cash flow management tools to help companies keep track of their liquidity so they don’t suddenly find themselves defaulting on wages and salaries.

The point here is that global companies should prefer ICPS that can offer more add-on services in addition to basic payroll management.

4. In-county expertise and experience

Local know-how and expertise are some of the unique selling points of the aggregator model. Therefore, companies looking for ICPs should evaluate them based on their expertise and experience.

Expertise here includes but goes beyond the technology that the ICP offers (as explained above). It also includes the quality of the management of the payroll service provider. Global companies must be confident that the management has what it takes to provide them value for money.

Evaluating expertise will also include considering how fast, flexible, secure, and error-free the whole payroll process is.

Speed is important because workers must be paid at the right time (failure to do this will be penalised in the UAE, for example). Flexibility is vital because companies might decide to tweak their payroll strategies to achieve better results for themselves and their employees.

Furthermore, data security is necessary to ensure that employee data is not compromised by scammers. The process should also be error-free so workers can be paid the right amounts every time.

In addition, global companies should look out for ICPs that have quality experience. Here, quantity is not to be valued over quality. What matters is not merely the number of years in operation as the quality of service that has been provided to clients.

Therefore, companies seeking ICPs should check reviews on their websites and speak to some of their customers to get feedback on the quality of service.

5. Accessibility

The first point here is that a good ICP must have an outstanding customer service team. Even companies that offer the best products or services must keep the channel of communication always open to receive complaints, ideas, and questions from users and clients.

Secondly, global companies should prefer payroll companies that allow them maintain control over their payroll data. In today’s world, the insights generated from data is a source of competitive advantage to many companies.

Therefore, by keeping control over their data, these companies can make decisions that will improve business outcomes.

In fact, this is one reason why payroll software is to be preferred to manual processing. The former allows easier data collection and analysis.

6. Cost

While cost should not be the only (or even primary) reason for choosing an ICP, it is nevertheless an important consideration.

However, instead of looking for the cheapest ICP, global companies should focus on getting the best value for money. The cheaper option should be considered only if it provides equal value as a more expensive option, in which case cost is the deciding factor.

Said differently, cost should only be a factor once all other factors have been considered. If A provides 2X value as B, then A should be preferred as long as its cost is not more than 2X of B. But if C also provides 2X value as B and costs half of A, then C should be favoured. Again, it is the value for money that matters ultimately.

How global companies can get value for money with NOW Money

By doubling as a payroll services provider and WPS agent, NOW Money is able to ensure full compliance with WPS regulations. This also allows it to provide a range of services, which includes mobile banking for employees.

The company’s payroll platform uses various automation technologies and allows the storage of payroll data in the cloud. With these technologies, it is able to reduce its cost.

NOW Money also provides fast, flexible, secure, and error-free payroll processing made possible by its competent technology and local knowledge and expertise.

Also, unlike other ICPs, NOW Money allows clients to take control of their own payroll management. It seeks to provide all the benefits of an ICP – compliance, accountability, low cost, etc – as a partner rather than as an outsourced company.

Therefore, it allows global companies to install the software (or access it on the web) and take control of its operations after a NOW Money staff has explained all its intricacies during onboarding. NOW Money will then be available to answer any inquiries from the company as regards their experience with the software.

In this way, global companies can tap into local knowledge and expertise without subjecting themselves to the problems that come with outsourcing.

[Are you a global company looking to work with a payroll ICP that will provide fast, flexible, secure, and error-free payroll management? Request a demo of the NOW Money payroll software to see how it can help you set up an efficient payroll system.]

Takeaways

- Global companies working in different countries are better served forming partnerships with in-country providers (ICP) to set up payroll systems in those countries.

- ICPs can help global companies achieve a high level of compliance, in addition to other benefits – accountability, cost effectiveness, etc.

- Before choosing an ICP, global companies must consider the level of compliance they can attain with it, its technology, range of services, expertise and experience, accessibility, and cost.

- Though global companies are better off with a payroll partner, they should prefer one which allows them to keep control of their payroll system.Photo credit: Mimi Thian via Unsplash