Sending money back home is a key part of life for many UAE residents, which is quite understandable since about 90% of them are foreigners.

Given the diversity of people sending money back home, remittances from the UAE play a huge role in supporting numerous economies around the world, providing an economic lifeline for countless families and communities. This money contributes to poverty reduction, education, healthcare, and overall economic growth and development, as stated by the United Nations.

In fact, remittance flows from diasporas have become essential to many countries, even far more than foreign direct investment (FDI).

The World Bank reported in 2018 that of all low-and-middle-income countries (LMICs, also known as developing countries), only China had more FDI than remittances. That statement speaks volumes about the power of global money transfers.

Today, remittances have become a significant component of the national economy of many countries when considered as a percent of GDP. As an example, a country like Tonga has a remittance to GDP ratio of 49.9%, according to data from Visual Capitalist. Lebanon (37.8%), Samoa (33.7%), Tajikistan (32%), and Kyrgyz Republic (31.2%) are other countries with high remittances to GDP.

Given the UAE’s large role in remittances, there is significant economic support going to the top countries that receive money from UAE residents.

1. Largest remittance countries receiving from the UAE in 2023

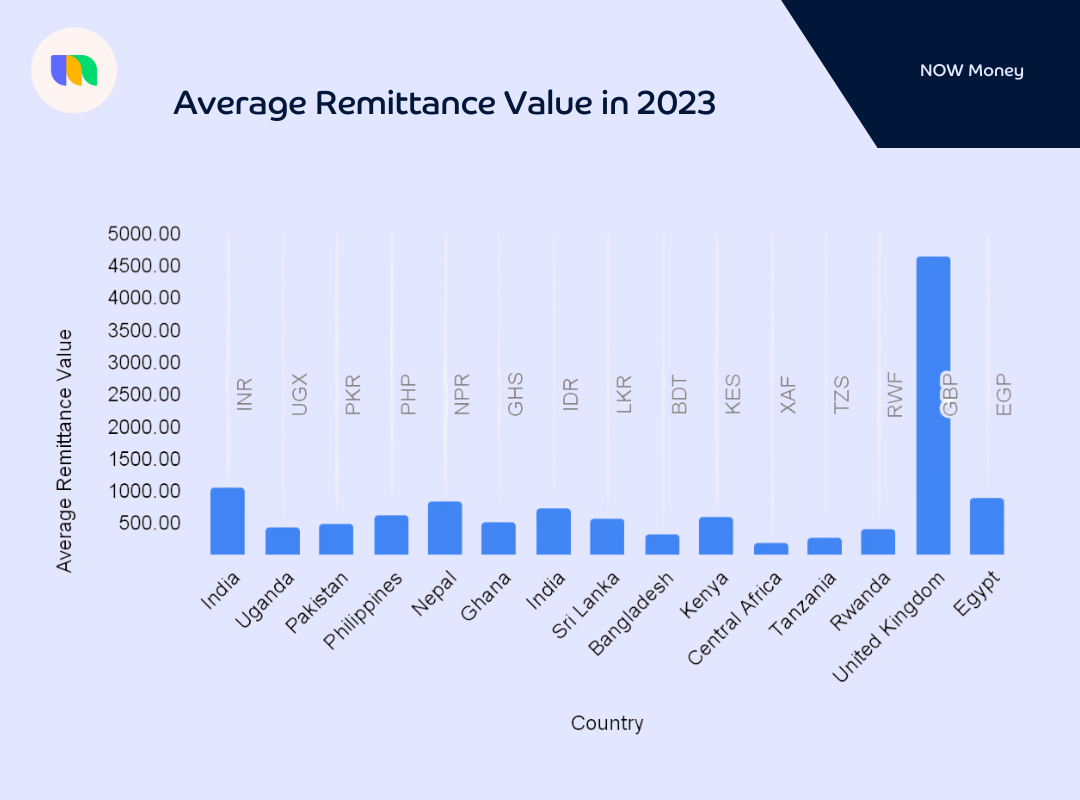

In terms of average remittance value (the average amount that our users sent to a given country), the following are (so far in 2023) the top five highest recipient of remittances from the UAE:

- United Kingdom: AED 4638.97

- India: AED 1060.32

- Egypt: AED 905

- Nepal: AED 834.66

- Indonesia: AED 737.32

On the other hand, the countries receiving the lowest average remittance value are:

- Central Africa: AED 205.09

- Tanzania: AED 282.53

- Bangladesh: AED 321.84

- Rwanda: AED 419.37

- Uganda: AED 437.49

Where a country stands in regards to average remittance value will depend on three factors: the average prosperity of its citizens (or family and friends) in the UAE, the exchange rate between the two currencies, and the cost of living.

The United Kingdom being the largest recipient by average remittance value is not surprising since it has the highest cost of living index among all the countries we covered in this survey. The UK also has a diverse population, which means many workers in the UAE are connected to family and friends there.

However, when the cost of living in a country is higher, there is a tendency to send more average monthly remittances that will be enough to cover the expenses of family and friends that live there. Cost of living does not explain everything, however.

For example, while Bangladesh ranks higher than Indonesia, Nepal, Egypt, and India on the cost of living index, its remittance value is far lower compared to them. This can be due to a variation in the financial prosperity (and/or generosity) of the average Bangladeshi migrant when compared to migrants from these other countries.

On the other hand, exchange rates do not seem to be a standalone explanation. For it to be a significant factor on its own, remittance values should be lower in countries with lower exchange rates to the dirham.

What do we find in this survey?

The exchange rates of countries with the higher average remittance value tend to be more favourable than those of countries with the lower remittance value.

- United Kingdom: AED 1 = GBP 0.21

- India: AED 1 = INR 22.3

- Egypt: AED 1 = EGP 8.41

- Nepal: AED 1 = NPR 35.7

- Indonesia: AED 1 = IDR 4083.42

- Central Africa: AED 1 = XAF 163.53

- Tanzania: AED 1 = TZS 650.15

- Bangladesh: AED 1 = BDT 29.47

- Rwanda: AED 1 = RWF 311.15

- Uganda: AED 1 = 1007.17

Average remittance value (ARV) vs total remittance value (TRV)

While ARV is an important measurement, it must be differentiated from TRV. Country A can have a greater ARV than country B but less TRV.

This can happen if country B has a larger population of expats sending money home. For example, an ARV of AED 300 sent by 1,000,000 people will yield AED 300 million while an ARV of AED 500 sent by 500,000 will yield a TRV of AED 250 million.

Therefore, a list of the largest remittance countries by ARV can differ from one created based on TRV.

For example, in a 2021 list provided by Statista, India, Egypt, Pakistan, Bangladesh, and Philippines were the top 5 remittance recipients. Despite its high ARV, the UK was ranked 21.

In 2019, Gulf Business also published a list of top remittance recipients created by the Central Bank. Here, India, Pakistan, Philippines, Egypt, and the UK were the top 5.

It’s possible that the UK’s ARV was still higher than others in 2019 and 2021 even while its TRV was lower since India, Pakistan, Egypt, Nepal, Indonesia, and the Philippines have a larger population of expats in the UAE.

The main point here is that TRV is a function of both ARV and population and any of these two factors can lead to a change in the ranking of the largest remittance countries receiving money from the UAE. Our own survey has focused on ARV.

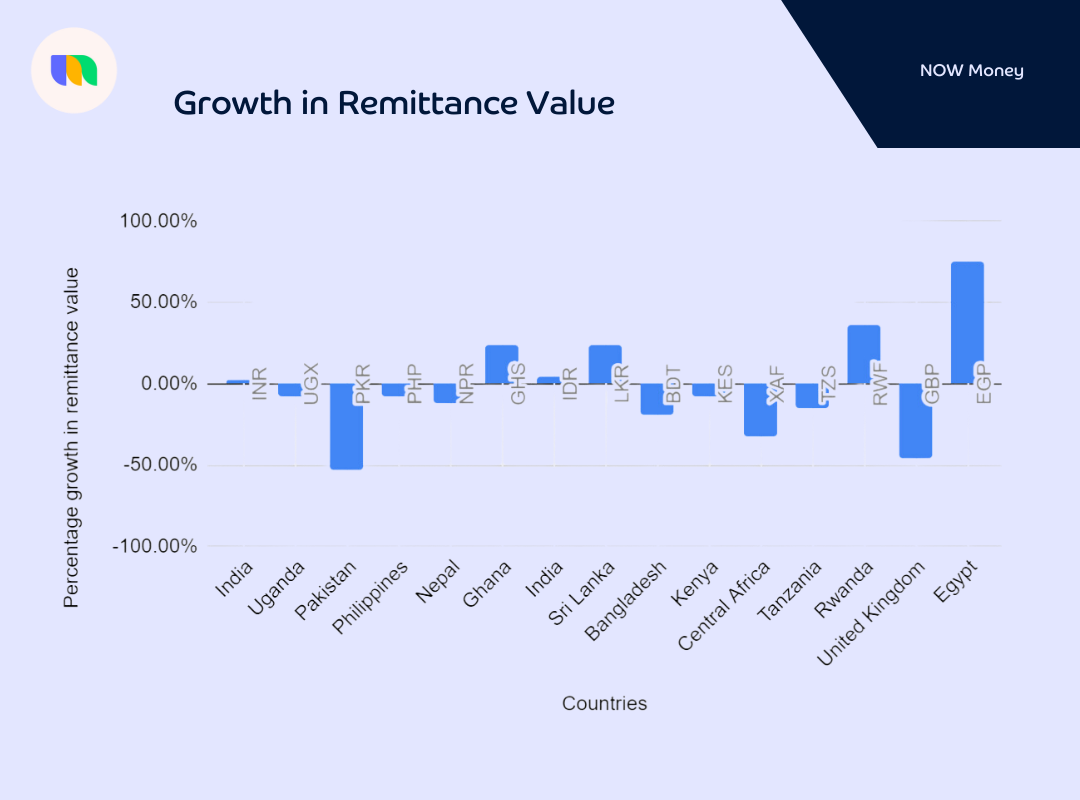

2. Trends in average remittance value

A more important analysis is to consider remittance trends – changes in the flow of remittances and the reasons behind the movements.

To do this, we compared the ARV of the selected countries in 2023 (YTD) with what it was for the same period in 2022.

Rise in remittance value

The following countries experienced the highest growth in average remittance value:

- Egypt: 75.25%

- Rwanda: 36.65%

- Ghana: 24.38%

- Sri Lanka: 24.30%

- Indonesia: 4.56%

In a December 2022 report, Zawya, a news agency covering the MENA region, published a brief report showing how remittances to various countries in Asia and Africa were increasing. They interviewed spokespersons for three exchange houses: Al Fardan Exchange, Al Ansari Exchange, and Lulu Exchange.

The spokespersons confirmed that the appreciation of the dirham relative to the home currency of the other countries was a significant factor in this growth. As Al Ansari’s CEO puts it: “the weakening of several currencies and the strength of the UAE dirham have provided expats with a greater purchasing power for their money, allowing them to remit more home to expand assets or pay off their debts and mortgages.”

The top performers for Lulu Exchange were India, Pakistan, Sri Lanka, Egypt, and Nepal while Qatar, Bangladesh, Pakistan, Egypt, Nepal, India, and Philippines were the top performers for Al Ansari.

Our 2023 research shows that remittance value in Egypt and Sri Lanka have continued to grow just as these two exchange houses noted at the end of 2022. More importantly, our research agrees that Asia and Africa are the two fastest-growing corridors with Indonesia and Sri Lanka representing Asia and Egypt, Rwanda, and Ghana representing Africa.

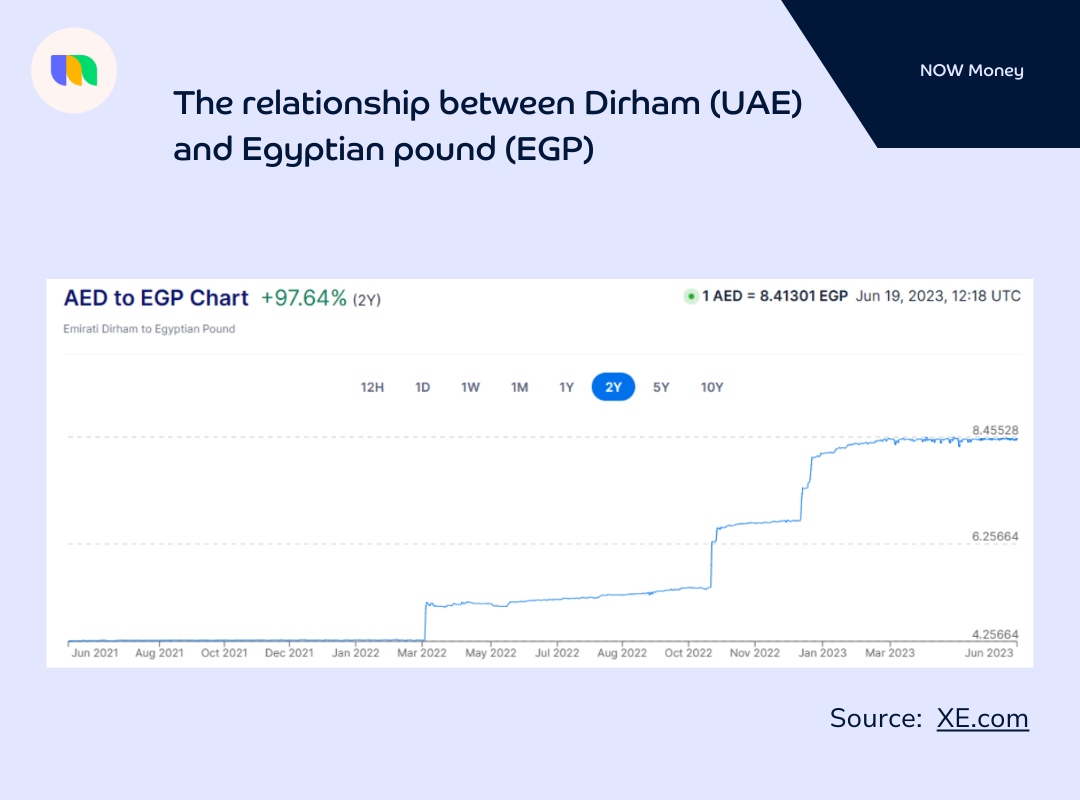

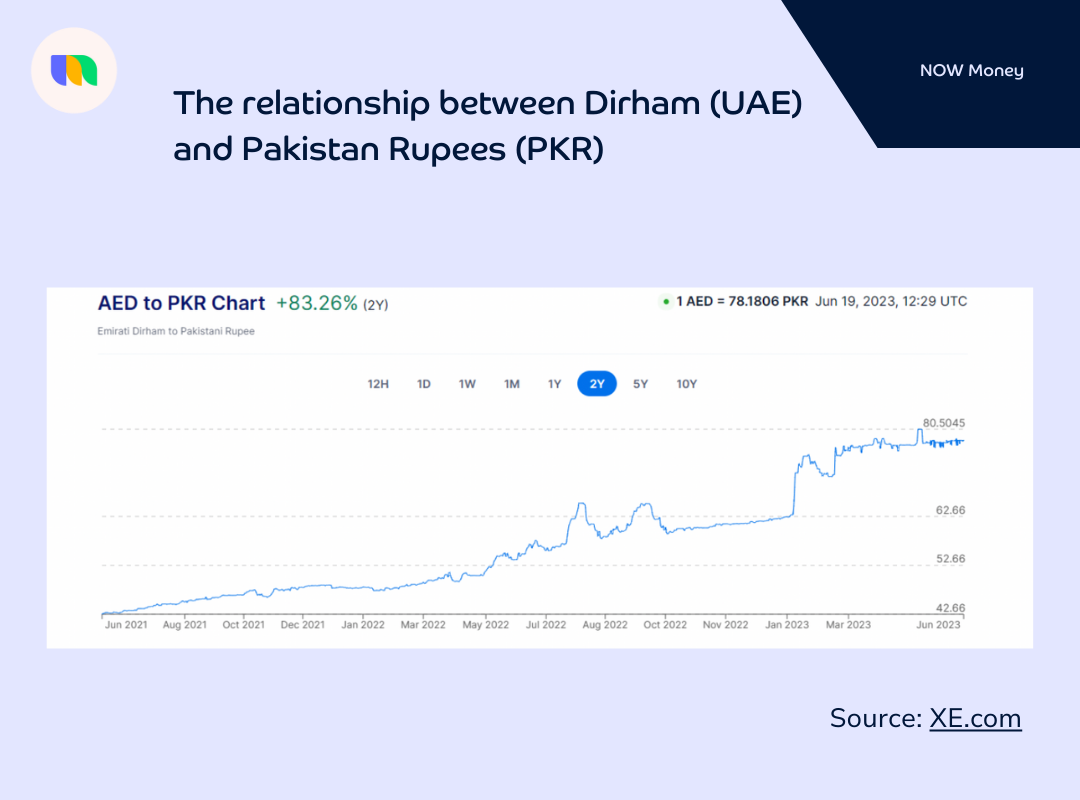

What about the explanation that dirham appreciation is a significant factor in the growth of remittance value? Well, it works. The chart below shows the relationship between the dirham and Egyptian pound (EGP) over the past two years:

Note that since March 2022, AED has continued to appreciate against the EGP. It is therefore understandable that remittance value to Egypt has increased significantly in 2022 (as per Zawya) and 2023 (as per our research).

More importantly, this explanation works across the board: AED experienced significant appreciation against all the other currencies in this list during this two-year period.

Fall in remittance value

On the other hand, the following countries experienced a fall in average remittance value:

- Pakistan: -53.46%

- United Kingdom: -45.72%

- Central Africa: -32.06%

- Bangladesh: -19.23%

- Tanzania: -14.62%

If appreciation of dirham is a good explanation for countries where remittance value is growing, is depreciation also a good explanation for countries where it is falling?

Well, it doesn’t always work that way.

For example, AED has also appreciated against Pakistan Rupees (PKR) over the past two years, as seen in the chart below:

In fact, while appreciation/depreciation works as an explanation for fall in ARV in the United Kingdom and Central Africa (there was appreciation between January and October 2022 and depreciation since then), it doesn’t work for Bangladesh and Tanzania (where, like Pakistan, there has been consistent appreciation).

Consequently, we must consider other factors.

A study by Western Union has shown that economic challenges in recipient countries (such as a pandemic-induced fall in household income) as well as festivities and other special occurrences (Eid al-Fitr and Eid al-Adha, for example) are all important factors (in addition to exchange rate) that can affect the value of remittances.

Intuitively, the economic performance and needs of expats are also significant factors that can affect remittance value.

Due to the absence of relevant data, it’s hard to say which of these is the cause of the fall in remittance value to Pakistan, Bangladesh, and Tanzania. But since our research is based on the same period in different years, we can rule out festivities. Any of the other factors can be in play.

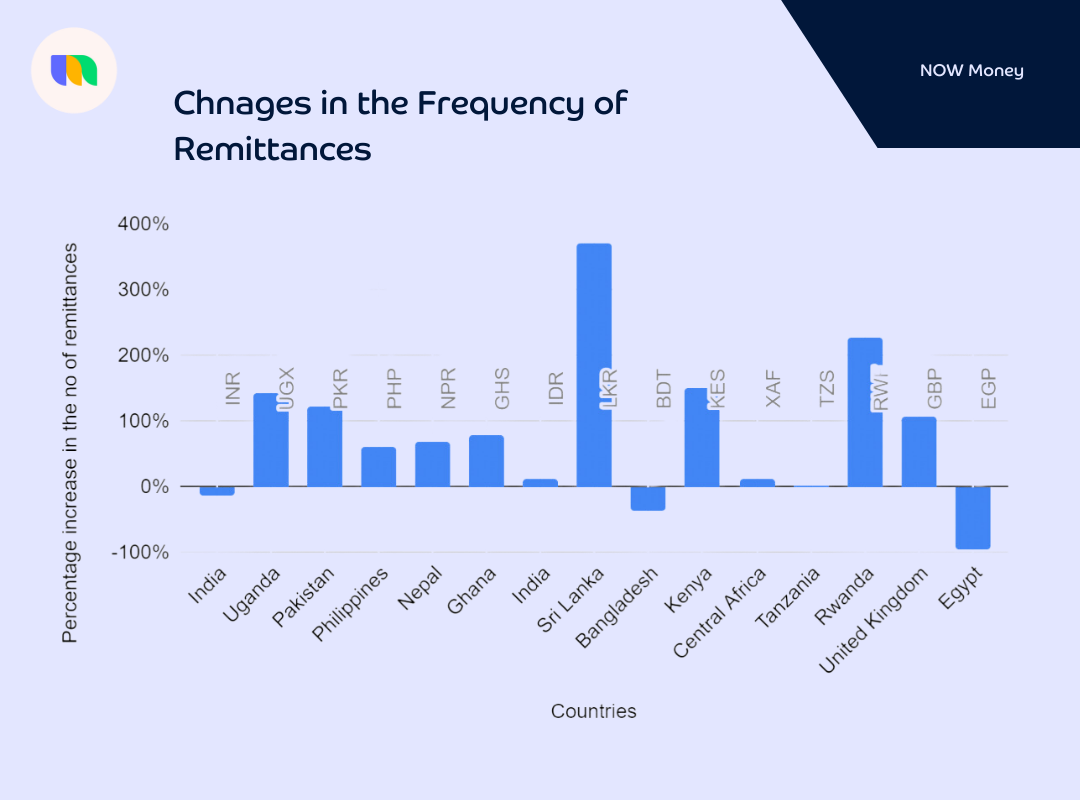

3. Trends in the number of remittance transactions

We also collected data about the number of remittances that are sent to the selected countries. Here, we are looking at the sheer volume of transactions while ignoring the value of those transactions.

What did we find?

Rise in number of remittances

The following countries have experienced the highest growth in the number of remittance transactions:

- Sri Lanka: 370%

- Rwanda: 228%

- Kenya: 150%

- Uganda: 144%

- Pakistan: 124%

One quick insight that jumps out is that the countries that have experienced the highest growth in the number of transactions are not the same as those that have grown ARV the most.

In fact, only Sri Lanka and Rwanda belong to the same list. The number of transactions in Ghana (80%) and Indonesia (11%) grew but they missed out on top spots here despite experiencing the third and fifth largest growth in average remittance value.

Surprisingly, the number of transactions in Egypt fell (-98%) even though it experienced the highest growth in remittance value.

All of these show that there is not necessarily a correlation between growth in the number of remittance transactions and the ARV. Consequential growth in the latter can arise because the average person is sending a higher amount of money.

For example, suppose Mr. A sent EGP 10 three times a month in January 2022 and then decided to send the same amount five times in January 2023. On the other hand, Mrs, B sent EGP 10 three times a month in January 2022 but decided to send EGP 30 on January 1, 2023 and EGP 20 on January 30, 2023.

Well, the average remittance value of Mr. A is still EGP 10 while that of Mr. B has increased to EGP 25 even as the number of transactions have fallen.

Fall in number of remittances

Conversely, the number of remittances fell in the following countries:

- Egypt: -94%

- Bangladesh: -36%

- India: -13%

In the case of Egypt, we saw that fall in remittance transactions did not affect average remittance value. The same holds for India where ARV by Indian migrants grew by 2%.

However, for Bangladesh, both the number of transactions and average remittance value (-19.23%) decreased.

We can explain the cases of Egypt and India with what we have noted already: average remittance value can increase even when the number of transactions is reducing. Users might be deciding to send less frequently (see below) even when the average amount they are sending is higher.

With Bangladesh, it is possible that one or more of the economic factors we noted above (the economic performance and needs of expats, the economic challenges in the home country, and festivities) are in play. That is, Bangladeshis might be having difficult times in the UAE or they might be sending less because of better economic conditions at home.

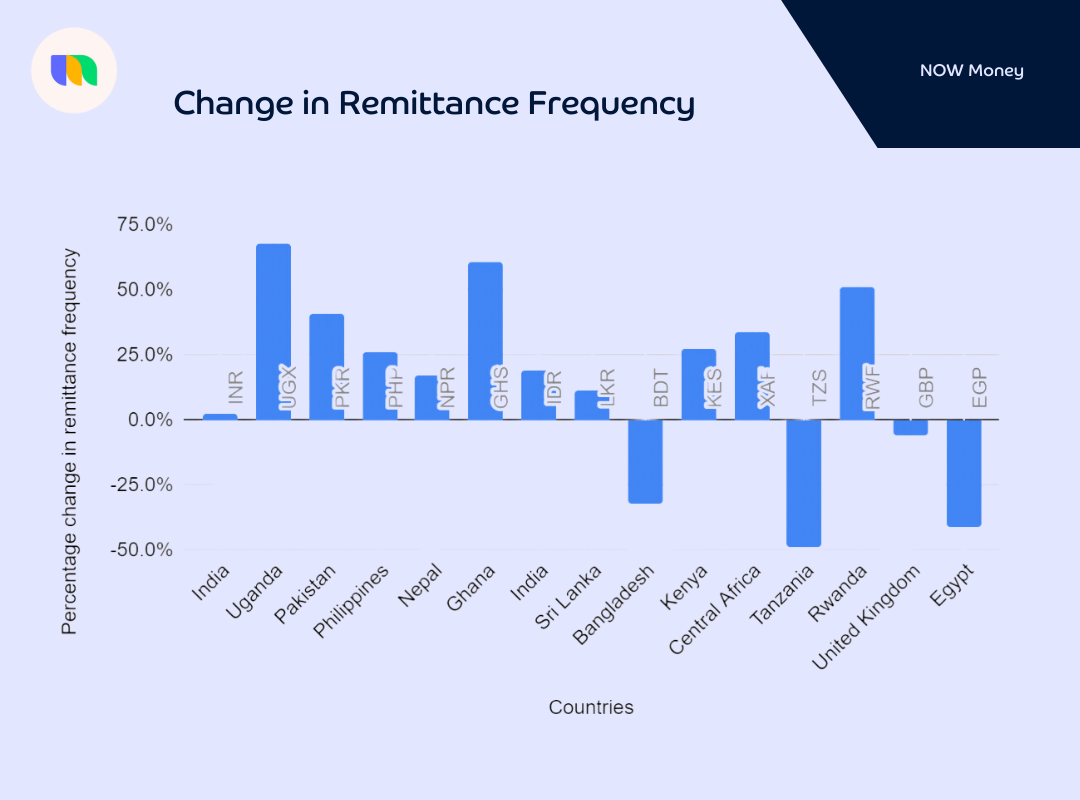

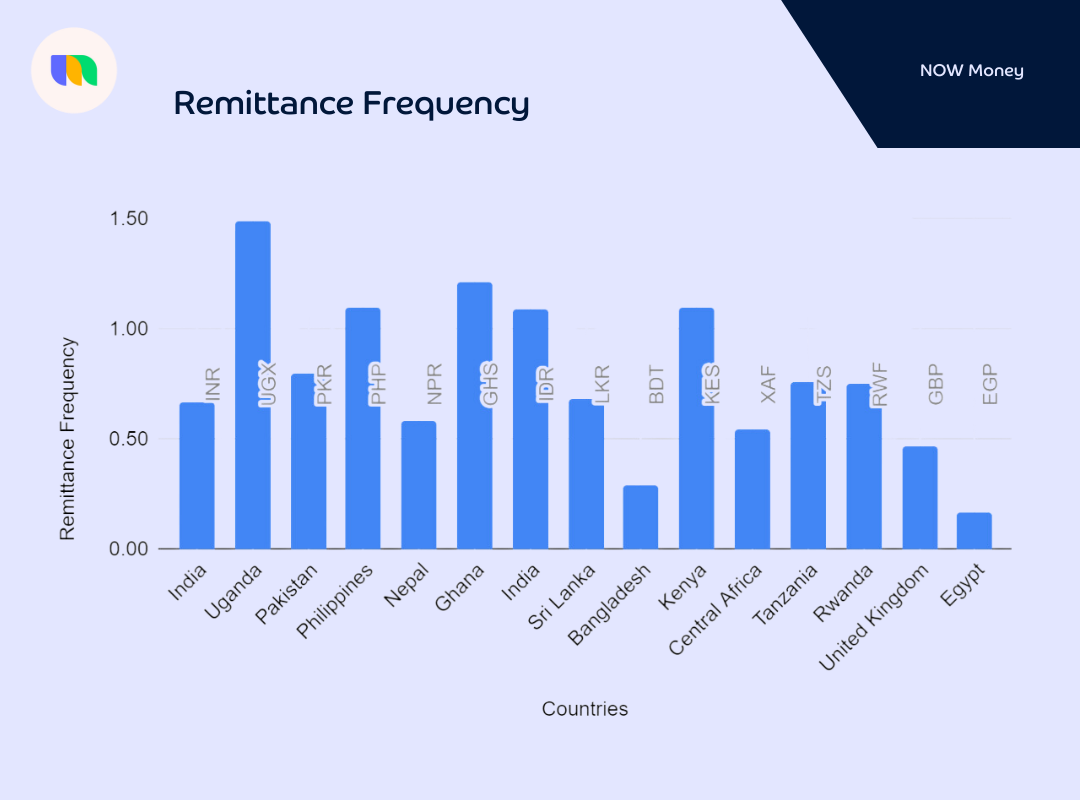

4. Trends in remittance frequency

The third variable we focused on is remittance frequency. Here, we consider how often users of NOW Money send money to a country.

Based on absolute numbers, here are the top countries by remittance frequency:

- Uganda: 1.49

- Ghana: 1.21

- Philippines: 1.10

- Kenya: 1.10

- Indonesia: 1.09

As in the case with ARV, looking at increase and decrease over the periods of interest will yield more relevant information.

So, let’s consider countries where remittance frequency increased or decreased the most.

Rise in remittance frequency

The following countries experienced the highest increase in remittance frequency:

- Uganda: 68%

- Ghana: 60.8%

- Rwanda: 51.3%

- Pakistan: 41%

- Central Africa: 33.6%

The first noticeable insight here is that all these countries except Pakistan are in Africa.

This shows either that more Africans are sending money back home with NOW Money or the same number of them are now sending money home more frequently.

Furthermore, as we saw in the Zawya report, the Africa corridor has generally become increasingly important and this is not only a NOW Money affair.

However, just as with the number of transactions, an increase in frequency does not necessarily lead to an increase in remittance value. For example, Central Africa is one of the corridors where average remittance value has decreased the most.

Again, people can send money home more frequently without the average remittance value increasing. Imagine Mr. A who decides to send XAF 1,000 thrice instead of XAF 3,000 at once because his parents tend to spend lavishly when they receive a large amount. Here, frequency is increasing but not the average remittance value.

The two can nevertheless coexist when AED appreciates against the home country or expats are more prosperous or economic needs at home grows or a combination of these factors.

Fall in remittance frequency

Remittance frequency have fallen in these countries:

- Tanzania: -49.1%

- Egypt: -41.2%

- Bangladesh: -32%

Note again that Egypt is experiencing a fall in frequency despite a rise in average remittance value.

On the contrary, Tanzania and Bangladesh are experiencing a fall in ARV as well as remittance frequency. Again, this might be due to difficult economic conditions for their citizens or increasing prosperity at home.

5. Why it all matters

Business executives should care about the remittance industry since a significant part of their workforce will be migrant workers. If sending money home is so important to the wellbeing and happiness of their workers, then they can’t be indifferent to it.

One of the low hanging fruits for business executives is to ensure that their employees are getting access to remittance systems that are cost-effective, fast, and convenient.

To take an example, employees who go to exchange houses to send money home have to take time off work to make the trip to an exchange house and then waste time staying in queues. This can lead to reduced productivity which harms both employer and employee.

Employers can solve this problem by encouraging transition to digital remittance platforms like NOW Money. With NOW Money, they can send money from anywhere with just a few touches on their phones.

They will also get access to competitive fees and exchange rates. Unlike exchange houses, NOW Money is digitised, thereby reducing operational costs. This allows us to pass the lower operational cost to consumers in the form of lower fees and competitive exchange rates.

Secondly, an understanding of the responsibilities of their workers towards family and friends abroad can help business executives to be more considerate and fair when negotiating salaries, wages, and other incentives.

The government must also care about data showing changes in the volume, value, and frequency of remittances, especially if these changes can be shown (through more extensive data) to be due to declining prosperity or currency depreciation. These are macro economic issues that must draw the attention of the government as they work for the wellbeing of their citizens.

Takeaways

- Remittance flows from the UAE (and other Gulf countries) to other countries has been increasing steadily.

- As international migration has increased, the importance of remittances to recipient countries have become more significant.

- The largest remittance recipients from the UAE include the United Kingdom, India, Egypt, Nepal, and Indonesia.

- Remittances to Asia and Africa have been increasing significantly, in terms of value, number of transactions, and frequency.

- Business owners and other stakeholders need to keep a tab on remittance trends as a supplier of insights on workers’ welfare.

Are you ready for a better way to pay your employees?

Find out how NOW Money can add value to your business with flexible payroll and inclusive employee banking solutions.

Arrange a quick call with our team to see how NOW Money can work for you.