Understanding and mastering the payroll cycle is important for employers who want a payroll system – and business – that runs without friction.

There is no way around it – a growing business has to streamline its payroll cycle if it wants to succeed.

The payroll cycle not only determines the frequency with which employees are paid, it also includes all the activities that go on between one payday and another. So, the efficiency with which an organisation performs these activities will then determine if employees are paid the right amount at the right time.

Consequently, your business payroll cycle must not only comply with relevant laws and adhere to industry standards, it must also be designed in a way that is beneficial to both employer and employees.

In this article, we consider what the payroll cycle is all about and how organisations can master it to their benefit and that of their employees.

We’ll cover:

- What is the payroll cycle?

- Types of payroll cycle

- Common payroll cycle activities

- Factors to consider before choosing a payroll cycle

- Payroll cycle and the need for a flexible payroll management system

1. What is the payroll cycle?

Simply put, the payroll cycle (also known as the pay cycle) is the time period that elapses between two consecutive paydays.

We can also define it as the frequency with which an organisation pays its employees.

If Business A pays workers at the end of every month, then there is a 30-day gap between two paydays. Consequently, the business has a monthly or 30-day payroll cycle. On the other hand, if Business B pays every week, then it has a weekly or 7-day payroll cycle.

However, the payroll cycle is not just another name for the payment period.

Payroll cycle and payment period

The payment period (or pay period or payroll period) is “a time frame used to calculate earned wages and determine when employees receive their paychecks,” according to NetSuite. In other words, it is the time period that a particular payment covers. So, if a worker receives a monthly salary, then the payment period is 30 days.

Though the payment period and the payroll cycle end up covering the same duration, the former is defined from an employee’s point of view and the latter from the human resources (HR) department’s point of view.

Additionally, the payroll cycle is used more extensively to also describe all the payroll activities that the HR department carries out.

Payroll cycle calendar

The payroll cycle calendar is a planning tool with which businesses identify their payroll cycle and payday for a given period, usually a year. Below is a sample of a payroll cycle calendar that uses a monthly or 30-day pay cycle.

Source: Forbes

Organisations tend to use the payroll cycle calendar in their cash flow management. By identifying beforehand when they are due to pay workers, they can arrange their finances to ensure that they can pay on time.

Payroll cycle flowchart

We mentioned above that the payroll cycle is also used to include all the activities that take place between one pay day and the other.

Some organisations use a payroll cycle flowchart (also known as a payroll processing flowchart) to identify these activities and their interrelationships. These flowcharts also function as a checklist that ensures payroll staff do not overlook any important payroll activity.

The chart shows that the end of one cycle is the beginning of another. Once wages or salaries for a pay cycle have been made, work must start in preparation for the next payday.

2. Types of payroll cycle

There are different types of payroll cycles that have been used by organisations across the globe. The most common are:

- Weekly: Where employees receive weekly pay, the payroll cycle is seven days or one week.

- Bi-weekly: Bi-weekly can mean that workers get paid twice a week or every two weeks.

- Semi-monthly: This means workers receive remuneration twice a month.

- Monthly: Monthly pay cycle still remains the most popular across the globe.

Payroll staff also classify payroll cycles based on the relationship between the payroll cycle and when employees receive their remuneration:

- Regular: If an organisation uses a 30-day payroll cycle, then every payment received by employers at every 30-day interval belongs to the regular payroll cycle.

- Off-cycle: On the other hand, it is possible that some employee benefits do not depend on the payroll cycle. A popular example is a one-time bonus payment (when a company goes public, for example). These types of remuneration can be paid on any day.

- Final: Final payroll is the last compensation an employee receives from an organisation they are departing. Depending on the location and the employment contract, a lot of calculations can go into determining what an employee’s final pay should be.

More importantly, the organisation might have to make this final payment outside of the regular pay day, depending on when the employee has decided to leave.

3. Common payroll cycle activities

We saw above that companies use the payroll cycle flowchart to outline key steps that will take place as they prepare for another pay day.

There are three broad activities that every payroll team must perform during this period:

Include new hires in the payroll register

If new employees have joined, the payroll cycle is the period where payroll staff must include their employee information in the payroll register, in anticipation of the next payday.

Perform payroll reconciliation

Secondly, payroll staff must conduct thorough payroll reconciliation at every payroll cycle.

The payroll reconciliation process ensures that the employee data with which payroll staff are calculating an employee’s compensation is accurate.

This often involves revisiting employment contracts (for pay rate), employee time sheets or time cards (for number of hours worked), and other records to confirm that no mistake has been made in calculating basic salary (gross pay), leave, allowances, payroll deductions (including payroll taxes, if it applies) and, by implication, net pay.

For those using manual payroll processing, there is also a need to double-check the maths to verify that what was supposed to be added was not subtracted, vice versa. Those using payroll software might not need to go through this process.

Furthermore, in the UAE, payroll reconciliation also involves getting familiar (and updated) with UAE labour law and WPS rules to ensure that the organisation is complying with every relevant payroll regulation.

Confirm cash availability

In looking at the payroll cycle calendar, we mentioned briefly that cash flow management is one of the reasons why such was needed.

In every payroll cycle, payroll staff must work in tandem with the accounting and finance departments to guarantee that there will be enough cash for the next payday.

An obvious advantage of this activity is that it helps the employer avoid missing out on payments on payday. Employees hate it when they don’t receive their payslips on time; organisations that value them must therefore work hard to avoid such a situation.

However, in the event that a company might struggle to make payment, confirming cash availability before payday will give HR ample time to talk to employees about the situation and give them needed assurances. Prior announcements coupled with assurances can help defuse the situation and deflate employee dissatisfaction and disappointment.

4. Factors to consider before choosing a payroll cycle

Should your organisation choose a weekly, bi-weekly, semi-monthly, or monthly payroll cycle? Well, there are four factors to consider before making that decision:

Relevant laws

If your company operates where a monthly pay cycle is established by law, then you don’t really have any leeway. However, in the UAE, the WPS gives employers the freedom to choose their pay cycle. In fact, organisations can have different pay cycles for different workers – daily or weekly for part-time workers (hourly employees) and monthly for full-time workers.

What the WPS demands is that firms must keep to what they agreed with workers in the employment contract. Also, it demands that every worker must be paid at least once a month.

Industry best practice

To guarantee competitiveness, it’s crucial that you stick to industry best practices when choosing a payroll cycle. If all the major players in your industry are using a weekly cycle, then you should try and do the same, where possible.

Employees’ desires

Since making your employees happy should be a priority, you should seek their opinion on the payroll cycle they would prefer. A simple survey should do the job. If they have a preference, consider it (along with all other factors).

Cash flow availability

You should also take a look at your finances (especially cash flow) to see which payroll cycle will be convenient for you. One key thing to keep an eye on is your Day Sales Outstanding (DSO). This is an accounting term that measures the number of days it takes for your customers to pay after you have delivered goods or services to them. If, for example, it takes you an average of 40 days to collect cash from customers, then it might be difficult to choose a weekly payroll cycle unless you have another steady source of cash.

In essence, HR must work in tandem with finance in deciding on a payroll cycle.

Payroll management system

Firms must also consider how long it will take them to carry out the payroll cycle activities listed above. If it will take you 14 days to include new employees, perform payroll reconciliation, and confirm cash availability, then you can’t work with a 7-day payroll cycle.

The essential factor here is the type of payroll management system (or payroll service) you are deploying. A manual system will take more time and require a lengthy payroll cycle while an automated system can cope with shorter payroll cycles.

5. Payroll cycle and the need for a flexible payroll management system

There is a final point worth mentioning: you don’t have to stick to one payroll cycle. If relevant laws, employees’ desire, industry best practice, cash flow availability, and payroll management system change, you should do a payroll cycle audit and be willing and ready to adjust your payroll cycle.

iPay, one of our clients, is an example of how this flexibility can work to your advantage. When they decided to change the payroll cycle for salespersons from quarterly to daily, they saw a 50% increase in the sales of many of them. In essence, changing your payroll cycle can have a positive impact on business performance.

However, such flexibility requires that you have a flexible, automated, and streamlined payroll management system that allows you to tweak your payroll cycle with minimal effort.

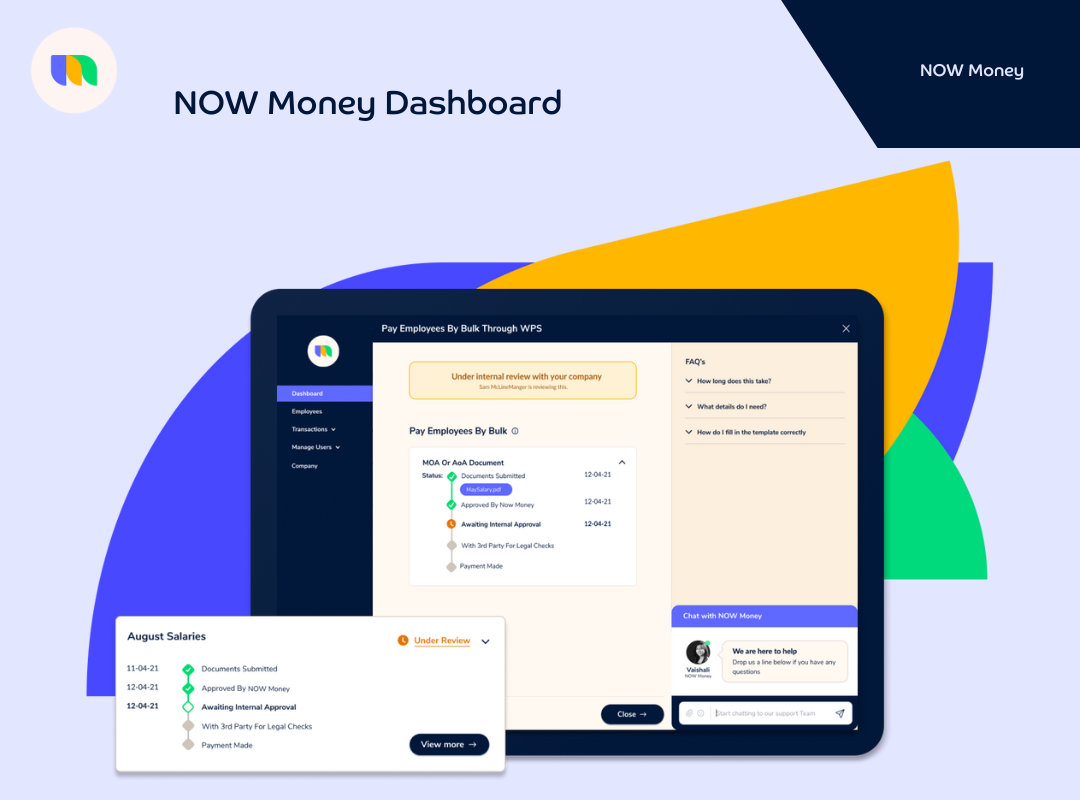

This is one of the benefits of using NOW Money. We don’t charge any extra fee for changing your payroll cycle. You can pay weekly, bi-weekly, semi-monthly, or monthly at no extra cost. Moreover, changing your weekly cycle takes minimal effort – you only need to upload your SIF (salary information file) and make direct deposits to your account at a new interval.

In addition to this flexibility, NOW Money is cost-effective (our WPS charges are among the lowest in the country) and easy to use (with our intuitive dashboard).

What is more? When you create an account with NOW Money, we will provide mobile bank accounts for all your employees. With these debit cards, they can receive their salaries, withdraw at ATMs, send money abroad, and recharge their phones, among other important basic financial services.

Takeaways

- The payroll cycle is the frequency with which an organisation pays its workers. It can be weekly, bi-weekly, semi-monthly, and monthly.

- The payroll cycle also includes the activities that firms must execute between one payday and another: including new employees in the payroll register, payroll reconciliation, and confirming cash availability.

- Relevant laws, industry best practices, employees’ needs, cash flow availability, and payroll management system are the five factors to consider when choosing a cycle.

- Organisations must conduct regular payroll cycle audits to ensure the one they are using is the best for them.

Do you want a digital payroll system that will help you easily adapt to any payroll cycle?

Find out how NOW Money can add value to your business with flexible payroll and inclusive employee banking solutions.

Arrange a quick call with our team to see how NOW Money can work for you.