Managing payroll for small business startups or medium-sized companies comes with unique challenges that big corporations don’t usually struggle with.

Due to lower budgets, small- and mid-sized businesses (SMBs) can’t invest in hiring big teams, acquiring expensive software, or outsourcing their payroll system. This is understandable since SMBs have a lower number of employees, which makes such investments inefficient.

Despite having a low budget, learning how to manage payroll for a small business or medium-sized firm is essential. Good payroll management will help you avoid legal issues, save time and cost, and maintain good relationships with your employees.

But how can you do this without the best HR talent, the most sophisticated technology, or outsourcing?

In this article, we’ll look at key insights that are necessary for managing payroll for small business startups and mid-sized companies.

We’ll cover the following steps:

- Familiarise yourself with the labour law

- Categorise employees and decide on pay schedule and structure

- Collect and review employee data

- Create and publish payroll policy

- Comply with the Wage Protection System (For UAE businesses)

- Keep an eye on cash flow

- Use a digital payroll system

At the end of this article, you’ll have all the information you need to manage business payroll without breaking the bank.

[Is your company looking for a payroll system that will help you manage your payroll efficiently? NOW Money offers a simple, flexible, and cost-effective digital payroll system for SMBs in the UAE. Send us a message or first tell us more about your company, and we’ll get back to you with the best way to move forward.]

1. Familiarise yourself with the labour law

While other concerns about effectiveness and efficiency are important, the primary concern is avoiding legal issues. As an SMB, you don’t have the luxury of getting locked into enduring litigation (where is the money and time for that?).

Therefore, the first point of action in managing payroll for small business startups or mid-sized companies should be gaining familiarity with the relevant legislation.

For example, in the UAE, this is Federal Law No. 33 of 2021, which came into force on February 2, 2022. The law contains 74 articles, of which many are only administrative (the fines to be paid for breaking the law, the power of the cabinet to amend it, etc.).

The National Law Review has provided a concise summary of the important prescriptive portions of this law and we have also covered its implications for salary calculation (basic salary, deductions, allowances, end-of-service gratuity) and leave calculation (annual leave and the others).

Make a note of these essential regulations and ensure that you are applying them to your business before you continue to the following processes below.

2. Categorise employees and decide on payment schedule and structure

Employee categorisation

One implication of the Labour Law is that you’ll need to categorise your employees to reflect the different treatments they will require in the payroll process.

First, there are full-time workers who earn a fixed salary and who are entitled to 30 days paid annual leave provided they have worked for a year.

Second, there are part-time workers who are paid based on working hours and whose leave compensation depends on the employer.

Third, there are temporary workers who work for a particular project and whose contract ends with project completion. Payment can be a lump sum at job completion, a salary for each month of the contract or even based on working hours.

Pay schedule and structure

According to the UAE Labour Law, salary should be paid monthly or bi-weekly depending on your agreement with your employees. In the absence of any such agreement, payment is due every 14 days.

For part-time and temporary workers, the pay schedule will depend entirely on the agreements you have made with them (which can be monthly, weekly, daily, or hourly).

Therefore, when creating an employment contract, ensure there are sufficient details about the pay schedule and structure to avoid misunderstanding and legal battle. Again, for clarity and simplicity, use the categories above as the baseline.

3. Collect and review employee data

An important part of managing payroll for small business ventures and mid-sized companies is collecting employee data. To save cost, a basic Excel Sheet or Google Sheet will do.

For each employee, you will need to indicate what category of worker they are, their employee number, basic salary, bank account number, among others.

In the UAE, the Wage Protection System (WPS) has a structure that includes the relevant data you must have for each employee.

[For more on the Wage Protection System read “What is WPS in the UAE: All You Need To Know About The Wage Protection System (2022)”]

In anticipation of the section on WPS, these include:

- Column A – Employee Details Record (must read EDR, which indicates that this row is part of the EDR section).

- Column B – Employee 14-digit labour card number (provided to you by the Ministry of Human Resources & Emiratization (MOHRE) when you secure a visa for the employee).

- Column C – Bank routing code (provided to you by your payroll processor, who may also be your bank).

- Column D – Employee bank account number (IBAN).

- Column E – Start date of salary (the start date of the week or month the employee is being paid for).

- Column F – End date of salary (the end date of the week or month the employee is being paid for).

- Column G – Number of days salary paid (calculated field; column F-column E).

- Column H – Fixed or Basic Salary of employee.

- Column I – Variable Salary.

- Column J – Number of leave (holiday) days per year.

To avoid errors, ensure you review the employee data before you make any payment. This is one way to avoid underpaying, overpaying, or paying into the wrong account.

4. Create and publish payroll policy

Aside from the specifics of each employment contract, there are some important foundational payroll issues that you must decide how to handle beforehand.

Often, your payroll policy should be published, or outlined in a workers’ manual for transparency.

Here are some items your policy must consider”

- What allowances will your workers (full-time, part-time, temporary) be entitled to? Though you are not legally obligated to pay allowances, they are crucial to employee compensation. Typical ones include housing, phone, transport, communications, children’s school fees, among others.

Ensure your payroll policy details what allowances are applicable to what employees as well as how they will be calculated.

- What salary deductions will apply? Allowable deductions are stated in Article 25 of the Labour Law. Ensure you state which ones apply to which employees.

- Will you treat commissions and bonuses as part of basic salary or gross salary? Including commissions and bonuses as part of basic salary will increase end-of-service gratuity payable to an employee provided their last basic salary included commissions and bonuses.

The law does not require you to do this. However, you must decide on whether to include or exclude them to avoid litigation (in which case the courts normally decide to include them as part of basic salary).

- Will your employee be entitled to salary advances? To avoid unnecessary confusion, it’s also helpful to state whether employees will be entitled to salary advances or not. Moreover, this will be important in determining the deductions that apply to an employee.

- What will your payment schedule look like? A good payroll policy will also state the payment schedules that are applicable for all the categories of workers. Such a policy will help to set expectations and avoid disagreement.

Once you have completed your payroll policy document, ensure it’s available for all your employees to read. Preferably, let them read it and give you feedback before final publication.

5. Comply with the wage protection system (for UAE businesses)

The Wage Protection System (WPS) was created in July, 2009 by the Ministry of Human Resources and Emiratisation in collaboration with the Central Bank of UAE. It is effectively an electronic wage transfer system for the payment of workers’ salaries.

The aim of the WPS is to protect the rights and interest of workers by ensuring their timely and accurate compensation. Presently, the WPS is applicable to all private sector employers in the UAE and the Jebel Ali Free Zone (JAFZA).

How does this apply to you?

Firstly, it requires that you prepare and submit a Salary Information File (SIF), which contains all the relevant payroll data about your employees. We have seen what these exact pieces of data are in a previous section. It’s important to emphasise again that you must ensure that all employee data is accurate.

Secondly, every company, even SMBs, must pay salaries through a WPS agent (financial institutions approved by the Ministry of Human Resources & Emiratization and the central bank). The WPS agent receives your SIF and the total amount payable to your employees for onward payment to your employees.

WPS agents charge you for every WPS payment.

Thirdly, there are certain WPS regulations that you must comply with:

- You have to transfer wages through the WPS by the stipulated deadlines – not more than 10 days from the salary due date stipulated in the employees’ contract.

- You must pay at least 75% of the wages or salaries of at least 70% of all staff.

- You must not provide any inaccurate information.

- You must not force employees to sign a payslip when you have not paid them.

Failure to comply with these regulations carries various fines and penalties.

6. Keep an eye on cash flow

Managing payroll for a small business or mid-sized company includes ensuring that you are never short of cash.

Even if such a situation arises, you must have the financial intelligence to anticipate it from afar and explore various options to solve it before the salary due date.

American Express, the global payment card service provider, has listed eight strategies that can help you improve cash flow, while Wave, an accounting and invoicing platform, provides solutions to nine common cash flow problems.

And just in case you anticipate an unmitigable delay in salary payment for your workers, Woculus, a digital communication firm, has listed some really helpful tips for communicating such delays.

Nevertheless, this is a situation you should try and avoid by all means. And it all goes back to keeping an eye on your cash flow. If the purpose of learning how to manage payroll for a small business or mid-sized company is to ensure timely and accurate payment, then cash flow management cannot be divorced from it.

7. Use a digital payroll system

Though SMBs don’t have the budget or need for big financial departments, they can still benefit from a simple, cost-effective, and flexible digital payroll system.

NOW Money, a WPS agent in the UAE, has provided such a digital payroll system.

To help manage the diverse employee range of SMBs, NOW Money allows for flexible payments at no extra charges. This allows SMBS to save when paying wages or commissions more frequently (daily instead of monthly, for example), and your company can easily convert workers from one category (say, part-time) to another (full-time).

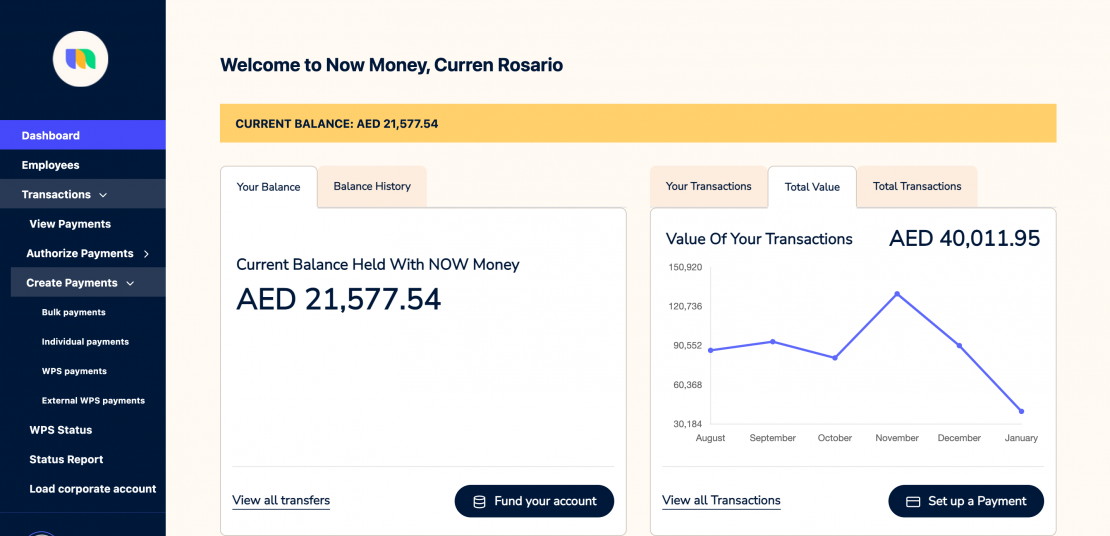

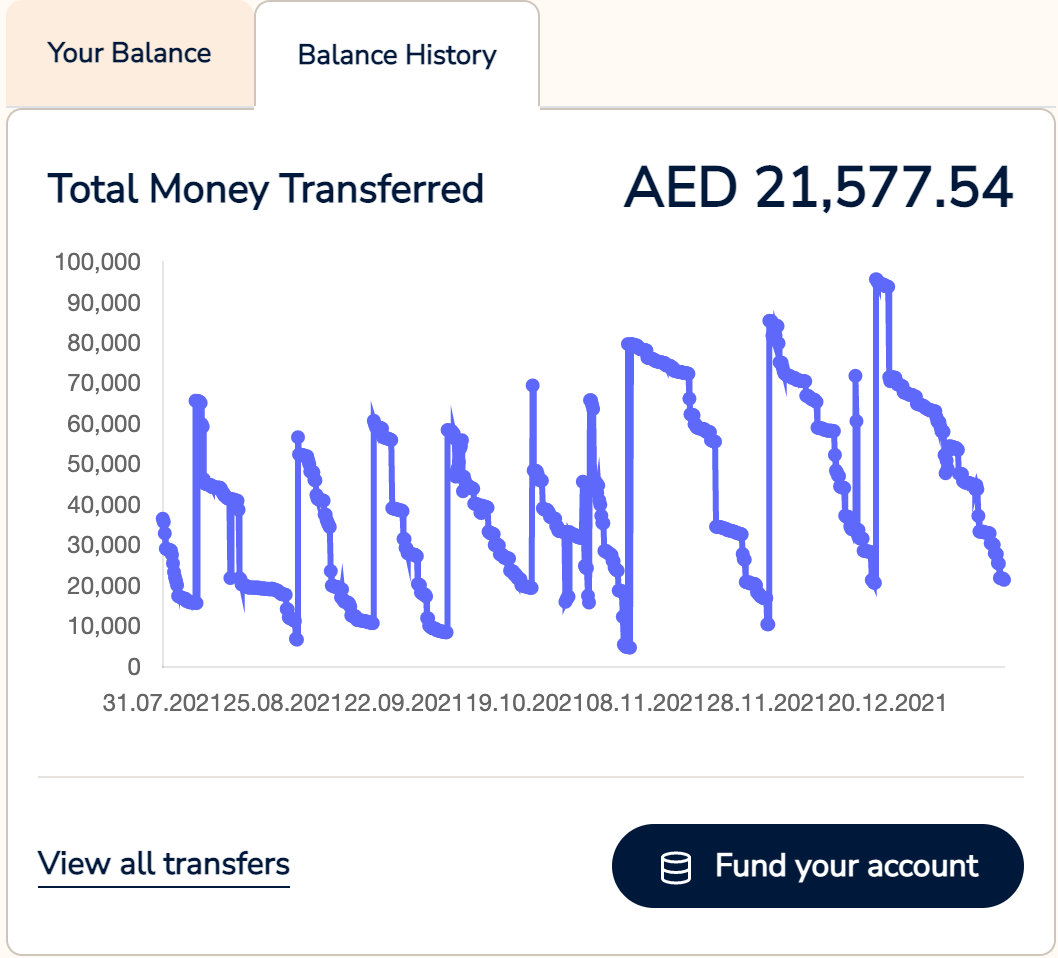

Our dashboard provides one easy place to help manage your entire payroll system. Just take a look at what you’ll see when you first log in:

NOW Money Dashboard

Once you have uploaded your SIF to the NOW Money platform, you and your payroll team can begin to manage your employees’ data, load money into your account, create payment orders (for both WPS and non-WPS payments), and monitor payment status.

Also, you can easily monitor the cash you have in your account.

This way you can easily manage your cash flow to avoid delayed or non-payment (both attract penalties and fines based on the WPS).

NOW Money also provides bank cards and a free digital banking app for your employees. By using this digital payroll system, you are also helping in the process of banking the unbanked.

Sign up at NOW Money to start managing your payroll with a simple, flexible, cost-effective, and efficient digital payroll system or first tell us more about you and your company.

Takeaways

- Small and mid-sized businesses often struggle with payroll because they don’t have the budget to hire big teams, use expensive technology, or outsource their payroll system.

- Even without a big budget, you can learn how to manage payroll for a small business.

- To manage payroll for your SMB, you need to familiarise yourself with the relevant Labour Law, categorise your employees and decide on their pay schedule and structure, create a payroll policy, collect and review your employee data, comply with the WPS in the UAE and keep an eye on your cash flow.

- A digital payroll system will help make your payroll management more effective and efficient.

- NOW Money is a smart, flexible, simple, efficient, and cheap digital payroll system that can help you manage your payroll in the UAE.