With many companies both large and small continuing to struggle with payroll management, there has been increased debate over the benefits of hiring outsourced payroll solutions in Dubai as a possibly better alternative.

Today, working with payroll outsourcing services in Dubai is common, but many problems have been left unsolved.

Outsourcing services in Dubai for payroll tend to intensify some of the problems associated with payroll management while creating others in the process:

- Your business will lose control of the entire payroll system

- You can’t guarantee the confidentiality of your employees’ data when outsourcing services in Dubai to providers

- You still have to spend lots of time coordinating with them

- When something goes wrong, your employees hold you, not the agency, responsible

- You may pay for services you don’t actually need

With all these problems of outsourcing payroll services in Dubai, why do companies still struggle to do this basic function in-house?

Existing payroll systems have proven to be complicated, expensive, inconvenient, and time-consuming (No wonder why the idea of hiring external payroll services in Dubai from experts remains appealing.)

This leaves finance and HR managers in urgent need of a simple, flexible, and effective payroll software system to cheaply, easily, and quickly pay their workers the right amount at the right time, all in-house.

Today, payroll managers must ask if payroll agencies have offered these solutions in the most effective and efficient way possible. Chances are, the answer is no.

In this article, we address today’s main challenges with payroll management by considering the following:

- What is payroll management and why does it matter?

- Top payroll problems in the Middle East

- The shift to outsourced payroll solutions in Dubai

- What are the cons of outsourced payroll providers

- Towards a simple, smart, and flexible payroll solution

At the end of this article, you will be in a better position to decide for your business between your current payroll system, a payroll agency, or integrating with a smart office payroll platform.

1. What is payroll management and why does it matter?

To begin with, what is payroll management?

Basically, payroll management is the process of compensating employees for the payroll services they have rendered to the company. This compensation can take the form of salaries, wages, bonuses, and commissions, etc.

Payroll management is one of the functions of the human resources (HR) department and it involves preparing payslips, calculating gross salary, bonuses, and commissions, withholding taxes and deductions, and making payment to employees, among others.

Why does payroll management matter?

Well, human resources remain the lifeblood of any organisation. “I am convinced that nothing we do is more important than hiring and developing people,” said Lawrence Bossidy, former CEO of AlliedSignal, an automotive and engineering company. “At the end of the day, you bet on people, not on strategies.”

Therefore, keeping your workforce happy and satisfied through timely and error-free compensation is crucial to the health of your organisation. Providing employees with mobile bank accounts to help them better collect their salaries has also proven to have many benefits, including the improvement of sales performance and mental wellbeing.

Put bluntly, if you require them to give their all and do their duties, you can’t be sloppy when it comes to making payroll for your business. This is why your payroll management system must be accurate and effective. However, it must also be efficient – saving time and costs while being flexible enough to respond to changing situations.

In this way, both employer and employee can be happy.

Yet, while this is the ideal, many companies tend to fall short. So, why is that?

2. Top payroll problems in the Middle East

There are many problems that HR departments face when it comes to payroll management. Oracle, a computer technology company, lists 16 of these challenges.

However, since many of them are similar, we’ll classify them under these six sections below.

A. Manual processing or legacy technology

Though manual processing may be cheaper, and even a bit more effective for very small organisations, they are very error-prone and time-consuming. What’s more, the bigger an organisation becomes, the more ineffective manual processing becomes.

One of the errors that can occur with legacy technology is under/overpayment – paying workers less than or more than what they should get. Both situations can be frustrating for workers who will be left dissatisfied.

B. Keeping up with changes

A resulting problem companies face due to legacy technology is the difficulty of keeping up with regulatory changes or changes to the organisation’s policies. Manually updating payroll can be very stressful, time-consuming, and error-prone.

In terms of regulations, one problem that UAE companies face is compliance with the wage protection system (WPS), a system operated by the Ministry of Human Resources and Emiratisation to ensure that workers are duly compensated as at when due.

[To learn more about the WPS in the UAE, read, “What is WPS in the UAE: All You Need To Know About The Wage Protection System (2022)”]

C. Misclassification

Most companies have a wide range of workers that include part-time positions, full-time roles, freelancers, and contractors. Compensation packages will widely differ amongst these workers and companies can mess things up when managing large and varied payroll records.

D. Lowering payroll cost

Every company wants to lower the cost of payroll management by increasing the value they get for the money they spend.

For example, UAE companies seek to reduce payroll costs by seeking WPS agents with the best value for money(usually, this means lowering the WPS charges per record).

Similarly, companies who have recognised the limits of legacy technology also seek advanced technology solutions that will provide value for money and not eat into the company’s resources.

E. Privacy and confidentiality

Both legacy and advanced technology have to deal with the issue of privacy and confidentiality. First, there must be an internal control such that only those approved by the company can access payroll information. Secondly, companies with advanced technology must use the best cybersecurity solutions to prevent cyber hacks.

F. Late payments

Delaying workers’ payment is a situation companies should try and avoid by all means. Companies must keep workers happy and one way to do that is to pay them the right amount when due since most of them have made plans based on the day they are expecting the payment.

In the UAE, this means ensuring that payments are sorted in advance when the pay date falls on a bank holiday.

These highlighted problems are a big concern for companies who want to operate an effective, accurate, and efficient payroll management system.

So, how can they solve these problems?

3. The shift to outsourced payroll solutions in Dubai

One way that many have attempted to solve current problems is to use a payroll agency.

Payroll agencies, also known as outsourced payroll providers are companies that specialise in helping other companies handle their payroll management systems.

So, instead of setting up your own payroll system, you choose a payroll outsourcing agency that is entirely focused on handling payroll.

Why are companies going with payroll outsourcing agencies?

Sovereign Corporate Services, a company specialised in outsourcing services for payroll solutions in Dubai, gives the following reasons:

- Potentially lower costs: Instead of hiring payroll staff, and incurring all the costs involved in supporting full-time employees, companies can outsource for a price cheaper than the accumulated cost of sustaining their own payroll systems.

- Compliance: Since a payroll agency hires experienced payroll professionals who keep tabs on the latest payroll policies, you can be sure you are always in compliance with new regulations. Likewise, experienced professionals won’t have problems forgetting when payday falls on a bank holiday.

- Infrastructure: Also, outsourced payroll providers who manage multiple companies can invest in advanced payroll systems since the cost is spread across many customers. The money one single company does not want to spend, an agency can spend it.

- Security and confidentiality: Similar to the above, a payroll agency can invest in quality cybersecurity solutions. Also, by outsourcing your payroll, you remove the risk that a staff who is not authorised gains access to payroll data.

- Business focus: A typical outsourcing argument is that you can focus on your primary revenue-generating business instead of other activities like payroll that are not revenue-generating.

It should be evident by now that outsourcing can really be beneficial in solving the five problems identified above.

However, there are also many disadvantages with outsourced payroll solutions in Dubai and the GCC as a whole.

4. What are the cons of outsourced payroll providers

According to Globalization Partners, an international talent acquisition company, there are three basic problems with outsourcing your payroll management:

- Control: When you outsource your payroll system, you give control over it to another company. Losing control in this way means there is a risk the payroll agency takes actions that don’t align with your company’s values. Also, there is the risk the company treats your payroll system as just another client account (since they handle many of those), refusing to give it the attention and thought it requires. Can anyone really take care of your business the way you do?

- Confidentiality: While outsourcing ensures no unauthorised staff within your company has access to payroll data, it also means that entire strangers in another company can have access to it. Imagine a neighbour of your employee who works for your payroll agency mocking him (or bitterly envying him) because he has seen his payslip.

- Coordination: In an attempt to ensure that outsourced payroll providers make decisions that are in line with your interests and values, you might still end up spending so much time coordinating with the payroll agency.

Small Business Chron, a website dedicated to helping small businesses succeed, adds two other cons:

- Responsibility: If the company providing you with outsourcing services in Dubai makes mistakes, you are the one responsible for the costs of those mistakes. If late payments or under/over payments occur, your employees will not be dissatisfied with your payroll agency, but you. Most of the time, there is no term that makes external agencies responsible for mistakes.

- Unnecessary costs: Payroll agencies can include unnecessary payroll services in the package they offer to you. Also, if the costs of these agencies increase, it might lead to higher prices even if you don’t directly benefit from the specific payroll services driving up their costs.

So, though outsourcing can be beneficial in tackling the payroll problems companies face, it has its own baggage. It solves some problems but it complicates others and introduces new ones.

What then can your company do? Are you confined to choosing between the devil and the deep blue sea when it comes to outsourcing services for payroll?

Maybe not!

5. Moving towards a simple, smart, and flexible payroll platform

NOW Money is a simple, smart, and flexible payroll solution that helps employers handle their entire payroll system, while providing expatriate employees with a digital mobile bank account and debit card.

We created our payroll system to enable companies to solve current payroll problems in the GCC while keeping everything in-house, and thus avoid the cons of outsourcing.

But how so?

With NOW Money, you can manage your payroll with an automated system and yet keep control over your payroll management. Why lose control to a payroll agency when you can use a technology that can deliver the value they promise?

Because it is an automated system that requires login access, you can solve the problem of privacy and confidentiality. You can also prevent unauthorised staff from accessing payroll data while also avoiding putting all your payroll data in the hands of another company you don’t control.

NOW Money also doubles as a WPS agent in the UAE, therefore, you will always be aware of new regulations and policies guiding payroll and the WPS system and how they affect your payroll management.

Furthermore, since everything is automated, payments to your employees can be made digitally on any day; you never have to worry about late payments due to bank holidays.

Another advantage of NOW Money doubling as a WPS agent is that you can get value for money by collapsing two expenses into one. Instead of paying for payroll outsourcing companies in Dubai and then for a WPS agent, with NOW Money, you are only making one payment for a very low fee.

How NOW Money works

So how exactly can you use NOW Money to improve your payroll? Let’s dive in.

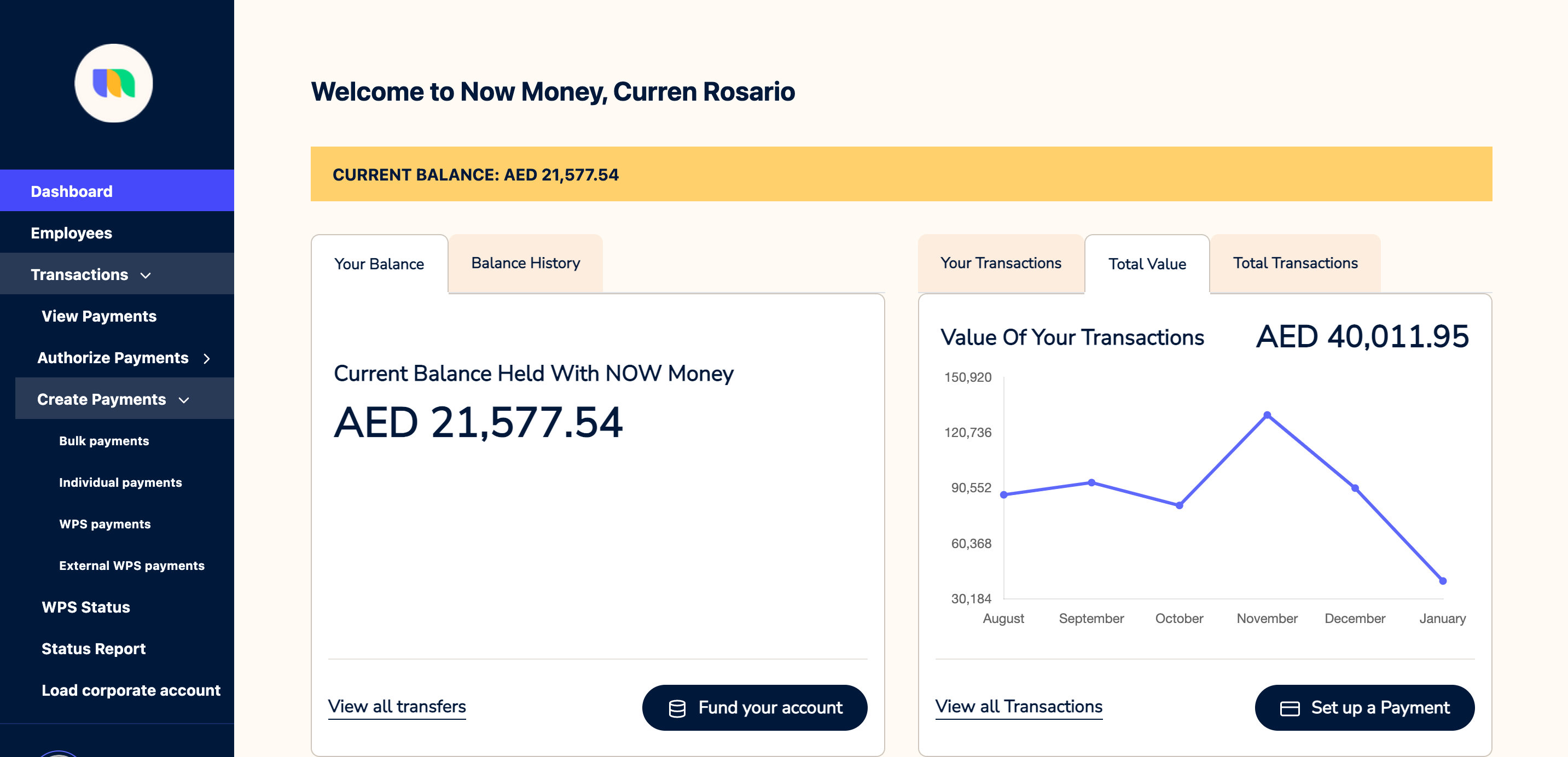

Start with the dashboard

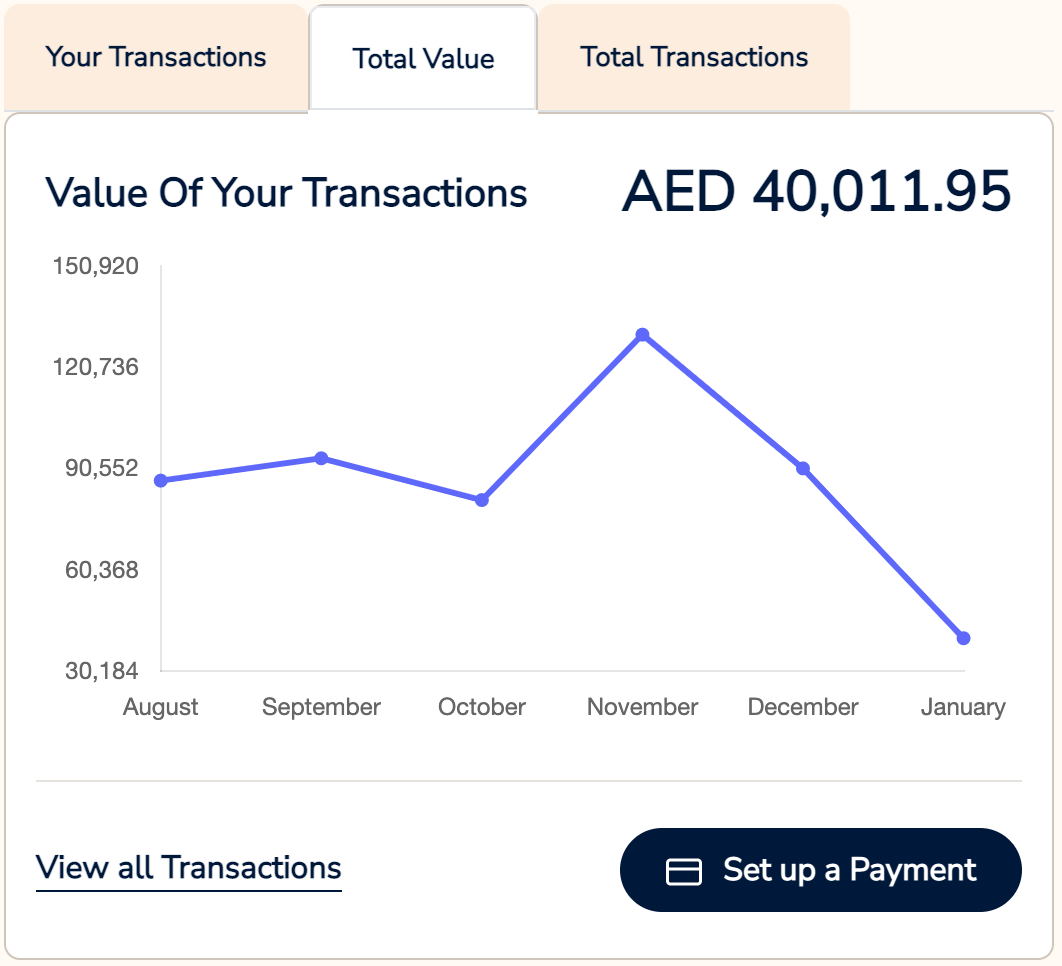

When you sign up for NOW Money, you get access to a dashboard where you can upload SIF files, add employees, view your WPS status, create and authorise payments, and view the transactions you have done.

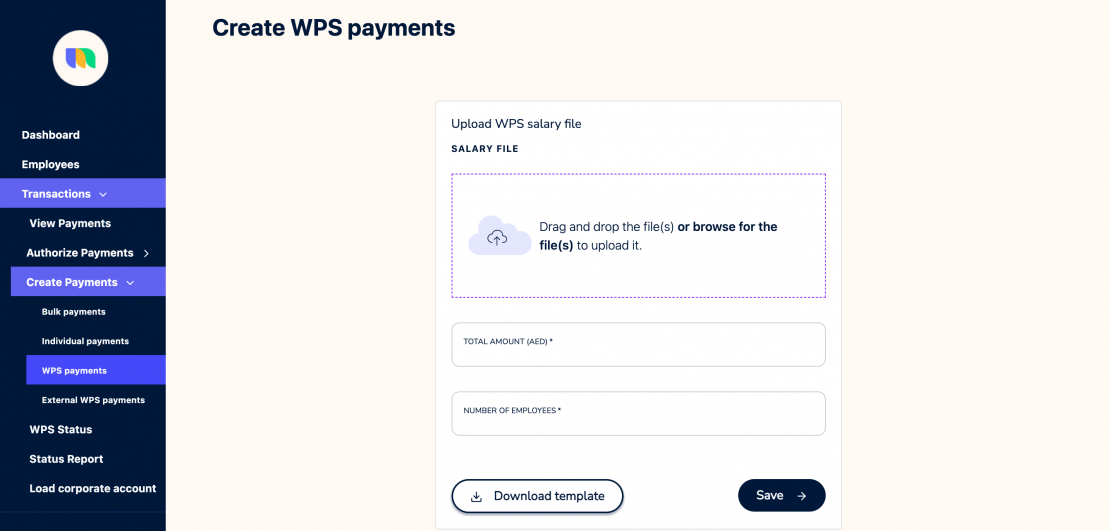

Upload SIF files

The first step to making payment is to prepare and upload your salary information file (SIF), which contains information about your employees, their gross pay, overtime bonuses, commissions, deductions, among others.

To prevent errors when uploading your SIF files, NOW Money uses a SIF format. As your WPS agent, NOW Money also double checks your SIF files to ensure no error has escaped you.

Once you have uploaded your SIF files, the details of all your employees will be on the system.

Pay cheaply and flexibly

With your SIF files uploaded, you can start making payment.

NOW Money combines low cost and flexibility in more ways than one. First, there is no extra charge for paying more frequently. If you pay wages instead of salaries or pay daily sales incentives, bonuses, end-of-service benefit or overtime, you won’t incur extra cost. You only pay based on the number of records on your SIF file.

Second, NOW Money will not charge you for making non-WPS payments (commissions, bonuses, expenses, end of service benefits, and gratuity) as long as you are paying them from money you have deposited on the platform.

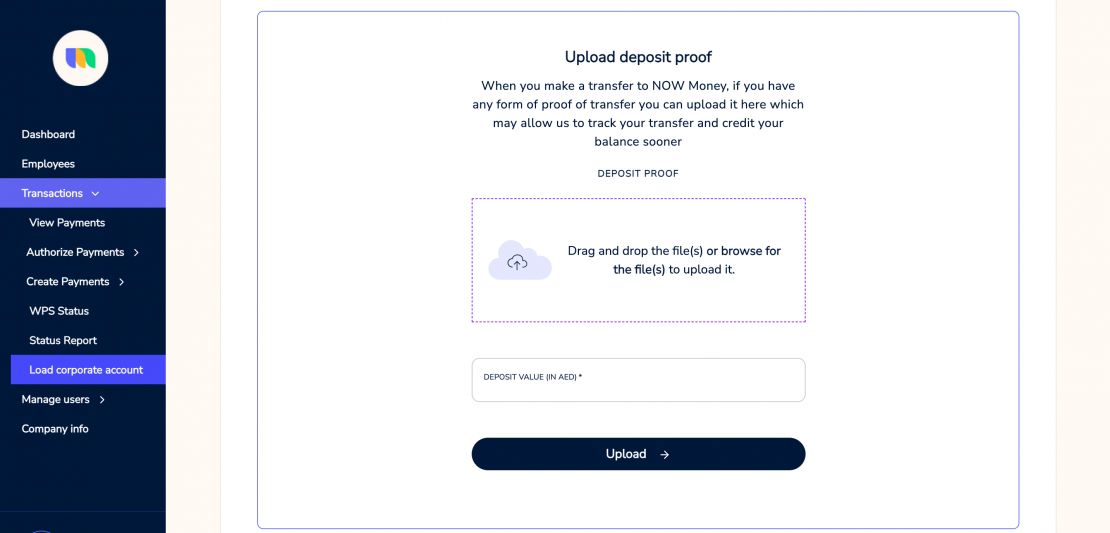

To deposit money in your company account, go to your dashboard, click on “load corporate account” and follow the prompt.

Once you have done this, you will upload proof of deposit and you are good to go.

Once your account is loaded, you can start making payments to your employees. You can keep a tab on all the payments you have made through the transactions tab.

Pay directly to your workers’ salary-linked accounts

Many expats find it hard to open bank accounts because they don’t meet some of the criteria set by the banks. NOW Money has solved this problem by providing unbanked expats with a digital mobile account and a debit card. You can send your workers salaries into this zero-balance account.

From this account, they can send money abroad, withdraw cash, and send global mobile recharges, among others.

Consequently, with NOW Money, you can also help your employees access banking services without the roadblocks that most banks in the region currently put before them.

Guarantee privacy and confidentiality

NOW Money allows you to control those who can have access to your dashboard. You can add users and regulate the actions they can or cannot take on the platform. Every user’s account is passworded such that no one without access to the password can access the platform.

You can also see more privacy protection on the privacy policy page.

[For more on how NOW Money works, read, “Smart Office Payroll: Pay Salaries With Flexible Payroll Solutions to Cut Costs, Paperwork and Headaches”]

Conclusion

While outsourced payroll solutions in Dubai can help you solve some of the persistent and ubiquitous payroll problems, a smart office payroll like NOW Money will help solve these problems more efficiently without the disadvantages of outsourcing.

Do you want simple and flexible payroll services and software that are cheap, convenient, easy-to-use and take away all the frustrations, headaches, and errors of manual processing payment and the disadvantages of working with payroll outsourcing companies in Dubai?

Sign up for NOW Money and your business will enjoy world-class payroll management that will benefit you and your employees.

Takeaways

- Payroll services are essential for businesses to get right because employees must be paid the right amount at the right time.

- Companies in Dubai and the GCC region face certain challenges with their payroll system, including the limits of legacy technology, the difficulty of keeping up with regulatory changes, misclassification, high cost, issues with privacy and confidentiality, and late payments of workers.

- Outsourcing payroll services in Dubai is done in an attempt to solve these problems, but payroll outsourcing providers sometimes intensify some of the problems in addition to creating new ones.

- A smart payroll solution is needed to solve common payroll problems while avoiding the cons of outsourcing services in Dubai.