Today, effective payroll business solutions must accurately manage the complexity of rapidly changing legal and digital payment environments, if the payroll system is to be worth integrating at all.

Admin overwhelm, keeping relevant records, using outdated or incompatible software, tracking employee absence, and staying compliant with regulations are the top 5 payroll challenges that every business faces, irrespective of size, according to Accuchex, a workforce management company in the US.

However, small, medium, and large businesses face these problems differently. For example, a large business will tend to feel the impact of administrative overwhelm more than a small business.

Also, there are problems unique to these three types of businesses. Small-scale businesses will tend to stick to ineffective and error-prone manual payroll processing, medium and large-scale businesses will tend to outsource and face the problems of control and data security, among others.

However, with payroll business solutions, small, medium, and large-scale businesses can solve their common and unique problems and create an affordable, error-free, timely, and efficient payroll management system.

In this article, we will consider the benefits of payroll business solutions to small-, medium-, and large-scale businesses and how payroll managers at these different size businesses can best deploy them.

We’ll consider:

- Payroll business solutions and small-scale businesses

- Payroll business solutions and medium-scale businesses

- Payroll business solutions and large-scale businesses

- How to get started with an enterprise payroll software in the UAE

[Looking for a digital payroll business solution in the UAE that is simple, flexible, and cost-effective? Learn more about the NOW Money payroll and employee mobile bank account system.]

Payroll business solutions and small-scale businesses

In this article, we define small-scale businesses as those with less than 200 employees.

Due to the size of these businesses, they more often than not don’t have large budgets to commit to an outsourced payroll solution. Even if they do have the budget, the benefits will often be less than the cost as they will have to pay for services they don’t need.

Nevertheless, manual payroll systems remain error prone and time consuming. And for small businesses, where the work hours of each team member is heavily influential towards the initial growth phase of the organization (compared to medium and large scale businesses), failure to reward employees appropriately can lead to bottlenecks that threaten the reputation and success of the business.

For small businesses in this quagmire, implementing digital payroll solutions can be a perfect solution.

How so?

Benefits of digital payroll business solutions for small-scale businesses

First, digital payroll solutions are cost effective.

For example, in the UAE, payroll managers can use a digital payroll solution like NOW Money to pay out salaries with minimal cost per salary information file (SIF) they upload. This is far more cost efficient than paying a retainer for an outsourced payroll solution.

Secondly, digital payroll solutions are simple and easier to use, often requiring no specialised tech skill. For example, any payroll staff that is computer literate can set up a payroll system on the NOW Money platform. This simplicity is essential for small-scale businesses who can’t afford to compete with the bigger organizations in the labour market. With digital payroll solutions, they don’t even have to.

Thirdly, small-scale businesses can take control of their own payroll system. Outsourcing means a loss of control over a business’ payroll system. This can be dangerous when the values of the outsourcing business do not align with that of the outsourced payroll solution provider. Small-scale businesses can avoid this scenario by using digital payroll solutions that allow them take absolute control over their own payroll system.

Fourth, and related to the third point, is confidentiality. With a digital payroll solution, payroll managers can control who gets access to what information. This is in contrast to manual paperwork that can get into the wrong hands and outsourcing where another organization has access to employees’ data. A platform like NOW Money allows payroll managers to create accounts for specific users. Only these users will ever have access to the company’s payroll system.

To maximise these benefits, it is important that small-scale corporations use the best small business payroll solutions.

Payroll business solutions and medium-scale businesses

Medium-scale businesses are corporations with 200-5,000 employees. While these companies will have the budget to outsource payroll, the loss of control, problem of confidentiality, and the need to spend time coordinating with outsourced payroll solutions makes outsourcing inefficient.

Moreover, medium-scale businesses are often at critical stages of growth and they need a flexible payroll solution that will support that reality. There cannot be flexibility without control, and so these businesses are better served with a digital payroll solution they can control in-house.

Due to the stage they are in the business lifecycle, medium-scale businesses also try to avoid staff turnover as much as possible. Therefore, employee discontent must be avoided. One way to do this is to ensure that they are being paid the right amount at the right time. Also, in addition to salaries, employees must enjoy other benefits that will make them motivated and productive.

Digital payroll solutions that can help achieve this kind of flexibility are therefore crucial for medium-scale businesses.

Benefits of digital payroll business solutions to medium-scale businesses

First, digital payroll solutions are flexible. For example, with NOW Money, payroll managers can decide to pay wages/salaries and other incentives daily, weekly, or monthly. This flexibility payments can convert to more productivity. When one user of NOW Money decided to pay sales incentives daily rather than quarterly, they recorded a 50% increase in sales.

Secondly, and still on the issue of flexibility, payroll managers of medium-scale businesses can introduce various rewards and incentives systems at no extra cost. Since everything is digitised, the same system for paying wages and salaries can be deployed to pay bonuses, leaves, allowances, among other benefits.

With a platform like NOW Money, you can make all these payments at zero extra cost. As said above, these rewards and incentives are often crucial to a low turnover of staff.

Payroll managers can easily tweak their payment systems as often as they wish until they find the best reward systems that will motivate and retain employees. And they can do this from the comfort of in-house enterprise payroll software.

Thirdly, digital payroll solutions are time efficient. Imagine the time it will take to manually process the payments of 2,000 or 4,000 employees. Medium-scale businesses can save that time by uploading a single SIF and authorising bulk payments with a few clicks of a button.

Fourth, digital payroll solutions are cost effective. Manual processing of say 1,000 or 3,000 employees will require many payroll staff working tirelessly. However, with enterprise payroll software, medium-scale businesses can cut down labour costs. And at this stage, cutting down costs can be a good opportunity for reinvestment and growth.

Payroll business solutions and large-scale businesses

Large-scale businesses are well-established, mature corporations with more than 5,000 employees across various departments/branches.

Due to the large number of employees, their payroll systems are the most complex. To deal with this complexity, many of them outsource their payroll management, paying large amounts in retainer fees, losing control of their payroll system, and leaving employees’ data in the hands of other organisations.

For those who decide to keep payroll management internal, there is the high cost of maintaining a large payroll department to deal with all the inherent complexities. But having a large number of payroll staff does not provide an immunity to errors, and while errors may not be as destructive as with small-scale businesses, too many of them can lead to a negative work environment.

Also, while these businesses have the money to compete for the best talent in the labour market, they have also realized that the cost of replacing staff can be two times that of keeping current ones, according to a conservative estimate by Gallup. That is money that can be instead spent in ways that will delight various stakeholders. Consequently, keeping current employees happy is also key for large-scale businesses. Digital payroll solutions are therefore just as crucial to these businesses for these specific reasons.

Benefits of digital payroll business solutions for large-scale businesses

The first benefit is simplicity. Manual processing is not a viable option for these businesses given the complexity of their payroll systems. Digital payroll solutions can turn that complexity into simplicity. For example, whether a company has 10,000 employees or 1,000, they follow the same processes on the NOW Money platform. That is, all of the otherwise complex systems can be coalesced into a few clicks of a button.

Secondly, large-scale businesses can save time and costs with digital payroll solutions, which would have been otherwise spent on a manual system or an outsourced payroll solution.

Thirdly, large-scale businesses, like medium-scale ones, can also introduce various reward and incentive systems that will reduce staff turnover. Again, these rewards and incentives can be included in a digital payroll system at no extra cost.

Fourth, digital payroll solutions also support international payroll services. That is, with digital payroll business solutions, large-scale businesses can incorporate all their employees across the globe in a single payroll system. And they can do this at no extra cost.

How to get started with an enterprise payroll software in the UAE

NOW Money is a digital payroll platform that provides simple, flexible, cost-effective, and time-efficient payroll management for small, medium, and large-scale businesses in the UAE.

The platform requires no specialised knowledge, so small-scale businesses can conveniently use it. Also, it can translate the inherent complexity of medium-scale and especially large-scale businesses into a simple system that any payroll staff can operate.

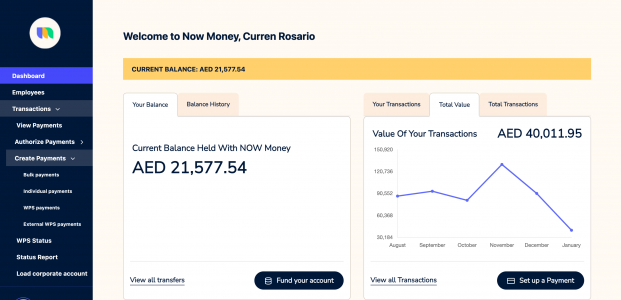

Just take a look at the easily navigable dashboard below.

NOW Money is also flexible, allowing users to tweak their rewards and incentives systems until they discover the one that is best adapted to your company’s strategic goals.

The NOW Money platform is also safe and secure, as all employees’ data are protected and made available to only those who the payroll manager or head of HR has created accounts for.

Even though the platform is simple and easy-to-use, NOW Money also offers free in-house training and onboarding as well as a 24/7 customer service that is available in many languages.

[Do you need a simple, flexible, and smart payroll solution for your small-, medium-, or large-scale businesses? Learn more about NOW Money.]

Takeaways

- Every business needs an effective payroll management system to keep employees motivated and productive.

- Though the needs of small-, medium-, and large-scale businesses differ, they can all benefit from digital payroll solutions.

- Digital payroll solutions are simple, time-efficient, cost-effective, flexible, and easy-to-use.

- They also provide more benefits than manual payroll processing or outsourced payroll solutions.

Photo by charlesdeluvio on Unsplash