*Please note: While we aim to keep our articles up-to-date with the latest WPS regulations, we always advise you to cross-check with official government information to ensure you are fully compliant.

Employers, employees, and potential employees should check the WPS status of a company to confirm its compliance. Here is how to do it.

Since being introduced, the Wage Protection System (WPS) has become a core part of labour laws in the United Arab Emirates (UAE) by helping to ensure the timely and accurate payment of employee wages.

Today, as an employer or an employee, it is important to be aware of your company’s compliance status with the WPS.

With most private sector employers in the UAE now required to comply with WPS, knowing how to check the WPS status of a company can help prevent, identify, and quickly resolve problems with authorities.

In this article, we will consider how to check the WPS status of your company and what steps to take if you are ever banned from the system. We’ll cover:

- An overview of WPS

- How to check the WPS status of a company

- Causes and consequences of non-compliance with WPS

- How to lift a WPS ban

[Do you want a smart, flexible, and cost-effective payroll solution that also helps you comply with WPS regulations? Request a demo to see how NOW Money can help transform your payroll management in the UAE.]

1. An overview of WPS

After its inception in 2009, the WPS underwent various reformations in 2016 and 2019. The latest reform happened in 2022 with the publication of Ministerial Resolution No. 43.

The Central Bank of the UAE and the Ministry of Human Resources and Emiratisation (MOHRE) created the WPS to ensure that employers pay workers agreed-upon wages and salaries and that they do it on time (and according to employment contracts).

Consequently, most of the WPS regulations have to do with what employers pay and when.

Some of the most important rules include:

- Payment becomes due (due date) a day after the payday the employer agreed with the employee

- Payment becomes late 15 days after this due date

- Employers must pay at least 90% of its workers in any particular month

- Each employee must receive at least 80% of their gross pay

- When the employer and the employee did not agree on a payday, the employee must still be paid at least once a month

- New employees must be incorporated into the system within 30 days from the data of employment

Private sector employers in the UAE (Abu Dhabi, Dubai, and the other Emirates) and the Jebel Ali Free Zone must register with the WPS and comply with all these regulations for them to keep doing business in the country.

To join the system, the firm will need to select a WPS agent (financial institution operating in the UAE) and open an account with it.

It is this WPS agent that will be responsible for forwarding employees’ salaries and wages to their bank accounts.

For every payroll cycle, the firm will submit a Salary Information File (SIF), which will contain all employee details. The WPS agent will receive this file and then oversee the disbursement of funds to employees.

2. How to check the WPS status of a company

Companies should learn how to check their WPS status to ensure and confirm that they have not been in violation of any WPS regulations.

Similarly, employees need to confirm the WPS status of their company to ensure the company is not contravening laws that are meant to protect them.

Also, potential employees need to know how to check the WPS status of a company they intend to work with to be sure the company is paying workers in accordance with the law.

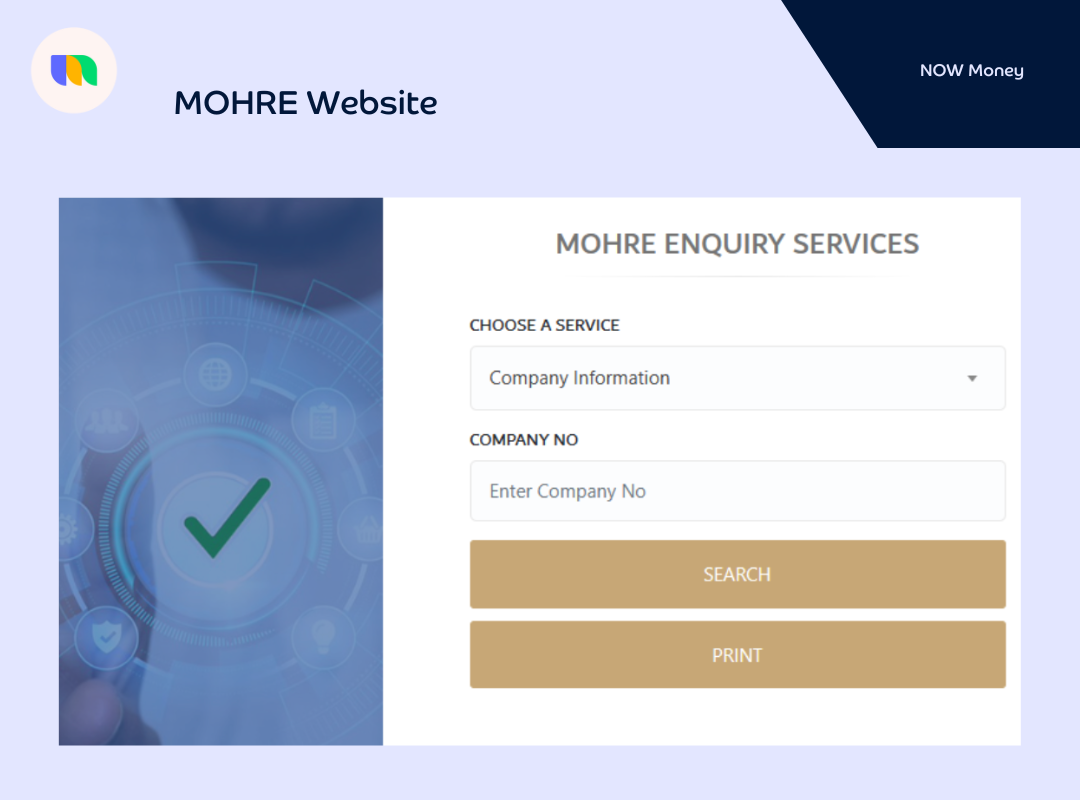

The actual process of checking the WPS status of a company has been simplified by the MOHRE and it involves the following steps:

- Visit the official website of the MOHRE (available in Arabic and English).

- Hover around the “Services” tab on the Homepage and select “New Enquiry Services” from the drop down.

- You will be directed to a new page from where you will be required to choose the MOHRE service you want to explore.

- Select “Company information” from the drop-down.

- Enter the company’s number.

- The platform will return information about the company including its WPS status (company status).

Employers, employees, and potential employees can also contact MOHRE’s customer service agents (via email, Whatsapp, phone call, online chat, among others) to request for information regarding a firm’s WPS status.

Companies that use NOW Money’s payroll system don’t need to go through all this stress. They can just check their WPS status on their account dashboard (as seen below).

By clicking on “WPS Status” and/or “Status Report” on the left side menu, they can get the latest update about their WPS status.

3. Causes and consequences of non-compliance with WPS

Violations of WPS regulations come with a varying degree of penalties and fines and some of these can affect the WPS status of a company.

Below is a list of non-compliance and their consequences, according to the Ministerial Resolution N0. 43:

- Non-payment, 17th day after the due date: MOHRE will suspend the issue of new work permits. They will also schedule inspection visits to employers with 50 workers and above to issue warnings about their non-compliance.

- Non-payment, 30 days after the due date: MOHRE will work with the Public Prosecution office as well as federal and local authorities to initiate legal action against companies with 500 workers and above and those considered as “high-risk establishments.”

- Non-payment, 45 days after the due date: MOHRE will now treat firms with less than 500 workers the same way they treated companies with more than 500 workers that defaulted for 30 days.

- Non-payment, 60 days after the due date: Issuance of new permits will be suspended for all other companies owned by the owners of the defaulting company.

- Repeated violation: The MOHRE will schedule inspection visits to issue warnings and impose administrative fines in line with Cabinet Resolution No. 21 of 2020. Also, they will downgrade the company to Category C or the third tier.

- Failure to pay a worker’s wage for more than 3 consecutive months: Suspension of issuance of new permits continues. An electronic notification will also be sent to the company and inspection visits scheduled once it is six months from the date of non-payment.

We saw above that wages or salary is due a day after the agreed payday. However, the WPS still gives a two weeks grace to pay salaries since payment does not become late until 15 days after the due date.

However, once it is 17 days from the due date, the MOHRE will place a ban on the company. This ban prevents it from issuing new work permits, in other words, hiring new workers. The longer the delay persists, the more serious the penalties.

This is why knowing how to check the WPS status of a firm is especially important for potential employees. A quick check will let them know if the company they are interested in is under a ban. Current employees also need this information to evaluate if they will want to stay or leave.

4. How to lift a WPS ban

Of course, the best thing for an employer is to avoid a WPS ban.

They can do this by using digital payroll software, adopting excellent cash flow management practices (so that cash is always available on payday), and mastering their payroll cycle.

However, reasons beyond their control can lead to a delay in payment that results in a ban. The next best thing the company can do is anticipate these delays and then give employees a prior notice (and assurances about the company’s stability and future viability). This will help calm the employees down during the delay.

Once the delay has happened and the ban has been issued, the next step is to seek to lift the ban. This will involve (according to the MOHRE):

- Paying registered workers (whether they are home or abroad) what was owed them.

- Requesting a salary period adjustment service through the services centres, ‘businessmen services’, Tawaseel or the establishment’s facilitation system.

- And if the ban persists, requesting technical support, with proof of payment attached.

Of course, it is better to take these steps before the default period extends to day 30 (for companies with more than 500 workers) and 45 (for companies with less than 500 workers), when it will become a legal case.

MOHRE and the Central Bank are always working to improve the WPS by issuing new regulations. Maintaining compliance will therefore involve keeping up to date with new and updated WPS regulations.

One of the advantages of working with NOW Money, a digital payroll solution that doubles as a WPS agent, is that you can keep up to date with WPS regulations and avoid non compliance.

We also saw above how easy it is to check your WPS status on this software.

In essence, the WPS agency service provided by NOW Money can help you maintain constant compliance even as you enjoy the benefits of a smart, flexible, and cost-effective digital payroll solution.

[Do you want an easy way to ensure compliance with WPS? Try out NOW Money’s digital payroll solution by requesting a demo.]

Takeaways

- The WPS is an electronic salary transfer system that was designed to protect employees by ensuring that salary payment is prompt and accurate.

- Employers, employees, and potential employees can check a company’s WPS status through the website of the MOHRE.

- Default in the payment of wages and salaries can result in a ban on the issuance of new permits. And if it persists, a legal case may follow.

- Companies in the UAE must always keep abreast of new WPS regulations and make plans to comply.