Millions of foreign workers send billions of dirham from the United Arab Emirates to other countries every year, making the UAE the second-largest source of international remittances in 2020.

However, for many foreign workers international money transfers continue to be a source of pain and discomfort:

- They have to make stressful and inconvenient round trips to exchange houses or banks.

- Exchange houses and banks keep charging them high fees

- Poor exchange rates, which is detrimental to their family and friends who receive the money

- They have to wait for 2-5 business days before transactions are completed, which makes it hard to meet the needs of their loved ones

- Those without local bank accounts (due to minimum income requirements) might have to take cash to exchange houses and pay higher fees to use the cash pickup method

Since sending money home quickly to loved ones is important to many people in the UAE, these drawbacks are especially harmful. And this hurt extends to their family and friends who depend on the money.

Bringing a lasting solution to this problem has been a top mission of NOW Money, a mobile banking solution provider in the UAE.

Consequently, we have sought to bring ease and comfort in place of pain and discomfort by offering international money transfers as part of the financial services available to the users of our mobile banking app.

We bring this ease and comfort through:

- Low transfer fees

- Competitive exchange rates

- Quick transfers

- Transaction tracking

- High coverage

- Accessible customer service

- Easy repetition of transfers

- Completely digital

In what follows, we will expatiate on all these points and then show you how you can quickly and easily send money to your loved ones abroad from the NOW Money mobile banking app.

[Do you want to send money to your family and friends abroad in a low-cost, quick, and convenient way? Inform your employers to register for our smart payroll software so you can access our mobile bank account on Android and iPhone and send money back home more efficiently.]

1. Getting the best of international money transfers with NOW Money

Low transfer fees

A study by The National News, a news agency in the UAE, has already shown that online money transfer services are cheaper than banks when it comes to international remittances.

At NOW Money, our aim is to provide the most cost-effective international money transfer services to foreign workers in the UAE, irrespective of the destination.

We do this by partnering with multiple Money Transfer Operators (MTOs) and choosing the ones that are most competitive (comparing pricing and foreign exchange rates), which is then reflected in the low transfer fees we can provide.

In addition to general low fees, we also offer two incentives that will delight customers:

- Zero fees on the first transfer: We won’t charge any fees on the first transfer made on our app, irrespective of the amount and the recipient’s country.

- Zero fees on transfers to Pakistan above AED 700: Pakistan is one of the top recipients of remittances from the UAE and – understanding the importance of this relationship – we have made every transfer above AED 700 to the country free of charge.

Competitive exchange rates

Our use of multiple MTOs also means that we can offer the most competitive rates in the market.

As one of our customers testified in a review: “This app is the best platform for money transfers. They give the best exchange rates.”

We know that sending money back home is important and we work hard to maximise the amount that reaches your loved ones by offering one of the best rates in the market.

Quick transfers

The big problem with waiting for 2-5 business days for your transactions to be completed is that you may not be able to meet the urgent needs of your family and friends back home.

While it can be painful if you don’t have the money to send for their emergencies, it is more heart-wrenching when you have the money but can’t get to them on time.

At NOW Money, we complete 99% of all transactions within 24 hours. And if it is a bank transfer, your transactions will be completed within an hour. With this time efficiency, you can meet the emergencies of your loved ones without delay and without the anxiety that comes with endless waiting.

Transaction tracking

One way we remove anxieties about the state of your transaction is to allow you track the transaction’s status on the app.

Relatedly, we will send you a notification on the app when the transaction in process has been completed.

High coverage

With NOW Money, it doesn’t matter whether your international money transfer is sent to India in South Asia (dirham to INR), Egypt in North Africa (dirham to EGP), or the US in North America (dirham to USD), or Italy in Europe (dirham to EUR): We cover all the main corridors and offer the same quality of service across the board.

Accessible customer service

If you ever encounter a problem when using the app or you ever need clarification on anything, our customer service agents are available from 9am to 9pm every day.

And if you prefer chatting to calling, you can use the in-app chat feature to talk to our agents.

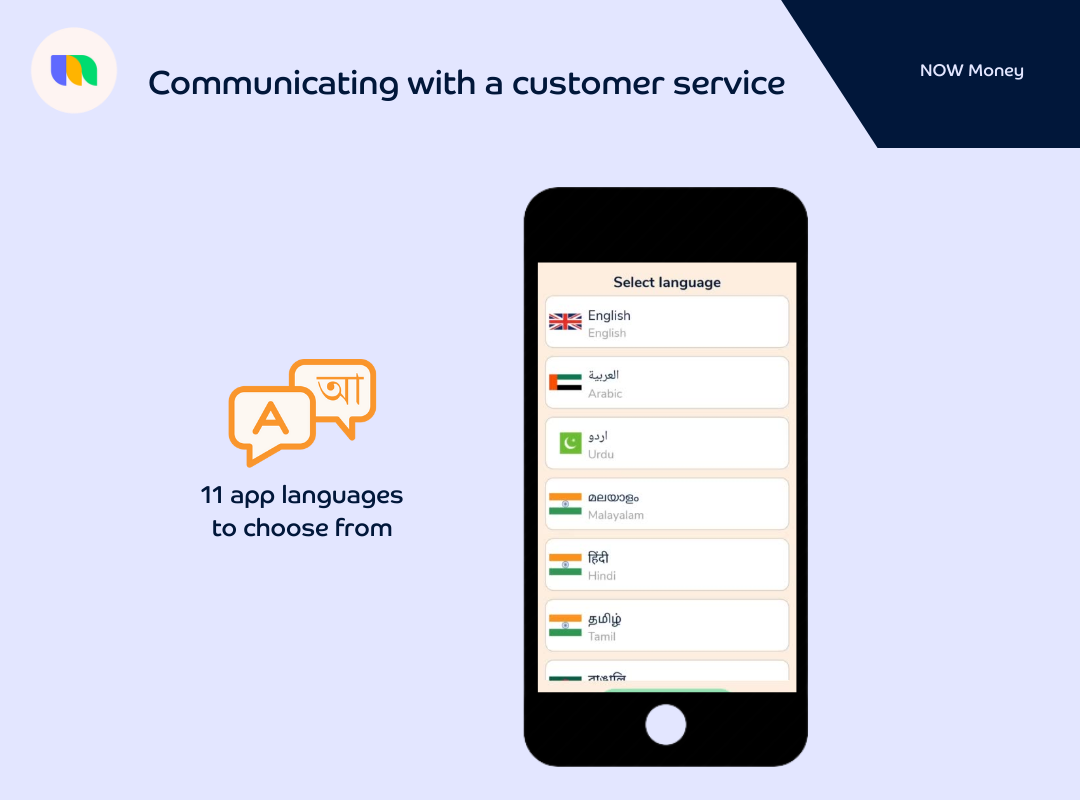

Moreover, you can communicate with our customer service agents in any of the 11 languages that UAE residents mostly speak. Our aim is to ensure no one is left behind or forced to communicate in a language they are not very comfortable with.

Easy repetition of transfers

Once you have sent money to a particular recipient, we save those details in the mobile app. This ensures that you can more easily send money to the same person the next time without having to re-enter the recipient’s bank details.

Again, your comfort and ease are all we desire.

Completely digital

Making round trips to exchange houses or bank branches (even to the nearest branch) is not convenient for anyone. These trips may even multiply if there are any errors in processing the transaction.

With NOW Money, you don’t have to leave your home or workplace to send money home. You can do everything – including talking to a customer service agent if you have any questions – at the comfort of your phone. Away with those needless commutes!

2. How to send money abroad with NOW Money

If you have a mobile bank account with NOW Money, international money transfers are one of the services you can access from our mobile app.

Getting a mobile bank account

Note that your employer must be using our digital payroll solution for you to access this mobile bank account. This ensures that you can directly receive your remuneration from them.

And this is beneficial for those who don’t have traditional bank accounts (around 80% of the population in 2020, according to Wamda, a thought leadership blog in the UAE). Today many more workers are receiving their salaries through a NOW Money account without the need for a traditional bank account.

Once foreign workers receive their remuneration (whether WPS or non-WPS payments), sending money back home is often one of their priorities.

Accessing international money transfers from the home screen

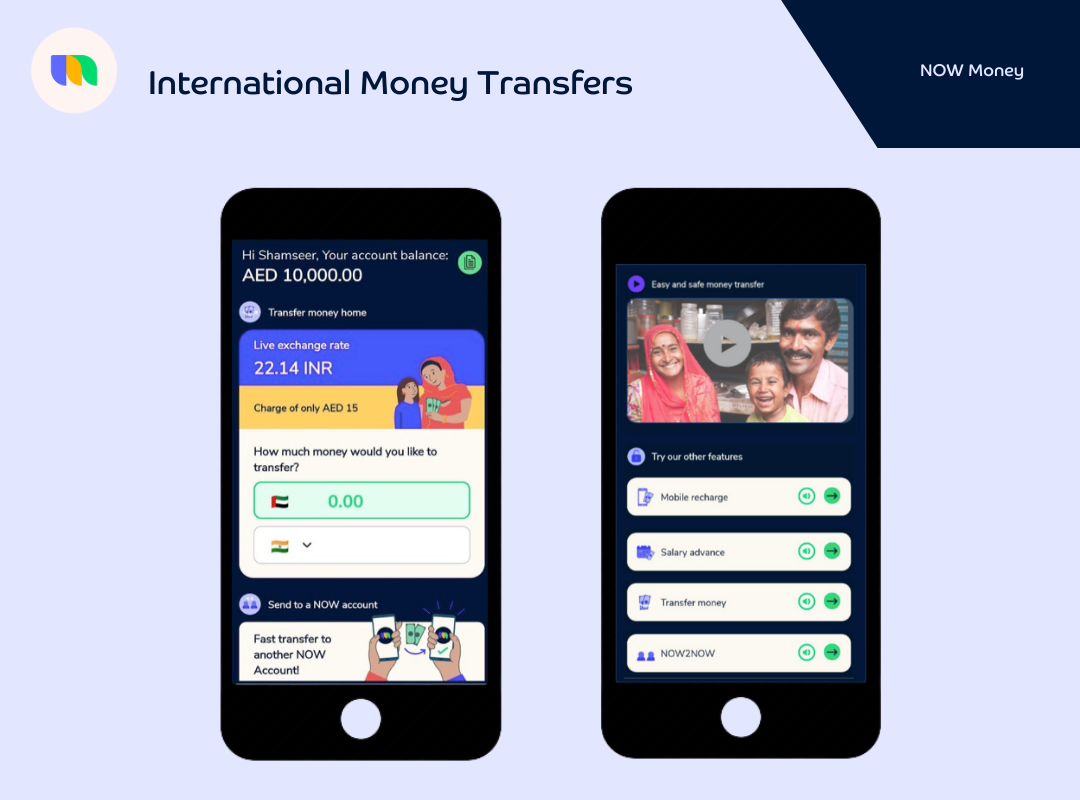

Since the home screen of our app is personalised to the needs of each user, international money transfers are the first service that most will see when they have just received their salary (as seen below).

From this home screen, people can select a recipient country and input the amount of dirham to send. Once this is done, the current exchange rate between dirham and the foreign currency and the fees that need to be paid for the transaction will be shown (everything is transparent, no hidden charges).

If you are fine with the current exchange rate and fees (which are always one of the best you can find at the time), then you can continue with the remit on the next page.

Completing the transaction

You will input the recipient’s bank details (account number, bank name, etc.) on the next page.

Before the processing begins, we will ask you to confirm these details so you can have another chance to identify any possible mistakes.

Once you have confirmed the transaction details, we will start processing.

Tracking the transfer

To remove anxieties about the transaction’s status, we will allow you to track the transfer. And you’ll also receive a notification when it’s successful.

Furthermore, our dynamic home screen also helps in this regard. On your next login after initiating a transaction, the first thing you will see is an update on the transaction’s status (as seen below):

Communicating with a customer service agent

If you have any enquiries while the transaction is processing, you can call or chat with a customer service agent in any of the 11 languages supported on the app (as seen below):

Sample chat with a customer service agent in Hindu.

Using our other services

While using our low-cost international money transfer services, you may find any of our other services useful:

- Salary advance: If you or your loved ones abroad need money to meet some emergencies, you can request for a salary advance on the app.

- Airtime recharge: You can also recharge phones locally and internationally with just a few clicks. If your loved ones need airtime instead of cash, you can also do that on the app.

- P2P transfers: You can also transfer funds locally to another NOW Money account at zero cost.

- Debit card: NOW Money also provides a debit card with which you can withdraw from ATMs or purchase goods and services online.

Repeating transactions

Once you have sent money to someone, you can easily repeat that transaction without having to input their details afresh.

[Are you ready to make low-cost, fast, and convenient international transfers to your loved ones abroad? Inform your employer to register for NOW Money’s smart payroll software so you can access our personalised mobile bank accounts and send money home more efficiently.]

Takeaways

- The UAE is one of the top sources of remittances globally with millions of foreign workers sending money home regularly.

- Despite the volume of transactions, many inefficiencies still persist: high fees, poor foreign currency exchange rates, slow processing speed, among others.

- NOW Money is one financial institution transforming international money transfer in the UAE by providing low fees, competitive foreign exchange rates, quick processing of transactions, accessible customer service, among others.

- With NOW Money, you can easily and comfortably send money to your loved ones.