Complex labour laws and frequently updated payroll regulations can make the management of the payroll process in the UAE a frustrating affair.

There are several pitfalls a manager must watch out for:

- Non-compliance with the Wage Protection System

- Incomplete employee master files (that can miss any of a number of important details)

- Unclear Salary Information File (SIF) data requests (further complicated by each bank requiring their own customised format)

- Limited transparency for employee pay slip generation

In particular, ensuring that companies maintain compliance with WPS regulations is of top concern.

In 2009, the government of UAE introduced the Wage Protection System (WPS), an initiative by the Ministry of Human Resources and Emiratisation (MOHRE) to protect the rights and interests of workers by systemizing payroll in the UAE. All companies in the UAE and the Jebel Ali Free Zone (JAFZA) are mandated to adopt the WPS, while other free zones and some royal or UAE government-owned companies are exempt.

In essence, the WPS ensures timely payment of workers’ salaries, and it is a determining factor of the centrally controlled payroll process in the UAE.

To ensure this timely payment and WPS compliance, employers must maintain accurate and updated key master files that include all employee data, such as employment contracts and personal credentials.

These master files are later translated into salary information files (SIF) to comply with the documentation model of the UAE central government.

Gaining a deeper understanding of these critical components of the payroll process in the UAE can help your company break down the complexities around WPS compliance, employee master files, and SIF, as well as make conducting business in the UAE a lot easier.

Above and beyond meeting financial and regulatory requirements, companies should also understand that payroll heavily overlaps with the HR department. This is why payroll managers must ensure they gather employee input, validate their concerns and meet their workforce on the same page when it comes to talking about salaries.

Simply, payroll is about getting employees paid transparently, accurately and quickly, and HR has a major role to play in this part of the business.

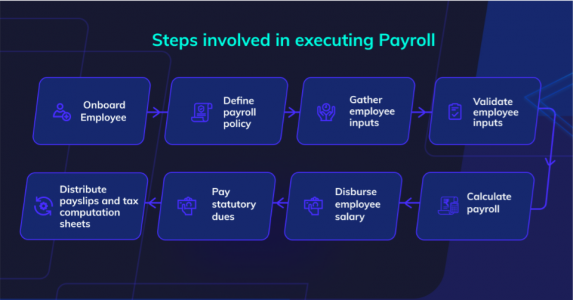

This article will describe in detail the 9 payroll process steps in the UAE that will help you better manage payroll for your organisation.

[Looking to improve how you handle the payroll process in the UAE? You can easily manage WPS payments, pay incentives frequently, and generate transparent payslips on employees’ mobile bank accounts through the NOW Money payroll system. Send us a message or first tell us more about you, and we’ll get back to you with the best way to move forward.]

Step 1: Understand the Wage Protection System (WPS)

The WPS in the UAE is a digital payroll system that credits salaries directly to employees’ accounts. It is mandatory for all private organisations to register for WPS to pay their employees through the Central Bank of the United Arab Emirates.

This centralised system of salary payment to employees protects the rights and interests of the workers in the UAE and ensures that salaries are paid in full and on time, according to the agreed-upon contract conditions.

Some of the key highlights of the WPS system include:

Frequency of salary payments

Under the labour laws of the United Arab Emirates, salaries must be paid either monthly or biweekly depending upon the contractual agreement between the employer and the employee. If the period is not specified under the contract, salaries are due every 14 days.

Late wages

Salary payment is considered late after a period of 10 days from the salary due date.

If the employer hasn’t paid after 30 days, it is considered a refusal to pay salary.

A fine of AED 1,000 is levied for late salary payments and a fine of 50,000 AED is levied for refusal to pay salary.

Fines for evading WPS

If an employer evades the UAE law by inputting incorrect employee data, the employer can be fined a maximum of 5,000 AED per employee. This fine goes up to a maximum of 50,000 AED in total.

Step 2: Gather and validate employee input

Payroll is as much a function of HR as it is of the finance department, and open communication and collaboration with employees is crucial.

This is why an important step to creating a successful employee payroll system is to first gather and validate employee input.

This involves collecting information such as:

- Personal details for their records, such as full name, date of birth, date of joining along with supporting documents such as a copy of the birth certificate, joining letter etc.

- Job details, such as a detailed job description, educational background and experience

- Base salary as per contract

- Benefits added to the base salary

- Employee performance data gained through periodic evaluations

- Bank account information (if they have one)

In the process of gathering this information, you’ll be keeping the channels of communication open between HR and employees. This makes not only the data collection in the future easier but also establishes trust between both parties.

When it comes to asking about banking information, HR may discover that there are still many employees that are unbanked or simply don’t understand how to best receive their salaries in the UAE.

Listening to your employees’ top concerns will likely reveal key problems with financial inclusivity that your company can work to resolve to make the payroll experience better.

Step 3: Create employee master files

The employee master file is a file containing all the details of all your employees including their credentials, base salary, contingent compensation, advance salary payouts, salary increments, company authorised allowance, etc.

The master files are essentially a compilation of all of the gathered employee data.

This document makes payroll processing and payment easy by centralising employees’ information.

While spreadsheets are a popular (manual) way to document this information, a smart payroll software system makes maintaining employee master files significantly more efficient.

Moreover, payroll software makes it easier to update all employee data across internal platforms (such as a company’s HR systems), as well as the WPS system.

Step 4: Calculate gross wages/salaries

The base salary, plus allowance, and plus overtime make up the gross salary payable to an employee. This constitutes the basis of your payroll policy.

Here is how these three elements are calculated:

Base Salary (depending on the type of contract)

There are two types of contracts in the payroll process in the UAE — limited contracts and unlimited contracts. Limited contracts are signed with a start and an end date at the commencement of a job. Unlimited contracts have no time durations factored in.

The base salary for each employee is the agreed-upon salary (monthly) or bi-weekly wages in the employee’s contract.

Calculating allowances

Allowances include sales commissions, relocation bonuses, travel allowance, meal allowance, entertainment allowance, etc.

These allowances are included in the contract at the very beginning and are updated as and when employees receive promotions or change departments within the company.

Manually calculating allowances under various brackets (such as travel allowance, house allowance, phone allowance) can be a tedious task especially since these are often not fixed amounts and can change every month.

Smart payroll systems make calculating allowances easier by giving employers access to an integrated digital payment portal. Instead of manually tallying receipts at the end of each month, smart payroll systems allow companies of all sizes – be they small, medium or large – to directly add this information to the employee master files.

Calculating overtime

Overtime is a very important component of the UAE labour law. The law stipulates that workers must not be exploited and are fairly compensated for working overtime.

This is how overtime is calculated in the payroll process in the UAE:

- For overtime hours occurring between 10 pm and 4 am, workers are paid an additional compensation of at least 50% of their wages or salaries.

- For overtime at other hours, additional compensation starts at a minimum of 25% of wage.

- Overtime on rest days (weekends and public holidays) is also compensated with at least 50% of wages or salaries.

- Nevertheless, overtime cannot exceed two hours a day

Step 5: Calculate salary deductions

Leaves of absence, fines, violations, etc., are to be subtracted from the gross salary to calculate the net salary in the UAE.

Some of the common leaves include:

Authorised annual leave

When an employee has worked for over a year, he/she is authorised to take a 30-days paid leave.

Authorised sick leave

Employees on a probationary period are not entitled to paid sick leave. However, employees who are under a permanent contract can have 90 days of sick leave. The compensation is calculated as follows:

- The first 15 days: with full pay

- The next 30 days: with half pay

- Next 45 Days: without pay

Hajj leave

Hajj is a Muslim pilgrimage and employees are entitled to 30 days of unpaid leave for Hajj once during their entire period of service.

Maternity leave

Female employees who have been in service for over a year are entitled to 45 days of maternity leave with pay.

Paternity leave

Private sector employees are entitled to 5 days of paid paternity leave to look after their newborn children.

Unlike leave, the rules on fines and violations are specific to each company but revolve largely around the calculation of working hours.

Smart payroll systems incorporate these calculations, making final salary payments and compliance with WPS easier.

Step 6: Factor in gratuity

Gratuity is a financial component periodically added to base salary and bonuses. It is an acknowledgement of the employee’s service to the company.

Gratuity for employees in UAE is calculated as follows:

- Twenty-one days’ pay for every year of the first five years of service.

- Thirty days pay for every consecutive year after that.

Gratuity cannot exceed two years’ pay during the entire period of service and it does not include leaves without pay.

Step 7: Make a WPS salary transfer file

A Salary Transfer File, also known as a Salary Information file (SIF), is a document the Ministry of Labour requires to pay salaries through the Wage Protection System. It includes all of the components of the employee master file such as employee credentials, designated salary, and bonus.

Every bank and financial exchange in the UAE follows this system, and some of them demand a customised format for their salary transfer files. Ensure you request a customised format before submitting your SIF.

Step 8: Generate payslips

A payslip is a document that accounts for all of the components of an employee’s salary including both allowances and salary deductions.

This document also proves useful for the employer to track performance, calculate compensation, and evaluate periodic increments.

Payslips need to be prepared specifically for each employee of the company. Manually generating payslips can be time-consuming and may often lead to errors.

It is advisable to use a payroll software to generate payslips with accuracy and promptness. Also, it helps if your employees have a mobile bank account to make communication of payslips and accountability easier.

Step 9: Use smart payroll systems

Smart payroll systems are software solutions that account for components such as leaves, vacation days, overtime compensation, and allowances in one central platform. This makes it easier for employers to access this data and create payout structures accordingly.

In essence, making smart payrolls an integrated part of the payroll process in the UAE can help you regulate payroll, comply with the WPS policies, and save precious time.

NOW Money offers a payroll system that allows you to easily manage WPS payments, pay incentives frequently, and generate transparent payslips on employees’ mobile bank accounts.

Contact us to learn more about how we are helping employers and employees get the best out of smarter and more flexible payroll solutions.