You can best help your family financially by keeping your finances in order, sending them money in a strategic way, and then helping them to manage that money well.

Sending money back home to help family members is often a key motivation for foreign workers in the UAE. In 2021 alone, about $47.54 billion was sent by workers to their loved ones in Asia, Africa, and Europe.

However, when not well managed, this key motivation can become disastrous. The demand for financial help from families abroad can become overwhelming to the extent that migrant workers struggle to invest, save, or even live a good life in the UAE.

Similarly, families abroad can become so dependent on the money that comes from their adult children that it becomes a disincentive to work, thus piling pressure on the worker.

In a worst-case scenario, they can even begin to mismanage the funds, spending it unwisely while the UAE-based worker continues to labour hard to keep the money flowing.

Even in the best-case scenario, families of migrant workers are often clueless about personal finance and financial management, and thus end up mismanaging the money even without being willing to do so.

For these reasons, it is important that you learn how to help your family financially in a way that both of you will end up being better off.

In this article, we will consider the best way for UAE-based workers to help their families financially without harming their own financial future. We’ll cover:

- Put your finances in order first

- Create a strategy for helping your parents

- How to help your parents financially beyond sending them money

- Increase your capacity to help

- The best way to send money home to your family

[Do you want to send money home to your family in a fast and cost-effective way? Inform your employer to sign up for NOW Money’s digital payroll software so you can get a mobile bank account and enjoy our international money transfer service.]

1. Put your finances in order first

As a foreign worker, you have your own needs (housing, clothing, health care, transport, life insurance, etc.) and wants (entertainment, travels, vacation, eating out, etc.). And if you intend to retire one day as well as build wealth for the future, you’ll also need to save part of your income every month and invest it in the financial market (including retirement plans and other wealth-building portfolios).

Yet, you’ll also need to send money to your family back home.

In fact, your family probably depends on that money to live. As the United Nations found out: “Although the money sent [abroad] represents only 15 percent of the money earned by migrants in the host countries, it is often a major part of a household’s total income in the countries of origin and, as such, represents a lifeline for millions of families.”

Navigating this situation requires that you have a financial plan, better known as a budget.

A budget is an estimate of expected income and expenses within a particular period. For workers, a budget is typically for a month.

The first part of a budget is identifying your sources of income (every month) and summing them up. By doing this, you will have a clear idea of how much you earn and how much you can spend. Knowing this figure is crucial for the second stage of budgeting.

In this second stage, you have to identify all the things you spend money on in a month and group them into categories. The most popular budgeting systems tend to categorise expenses into needs, wants, and savings/investments. As a migrant worker, you will need to include a fourth category: remittances to family.

Once you have done this, you need to decide what portion of your income you should be spending on each of these four categories every month. There are two ways to proceed from here:

a) Looking back to look forward: With this method, you will start by looking back at your spending pattern and adding up everything you typically spend under each category.

Suppose your monthly income is AED 1,200, you may notice that you have typically spent AED 500 – AED 700 on your needs, AED 400 – AED 500 on your wants, AED 0 on savings, and AED 150-300 on remittances back home.

When you arrive at these figures for each category, you then need to evaluate whether you want to continue with this pattern or if you want to shake things up. For example, you might realise the need to start saving say AED 100 every month as a preparation for your future financial freedom.

To do this, you might decide to spend less on eating out (wants) and cooking at home instead. You might also decide to fix the money you send home at AED 200 and/or cap spending on your needs at AED 500.

Your budget for the next month can then be: AED 500 on needs, AED 300 on wants, AED 200 on saving/investing and AED 200 on remittances. You can then stick with this budget until your income increases.

You can proceed however you want. But the point is that you should start with your past spending pattern, then adjust it to meet your current financial goals.

b) Looking forward from the present: Another approach is to make each category a percentage of your income. For example, the 50/30/20 rule is a popular budgeting system that allocates 50% of income to needs, 30% to wants, and 20% to saving/investing.

You can tweak this rule to fit in with your own situation. For instance, you can do 40% on needs, 30% on wants, 20% on saving/investing, and 10% on remittances. To continue with the above illustration (AED 1,200 income), that is AED 480 on needs, AED 360 on wants, AED 240 on saving/investing, and AED 120 on remittances.

Once you have decided on a formula, you will then need to adjust your current spending pattern to fit in with it, which means spending more in some categories and less in some categories.

Whatever path you take, the result is the same: you start controlling how you spend your money rather than allowing your money to control you.

One advantage this has is that it will ensure that you are not overspending in one area to the detriment of another. For instance, sending a lot of money home but not saving for your own retirement or spending too much on entertainment and not sending enough money home.

Said differently, a budget helps you attain a balance.

Also, gaining a foothold over your finances will prevent you from amassing consumer debt (personal loans, credit card debt, bank loans) or stop you in your tracks (if you are already embroiled in it). This is because spending beyond one’s means is often the cause of indebtedness.

2. Create a strategy for helping your family

The end product of the process we have considered in the previous section is that you have a budget that specifies how much you will be sending to your family at the end of every month.

It’s worth mentioning that we are not specifying a particular amount or percentage but showing you how sending money home does not need to undermine all other things you need to spend money on.

According to the United Nations, migrants usually send about 15% of their income to their families abroad. You might decide to stick to such a figure (or more or less, depending on the condition of your family); what matters is that you are consistent with whatever you are sending.

For example, Aaron Juliet, a NOW Money user, consistently sends AED 500-700 every month to her parents and siblings in Uganda.

Sending a particular amount regularly and consistently will help your family members receiving the amount to also create their own financial plans and make better financial decisions. If it were haphazard, say AED 300 this month, AED 0 next month, and then AED 100 in the third month, it will become difficult for the recipients to keep a handle on what they are receiving.

And this leads to our next point.

3. How to help your family financially beyond sending them money

Learning how to help your family financially must go beyond just sending them money.

You must also ensure that they are accountable for the specific amount they are receiving every month. In this way, you will be saving yourself from bearing the burden when they mismanage the funds.

One way to achieve this is by helping them to create a budget or encouraging them to create one. It’s only by putting your family finances in order that you can help them make the best use of what you are sending them.

Let them also create a budget: identify their monthly income (from all sources, including your remittances) and then allocate it to their relevant expenses categories.

You can also give them financial advice that will help them stick to their budget and manage their finances responsibly. Alternatively, you can insist that they see a local financial advisor.

In essence, if you are living within your means to help your family, then it is necessary that you equip them to do the same.

By doing this, you will ensure that they are not making random requests for financial assistance but that all the money you send is directed towards budgeted items. (Yes, emergencies like unexpected medical expenses will arise. But such emergencies will be easier to identify – they are outside of the monthly budget – and you can help them meet those from your emergency fund).

Another way to help your family financially beyond sending them money is to help them explore other sources of income at home.

Are they still in the labour force but unable to get a job? You can use your contacts (if you have any) to help them get one. And if work is available but they are unwilling to work, you can consider persuading or encouraging them to do so. Setting up a business for them from your savings is another option.

4. Increasing your capacity to help

Even though you have already decided on an amount to send to your family every month, you don’t need to be stuck with that amount forever.

By increasing your income (thus improving your financial situation), you will increase your capacity to provide financial support to your aging parents, spend on your needs and wants, and save/invest towards your financial goals.

If you are motivated to increase your income because of any or all of these three reasons, here are some options to consider:

- Negotiate better pay at your current job: Sometimes, your employer will not think about giving you a pay raise if you don’t ask. Improve your skills, capabilities, and productivity (among others), then approach your employer and ask for a pay raise if you believe you deserve it.

- Get a higher-paying job: If your employer is not forthcoming and/or you see a better offer from another company (all things considered), then consider changing jobs.

Furthermore, you can also increase your capacity to help your family abroad by reducing your living expenses (needs plus wants) if you believe you are overspending on certain items.

For example, you can make do with a smaller apartment if you believe such a move will not lead to you suffering any inconvenience.

You should also consider some of these strategies for saving money in the UAE suggested by the Ministry of Finance.

5. The best way to send money home to your family

One final way to help your family financially from the UAE is to use an efficient remittance system that will ensure they get maximum value from what you send to them.

There are two considerations here: fees and exchange rates. If remittance system A has lower fees and better exchange rates compared to B, then your family will receive a higher amount when you use A even when you send the same amount of dirhams.

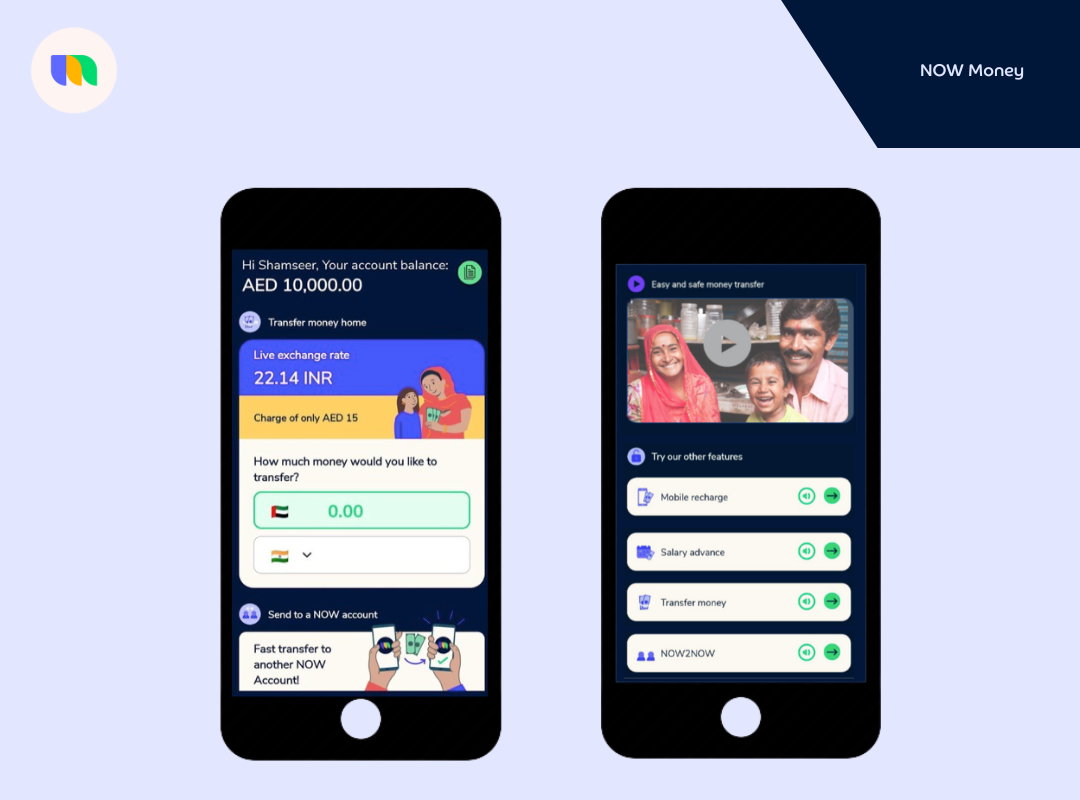

NOW Money is one platform with low fees and competitive exchange rates that will maximise the value your family gets from the money you send to them. It ensures that after working so hard, you don’t lose your hard-earned salary to expensive fees and low exchange rates.

Furthermore, all first transfers on NOW Money are free, irrespective of the destination. And it is always free if you are transferring an amount higher than AED 700 to Pakistan.

NOW Money is also easy to use. Neeta, a nurse from India who uses NOW Money to send money back home and to recharge her phone (more below), commends the app for its “simplicity” and “ease of use.”

What is more, NOW Money completes 99% of transactions within 24 hours. You won’t need to be anxious about the state of your transfer or worry that the money won’t reach your family on time.

This is why Shipia, who has been in Dubai for the past 10 years is “very happy” using NOW Money to send money to her loved ones in Bangladesh.

With NOW Money, transferring money home (wherever home is) has never been faster and more cost-effective.

In addition, NOW Money also allows you to recharge your phone and that of your loved ones abroad.

Satrugan, another user of the NOW Money app, says he “mostly uses NOW Money for mobile recharge” in addition to sending money to his family in Nepal every three months.

[Are you ready to help your family financially by sending money home to them? Learn more about how to make low-cost international transfers with NOW Money or start talking to your employer to register for NOW Money’s smart, flexible, and cost-effective payroll software so you can access our mobile bank accounts and send money home more efficiently.]

Takeaways

- While trying to help your family abroad is a good deed, you should do it in a way that does not harm and distress you.

- You should first put your finances in order by creating a budget so that sending money home does not undermine other things you should be doing with money.

- Send money home in a strategic way and also teach your family basic financial management skills to make good use of the money.

- You should also consider increasing your capacity to help your family abroad by increasing your income or cutting down on your expenses through various cost savings strategies.